Top 5 Best Defi Projects and Coins to Buy in July 2024

Change happens rapidly and steadily throughout time, as we have seen with tech advancements like streaming apps taking the place of DVD players and books being replaced by tablets. Now, cryptocurrencies are beginning to replace regular money. The financial sector is currently undergoing a significant transformation, creating plenty of new opportunities for those who invest in crypto.

Defi emerged as a result of the growing demand for financial alternatives. As a result, decentralized technology will enter the new field of financial services in an unreliable and transparent way. The anticipated decentralization of blockchain technology will turn the financial sector on its head compared to what we are used to with centralized banks.

Are you a crypto enthusiast or just starting to learn about blockchain technology? If so, then understanding Defi and its potential impact in the future should be of great interest to you. This article shares five significant new best-defi projects that will revolutionize finance across both traditional and global horizons.

Table of content

The best De-Fi project Colony Lab

Project Colony is at the top of our list of Defi projects. Project Colony is the first community-driven, future-oriented fund. The Avalanche Foundation has already pledged support and money to this initiative, making it essentially an Avalanche project.

Simply defined, Colony is a collection of smart contracts that build the backbone of the organization's fundamental operations. This project also concerns online business ownership, structure, and authority.

So, where do you begin? You'll need tokens to get started. Colony applications, for example, operate on networks that use their tokens. These tokens are identified by the ticker symbols used on trading platforms.

After you've bought your tokens from a Colony-supported wallet, you'll need to move them into a personal one. The coins can be used as currency for exchanges. When selecting your preferred payment network, take into account their transaction fees – the lower rate you select, the more money you save! Also, take care to double-check which network you're using before transferring any funds.

The most popular type of service available online is the Decentralized Exchange (DEX), which you may find by googling “Decentralized Exchanges” or similar terms. You can also provide liquidity in exchange for interest or lend funds, and charge interest. The opportunities are boundless.

Aave Protocol is a cutting-edge open-source project that delivers the highest quality user experience and prioritizes security, privacy, and compliance.The Aave Protocol is a decentralized financial platform with liquidity protocol that allows users to lend and borrow digital assets.

Functions

The Colony CLY token is designed to support the colony network, which is a community-driven initiative that provides early-stage funding for Avalanche-based projects. This will also give liquidity to existing Avalanche Defi systems. AVAX (AVAX) and future subnetwork coins are being acquired as part of this deal.

The goal is to launch an initial coin offering (ICO) for funding. The company plans to work with Avalanche and may share a stream of transactions to set the stage for project financing on the platform. The true beauty of this project lies in its communal-based approach.

It also includes a regulated framework that allows investors to get to know the Avalanche ecosystem, which will help to increase its market capitalization as a result of their curiosity. From the outset, the project has an established community. It will collaborate with other key players in the ecosystem as well as Avalanche.

It's worth noting that the Avalanche ecosystem is intended to support DeFi. The Colony initiative will assist in realizing Avalanche's goal through a fully decentralized exchange and a democratized financial system. One reason is that Colony offers a solid infrastructure for new decentralized apps on the Avalanche network.

The colony's success depends on marketing, momentum, technical knowledge, and networks. In addition, Colony ensures that its investment is correctly utilized and appreciated by using airdrops, stacking rewards, and a buy-back mechanism.

The business model has been adjusted. A perfect combination of two components now exists. The first is access to early-stage deals, which previously only institutions and their investors had access to. The project's comprehensive investment process will be carried out by the core team, which includes professionals in the cryptocurrency space. As a result, these equity experts will have a better understanding of the projects. The second component is an improved way to receive payouts.

The network of investment firms at Colony will provide funding to developers working on the Avalanche Protocol. When the project reaches its initial phase, it will no longer need to concentrate on soliciting capital; rather, it can prioritize further advancement.

The DAO (Decentralized Autonomous Organization) is the foundation of our success. Its primary objectives are to increase liquidity in the Avalanche ecosystem and to utilize stakes to improve network security. This component is also intended to collect Defi Avalanche's increasing assets with a specialized index.

Overall, Colony combines DeFi and conventional finance to create value in the Avalanche network through its community.

The founder of Cryptominati Capital, a private investor named Mark Karpeles, has teamed up with Colony Lab as a corporate partner. They wrote the following on Twitter: “Colony Lab is providing funding and liquidity to The Avalanche ecosystem, which is a game-changer.”

