Crypto-bubble: What’s Next?

Table of content

- What is a crypto-bubble?

- The cryptocurrency bubble is an example of mass hysteria over investing.

- Valuations for crypto startups have been bubbling up lately.

- This performance is hardly inspiring confidence.

- The most rigorous test of cryptocurrencies

- Is the cryptocurrency bubble going to deflate because there's less cash circulating in the economy?

- Comparing cryptocurrency prices to the stock market

- Some crypto entrepreneurs are still willing to double down despite the danger.

- A comparison of eight cryptocurrencies shows that Bitcoin Cash has the fastest transaction speed, followed by Litecoin.

- Is there a Bitcoin bubble?

⚡️ What does a cryptocurrency cryptocurrency bubble meaning?

From a skeptic's perspective, cryptocurrencies are a highly volatile and unsustainable bubble bound to collapse eventually.

⚡️ Which cryptocurrency will explode next?

Chainlink is one of the most solid cryptocurrencies today. It's one of the top cryptocurrencies to surge in 2022 because of it. Chainlink is a cryptocurrency that connects blockchains to the outside world using “oracles.”

⚡️ Is Etherium a bubble crypto?

Despite the surge of popularity that Ethereum has experienced in 2017, some industry experts contend it is not a cryptocurrency bubble. The cryptocurrency market exploded last year, and Etherium is one of many examples. At the turn of this year, Ether was a viable investment at only $8 per coin and rapidly rose to become one of the most prolific cryptocurrencies in market capitalization.

⚡️ Will XRP explode?

In recent times, Bitcoin (BTC-USD), Ethereum (ETH-USD), and Solana (SOL-USD), the most widely used cryptos, have felt immense pressure. Nonetheless, the coins' popularity and blockchain technology behind them are still strong.

A bubble is a term that has been overused recently in the financial press to describe everything from the housing market to stocks to used automobiles.

As the Federal Reserve has injected trillions of dollars into the economy to fight COVID-19, real estate and stock prices have skyrocketed.

While it is true that market valuations have become stretched due to conventional factors and that the real estate market may never have been hotter, it is difficult to determine whether these assets are in a bubble.

Then there are cryptocurrencies, a rapidly expanding asset class that, during the pandemic, produced money that transformed early investors' lives.

Over the past several weeks, XRP's worth has fluctuated drastically and many have questioned if cryptocurrencies are founded upon speculation. Bitcoin and Ethereum are two of the most widely-traded digital currencies by market cap, skyrocketing in value since 2019 – making some believe a crypto bubble could be forming across international markets.

What is a crypto-bubble?

A crypto-bubble is a bubble in the cryptocurrency market.

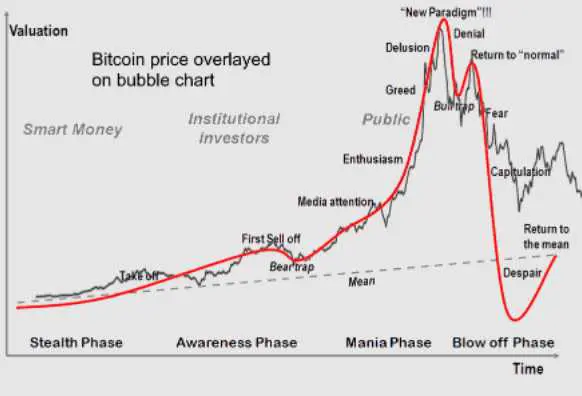

In 2017, Bitcoin prices rose to a staggering $20,000 per coin. This surge in value was driven by speculators who were convinced that the price would keep climbing forever. Sadly, this bubble eventually burst and caused dramatic losses over a short period of time – with values falling all the way back down to around $6000 each within just months! A crypto-bubble is created when market prices suddenly soar before rapidly collapsing at an equally fast rate.

Cryptocurrencies are always accessible for trading online, meaning they can be converted into liquid assets without the influence of a central bank or government. This may be why investors have yet to pay attention to cryptocurrencies during times of crisis.

As the epidemic spread, large institutional investors began to invest in cryptocurrency markets. Legendary investors like Paul Tudor Jones bet on these fascinating financial instruments.

You might also experience FOMO, or the Fear of Missing Out on a chance, which could help push cryptocurrency market prices to record highs.

Add to that government stimulus payment and people trapped at home practicing social isolation, and you've got the makings of an epidemic.

Now that the pandemic is winding down, investors are wondering if the sudden growth in cryptocurrency markets was just due to more money being available overall.

Cryptocurrencies remain a highly debated topic – while some people hail them as revolutionary technology that could completely revolutionize our idea of money, others are skeptical about their true potential.

The cryptocurrency bubble is an example of mass hysteria over investing.

Crypto skeptics have plenty of data to suggest that the cryptocurrency market is undergoing a speculative bubble.

Where will venture capitalists be investing their money in 2022?

By understanding these goals, we can gain a better overview of what these volatile assets are.

Due to its advantages over traditional fiat currencies, Bitcoin has earned its stripes as the world's foremost virtual currency. Just keep in mind that it is much more like a stock than, say, the US dollar or other trusted state-backed money supplies because of its extreme volatility.

Cryptocurrencies are unstable, making them an unreliable method of saving money.

They're also easy to counterfeit—all you need is some basic programming skills. As of today, Coin Gecko records a staggering 12,000+ different forms of cryptocurrency in circulation.

Cryptocurrency prices reaching record highs in November should be a reminder to investors of how quickly these prices can drop. The market value has plummeted by over $1.2 trillion within a few months.

Most crypto bubbles go through these five stages: displacement, rise, euphoria, profit-taking, and panic.

As investors liquidate their holdings to capitalize on recent gains, it will be intriguing to observe the cryptocurrency sector's response once the Federal Reserve increases its measures against inflation.

