Massive ETF Surge Drives Bitcoin Close to $66K

Spot Bitcoin Exchange-Traded Funds (ETFs) have had a noticeable impact on Bitcoin's price fluctuations. This could signal potential price rallies for the cryptocurrency in the near future.

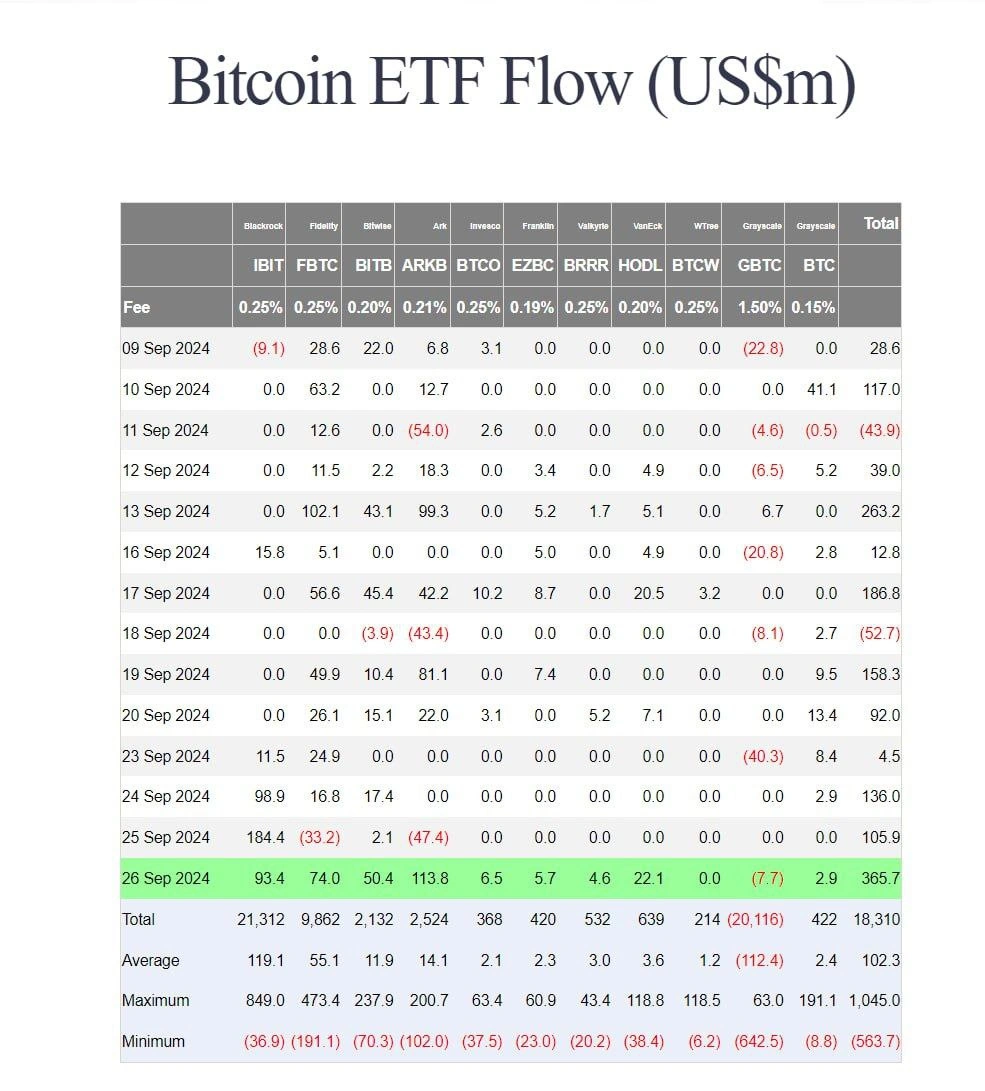

Yesterday, investors directed more than $360 million in net inflows into U.S.-based Bitcoin ETFs. This is the largest amount invested in over two months, indicating growing interest in these financial products.

Growing Interest in Spot Bitcoin ETFs

Investor sentiment and behavior towards spot Bitcoin ETFs play a key role in shaping price movements. When there is an increase in inflows, Bitcoin's price tends to rise. On the other hand, when outflows occur, the price often experiences a correction.

Over the past few weeks, investors have been actively buying up Bitcoin ETFs. Since September 6, only two out of 14 trading days have seen net outflows. This period of strong demand reached a peak yesterday with $365.7 million in net inflows, the highest since July 22.

Among the leading ETFs, Ark Invest’s ARKB fund attracted the most attention with inflows of $113.8 million. It was followed by BlackRock’s IBIT fund, which saw $93.4 million in inflows, Fidelity’s FBTC with $74 million, and Bitwise’s BITB with $50.4 million. Grayscale’s GBTC was the only fund to experience a small outflow, losing $7.7 million. As a result of these inflows, BlackRock’s IBIT, the world’s largest Bitcoin ETF, now manages assets worth over $21.3 billion.

Price Impact of Inflows

The surge in inflows has coincided with a sharp increase in Bitcoin's price. Notably, since last Wednesday, when the U.S. Federal Reserve announced a 0.5% reduction in key interest rates, investors have been increasingly pouring funds into Bitcoin ETFs. This move by the Fed has likely encouraged investors to seek higher returns in alternative assets like Bitcoin.

During this period, Bitcoin’s price has climbed from $59,300 to nearly $66,000 today. This represents an impressive 11% gain in just over a week. The growing demand for Bitcoin ETFs, combined with favorable economic conditions, suggests that Bitcoin may continue to experience upward momentum in the coming weeks.