A liquidity protocol for a decentralized financial platform Aave

The XIAVE project is another decentralized financial system where users can loan and borrow a variety of cryptocurrencies. Leveraging the power of smart contracts, this platform enables people to easily participate in cryptocurrency-based peer-to-peer lending. People want to lend cryptocurrency to earn interest or borrow money in exchange for interest payments.

With Aave, you don't have to trust large banks or financial institutions with your money; now you can keep it yourself! The app is powered by the Ethereum blockchain and executed transactions through a network of computers running Aave. Algorithms and smart contracts handle all assets within the system.

Functions

Aave's goal is to make simple financial services more accessible, which means you may lend and borrow without the assistance of banks, brokers, or middlemen. In a nutshell, you invest in technology while also influencing its development.

There are currently 26 distinct cryptocurrencies available for deposits, and 25 of them are accessible for borrowing. ETH, LINK, and LEND are the most popular assets on Aave. Here, you can discover a comprehensive list of all the resources and their individual interest rates.

You can view the borrowing and lending rates of each cryptocurrency on the Aave website. Aave employs an algorithm to generate current rates based on the utilization rate, as shown in the example above. When there is a limited number of cryptocurrencies available, the interest rates are typically heightened to attract more individuals. In contrast, if there is an abundance, rates will be lower to stimulate more activity.

Aave offers two distinct DeFi tokens: AAVE and AAVL. The first is AAVE, which is the protocol management token of the company. You can buy shares in Aave by purchasing AAVE tokens, which function similarly to stock in the firm. That way, you may vote for changes that could alter the protocol's course.

The second Aave token is the AToken, which are interest tokens given to lenders to earn interest on deposits. The interest is immediately credited to your wallet, and the tokens are tied to a 1:1 value of the underlying asset you have put down.

Instant credit is one of the most popular loans on Aave, which you may use to take advantage of arbitrage possibilities in the cryptocurrency world. Flash loans do not require any security. You must return the money in the same transaction, usually within seconds.

Unless payment is finalized during the same transaction, it will be reimbursed. There are only 16 million tokens in circulation with the Aave protocol. The Defi ecosystem reserve contract contains three million of these tokens for program creation purposes.

Aave's protocol comes with stackability, which is a security module that allows you to store Aave tokens as insurance against any potential market problems. For example, if one of the most popular stack coins on Aave were to lose its US dollar peg, you could use up to 30% of the security module to make up for the loss.

Since the debut of Aave in 2020, you may now borrow and lend actual money on the platform.

Fantom

The company uses blockchain as a way to build, own, trade and administer digital assets. Decentralized applications and intelligent contracts embody the revolutionary power of blockchain technology.

Ethereum pioneered the introduction of smart contracts to the cryptocurrency marketplace. Yet, in recent years due to intense congestion and sky-high transaction costs, it has become a challenge for users. In response to this issue, several other options have arisen that allow for faster transactions at more reasonable prices.

Another option is Fantom, an open-source smart contract platform for dApps and digital assets. The process of borrowing, lending, and trading synthetic assets is simplified on this platform. Simply log into your digital wallet and deposit tokens to begin earning.

Functions

Fantom is gaining popularity since it provides a viable answer to the blockchain trilemma. It endeavors to find a perfect equilibrium between security, stability, and decentralization that is sustainable in the long term. The platform is quick because it uses a special consensus mechanism called Lachesis. Transactions are thus extremely rapid as a result of this. As a blockchain with smart contract support, Fantom is also highly versatile.

Fantom's quick transaction processing ensures that transactions are processed in one to two seconds. This system is incredibly reliable and efficient by executing thousands of transactions per second with minimal cost. The number of transactions on the Fantom platform grew to over three million in May, not surprisingly.

Fantom utilizes the POS about consensus method, making it decentralized and not requiring a governing body. With this network setup, Fantom as a whole remains much more efficient.

The consensus mechanism of Fantom aBFT validates data and transactions across the network. As a consequence, it may agree in a trustworthy and transparent manner. Achieving consensus is a fundamental requirement for any decentralized application.