Valuations for crypto startups have been bubbling up lately.

Cryptocurrencies like FTX and OpenSea, which have seen a recent surge in value, may be indicative of an economic bubble.

The Chinese government's ban on ICOs is a primary factor driving the recent upturn in cryptocurrency prices. In mid-January, Chinese authorities announced their decision to regulate or prohibit Bitcoin transactions. Not long after, negative news from China sparked a global price drop. However, the skyrocketing popularity and usage of cryptocurrencies have caused bitcoin ATMs to explode in number.

Since its last round of funding, the company's rapid expansion has been reminiscent of the tech industry's dot-com days when billion dollar valuations were commonplace. However, it is not alone in this growth; numerous IT companies are experiencing similar success.

With a current valuation of $13.3 billion, OpenSea stands as the premier cryptocurrency marketplace according to CoinMarketCap's metrics.

NFTs sales reached $7 billion for the first time in January, but many of those were purchases made by the seller to falsely increase demand and drive up prices.

This performance is hardly inspiring confidence.

With digital assets like cryptocurrency companies and NFTs “CryptoPunks” being sold for millions of dollars, it's hard to deny that there is a bubble forming right before our eyes.

The most rigorous test of cryptocurrencies

In recent months, numerous warning signs have pointed to the possibility that crypto markets may be enduring a drawn-out bear market. All signs point to 2022 being a pivotal year for the trajectory of this exhilarating asset class.

Is the cryptocurrency bubble going to deflate because there's less cash circulating in the economy?

As cryptocurrency and blockchain technology becomes increasingly popular, will investors dump traditional currencies for digital ones?

Undeniably, those who embraced cryptocurrency early were generously rewarded for their faith in this revolutionary technology.

crypto bubbles often burst, leaving investors who are late to the party badly burned. Given the aforementioned danger signals, cryptocurrency investors should be especially wary of investing at this point since

Comparing cryptocurrency prices to the stock market

Cryptocurrency prices routinely outperform the stock market. A single Dogecoin token was never worth more than one dollar, but its value shot up to 72 cents last year from half a cent at the end of 2020, resulting in a 15,000 percent boost. It subsequently tumbled just as rapidly.

As the crypto space continues to expand, pioneering and forward-thinking projects are emerging with boundless potential. Some of these networks have their coins that could potentially be used to trade a variety of items, from carbon credits to digital copies of educational textbooks. Other notable networks include Solana, Polygon, etcetera with their cryptocurrency coins that may also be employed for trading everything from emissions permits to electronic versions of college course material.

Many coins, like Dogecoin and Shiba Inu, were designed as Internet jokes or $wool, a token created for Wolf Game that has no discernible function other than as a means of trading. At one point in 2017, the value of Dogecoin exceeded that of Twitter’s entire market capitalization. Shiba Inu's market capitalization is greater than that of American Express, and $ wools is more than Goldman Sachs.

George Caludis, an analyst at media publication CoinDesk, said the cryptocurrency is turning our concept of “worth” on its head. “A Shiba Inu shouldn't be worth anything close to an 11-figure sum,” he added.

Some crypto entrepreneurs are still willing to double down despite the danger.

PDX is a payment processing firm founded by former investment banker Shane Rogers that will allow customers to make purchases using cryptocurrencies from merchants who don't accept them. Mr. Rogers, on the other hand, launched PDX Coin in December rather than requesting conventional investors to fund his company. The founder of this firm may sell tokens in place of shares.

Given that Mr. Rogers put all of his firm's assets into Bitcoin rather than a more stable currency, he lives in fear of a significant sell-off damaging the value of those assets to nothing. For example, on May 19th after China announced it would ban banks from cryptocurrency trading, the prices of digital assets dropped by about 30%.

A comparison of eight cryptocurrencies shows that Bitcoin Cash has the fastest transaction speed, followed by Litecoin.

At one point in 2017, the value of Dogecoin exceeded that of Twitter’s entire market capitalization. In addition, only a small number of individuals are investing large amounts.

“Bitcoin is utilized by individuals all over the world,” according to Chainalysis's Maddie Kennedy. “Coins with a lot of activity by a few users are dominated by an active insider club.”

Choosing a coin or token intended to fulfill a particular need – as opposed to conventional money like bitcoin, or say, as a means of sending money across regions where basic financial services are limited – might help you break through the jungle. Despite its volatility, cryptocurrency will remain a part of the global economy for years.

But, as with any investment, do your homework first. crypto-bubbles can form and pop seemingly overnight, so it's important to understand the underlying technology behind each project as well as the potential risks involved.

Is there a Bitcoin bubble?

It's tough to know — chiefly because it's complicated to determine Bitcoin's real value. Two factors make appraising Bitcoin particularly challenging.

- BTC's short track record means that newly established companies are unstable, and prices are likely to change dramatically as the market figures out its fair value. These sudden price changes can make it look like bubbles are forming and popping.

- Bitcoin is entirely different from other investments. Invariably, investors are able to determine a company's market value by assessing its capability of producing revenue. However, that doesn't work with cryptocurrencies because they don't function like companies. Bitcoin specifically doesn't make any money–which makes it tough to understand its value.

While prices have been low throughout much of 2022, some experts say this might only be a small setback. On the contrary, others contemplate that this could be the commencement of crypto's downfall. Nevertheless, financial institutions like Fidelity and Visa are committing to make Bitcoin more widely accepted. However, regulators are also paying closer attention to crypto which could mean stricter rules in the future.

A wise idea when considering investing in cryptocurrency is to limit potential downsides by only using 10% of your total investment portfolio for riskier assets, like crypto. In this way, you can benefit from the most positive conditions while lessening deficits if prices rapidly decline.