Phantoms are advantageous for payments since they have a lot of bandwidth and speed. It's also great for network management and control. This implies that you may use network management to vote on improvement ideas, suggest modifications, and make judgments if you possess tokens on the FTM network. Your impact will be based on how much FTM you own.

Fantom is ideal for wagering rewards. You may earn a minimum yearly percentage rate (APR) of 3.79% to a maximum of 11.59% here. The annual percentage rate is dependent on the total lock-in period and the amount of FTMs you deposit.

Fantom is yet another cryptocurrency that takes after EOS in its protocol. However, Fantom allows for both private and public transactions–a feature that will come in handy for individuals who wish to keep their identities hidden. Similarly to other currencies such as Stellar, Fantom may be used to purchase network fees and pay validators; but it doesn't stop there. With Fantom, you can also transact fee-free across the entire ecosystem!

Fantom's built-in Defi stack enables users to create USBs with FTM tokens. USB is Fantom's own Stablecoin, which is pegged to the US dollar at a 1:1 ratio. It can be used to trade, borrow and lend 176 different cryptocurrencies and synthetic assets, such as fETH and BTC

In the past seven days, Fantom has seen an impressive 9% increase in its price, rising to a total market capitalization of $2.03 billion on November 17th, 2021. Its daily trading volume on exchanges was approximately $748 million at that moment.

PancakeSwap

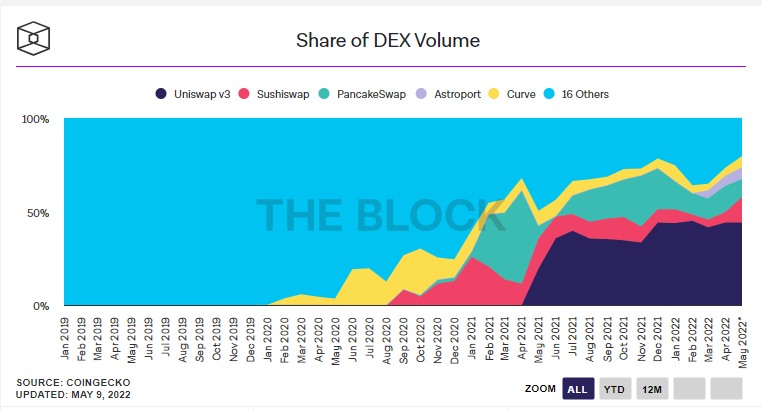

Another new decentralized finance technology is PancakeSwap. This Defi project was created just last year, and it's built on Binance Smart Chain, a machine-to-machine cryptocurrency market maker. PancakeSwap, like Aave, provides trading liquidity as a service.

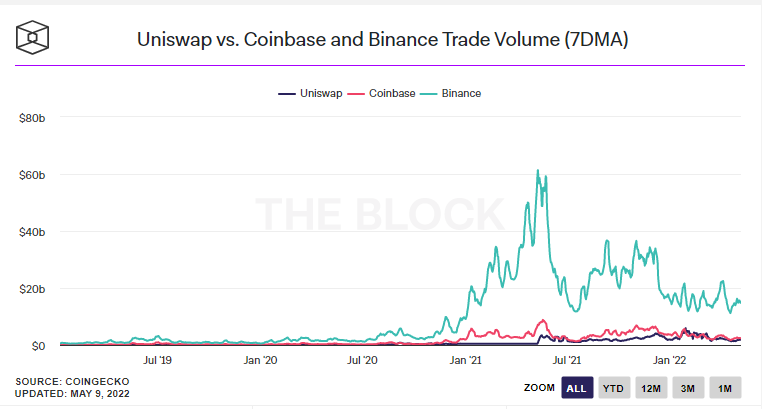

Users had wagered more than $5 billion on the PancakeSwap decentralized exchange by the end of October (DEX). PancakeSwap is a bargain when compared to rivals like Uniswap, which has a market value of only $4 billion.

Functions

Cryptocurrency owners should highly consider PancakeSwap for several reasons. For one, it uses the Binance Chain BEP-2 platform which was developed by none other than the world's largest cryptocurrency exchange, Binance. With an impressive daily transaction volume of $27 billion, you can have complete peace of mind that your funds are secure with them. Furthermore, all smart contracts have been verified and approved by CertiK a well-renowned firm specializing in contract security.

PancakeSwap offers a one-stop shop for all your cryptocurrency needs – securely exchange, store, and trade digital assets. Its decentralized architecture and user-friendly interface make it the perfect platform to make informed decisions about cryptos quickly. PancakeSwap does not rely on third parties for settlement or trading and allows you to keep your tokens. Although PancakeSwap is powered by Binance, it is not controlled or governed by Binance. The service is quite comparable to Uniswap and Sushiswap, but with a few notable differences.

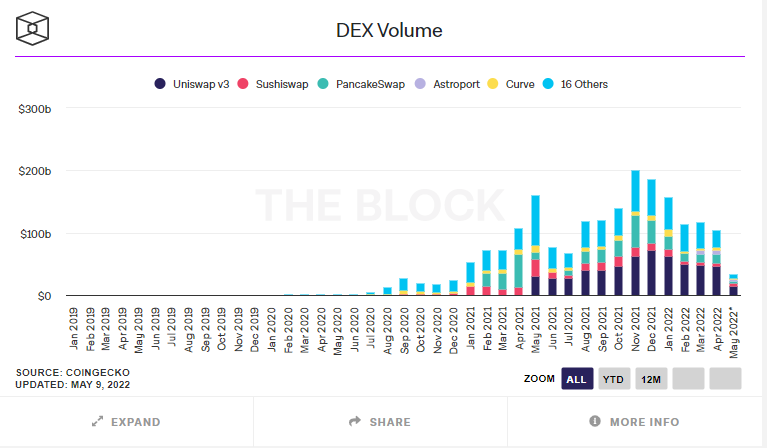

PancakeSwap is one of the most popular decentralized exchanges available today. In October alone, the platform processed over $12 billion in trading volume. That's more than all other decentralized exchanges combined!

PancakeSwap is designed for BEP-20 tokens that operate on the Binance Smart Chain. You can, however, utilize Binance Bridge to transfer tokens from other platforms. You may “wrap” them as BEP-20 tokens and use them on PancakeSwap DEX after they've been “wrapped.”

The first reward you earn after depositing your LP tokens into the liquidity pool is NOMIA. You can now give CAKE tokens to obtain SYRUPs. You may use SYRUPs to acquire MORE functionality, such as control tokens or lottery tickets with

You'll need a cryptocurrency wallet to use PancakeSwap. Math Wallet, Trust Wallet, Binance Chain Wallet, and even MetaMask are compatible with the decentralized insurance platform. By leveraging the power of MetaMask and Binance Smart Chain, you can easily configure your Ethereum wallet to support transactions made on both platforms. With just a few simple steps, you'll be ready for whatever comes next!

The Graph

The Graph (GRT) is a decentralized protocol for querying and indexing data from blockchains. Much like Google indexes content on the web, it also enhances access to information with remarkable efficiency. The Graph also indexes data from blockchains like Ethereum and Filecoin, much as Google does with the internet.

The Graph has primarily been indexing the Ethereum blockchain, but recent testing from the NEAR blockchain suggests that it may now be able to index blockchains that are not compatible with Ethereum.

Functions

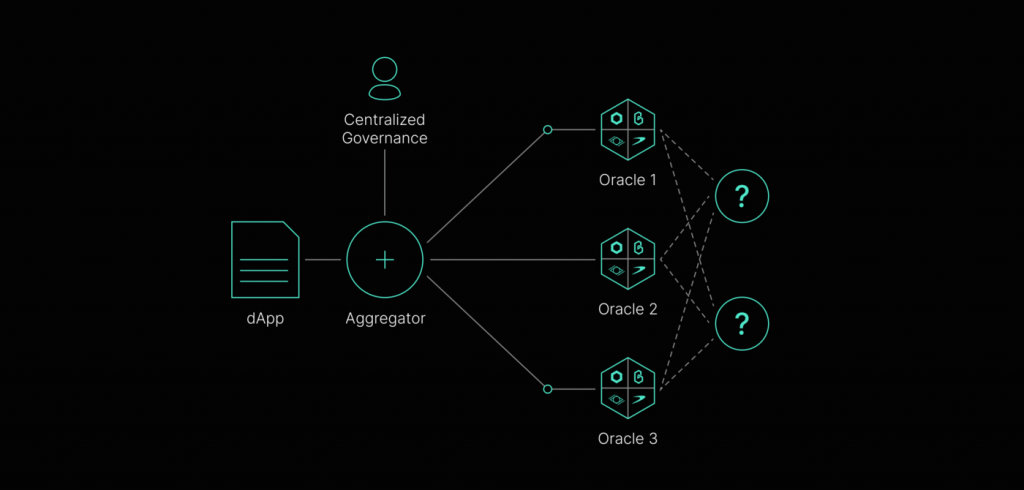

The graph organizes data into subgraphs, which are known as open APIs. The Graph QI API makes it simple for developers to search and retrieve data via the Graph QI API. Because it provides the required information to DEX applications like DEX to run properly, it allows them to access data quickly.

After StreamingFast, a blockchain data firm was given a grant by The Graph Foundation, the protocol has been able to support blockchains that aren't Ethereum-based. By using The Graph, developers can get access to data like prices and user information. Currently, as of November 2021, 25 different blockchain networks are operational with this protocol. Since its beginnings, StreamingFast has made many important contributions to The Graph's development process.

The Graph has two types of nodes: full nodes and indexing nodes. Indexing nodes run the GraphQL software that helps to keep the network organized while full nodes host and provide data to the network. The network is currently running on three tenets: mainnet, ropsten, and kovan.

Booming Fintech is a hot commodity, with its 24-hour trading volume of $136,511,855 and current market price of $0.65 reflecting the surge in demand. Revenue is anticipated to increase by 212.52 percent by 2026.

Conclusion: a rundown of the most interesting Defi projects to keep an eye on

You might be asking, “What is the future of DeFi?” Thanks to billionaire entrepreneurs and investors like Mark Cuban, Defi is in style right now. As a consequence, the monthly volume in May 2021 was $173 billion, up from $39.5 million in January 2019.

Decentralized Networks offer a plethora of benefits over traditional ISPs, such as the elimination of intermediary brokers. It's also considered one of the greatest money tools in nations where financial systems are poor, and anyone with a computer can run their funds effectively thanks to dApps.

This type of technology may be widely accepted later. However, its potential to gain tremendous popularity is undeniable. Most individuals may be unaware of such platforms because they don't have traditional access to them; however, the future looks promising for this project. The conventional financial system, including businesses and financial authorities, is still hesitant to incorporate new technology; but anyone who wants their project to be part of the future must learn how to accept change and operate in this environment.

We shouldn't dismiss these platforms just yet, even if they haven't fully evolved into a secure network. It still faces the same hurdles that the crypto environment faced during its early days.

You may have complete control and ownership of your crypto assets if you use decentralized financial applications. You can connect to the financial system as part of a peer-to-peer network by utilizing apps. Defi projects are becoming increasingly popular since they operate on top of blockchain networks like Ethereum.

We looked through the market to find only those five DeFi projects that meet our specific standards. Community-driven protocols, liquidity pool platforms, and industry facilitators are among these actors. We believe these initiatives will effectively shake up traditional finance, but you should exercise caution when investing in any Defi project.

⚡️ What is DeFi?

DeFi is a cryptocurrency-related term that refers to decentralized finance. It's a catchall phrase for the portion of the cryptocurrency world that wants to replace traditional intermediaries and trust mechanisms with blockchains.

⚡️ Why is Bitcoin not DeFi?

A modern financial revolution, Bitcoin is a type of currency that operates on its own blockchain – much like fiat currency. DeFi, on the other hand, enables you to lend, borrow, and trade cryptocurrencies like Bitcoin just as banks do.

⚡️ Is there a DeFi on Ethereum?

Ethereum was the first blockchain to enable users to develop smart contracts, which is something Bitcoin could not do. This helped Ethereum achieve its current leadership in DeFi.

⚡️ How much is the DeFi coin worth?

The market price for Defi Coin is $0.539106 per DEFC. The all-time high for Defi Coin was $0.567323, which it hit on January 11, 2018. The current circulating supply of Defi Coin is 0 DEFC.

⚡️ Is DeFi safe?

You're on your own with DeFi. While blockchain is recognized for its security, it's not immune to attacks. In fact, an Elliptic research predicts that fraud and theft linked to DeFi will result in more than $10 billion in losses next year, almost 600 percent greater than last year.