Users Of Ethereum Stake 28.9% Of The Supply, Indicating “Long-Term” Confidence

Due to tokenholders' sustained interest in the cryptocurrency and its potential benefits, nearly one-third of all Ether has been staked.

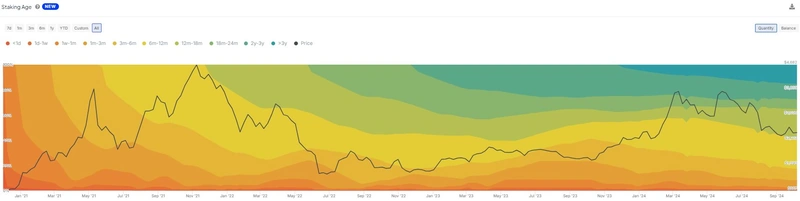

According to IntoTheBlock, an on-chain statistics provider, 28.9% of all Ether had been staked as of October 8. The data platform's January staked percentage was 23.8%, meaning that 5.1% more ETH was staked during the previous ten months.

Additionally, 15.3% of Ethereum stakes had been held for more than three years, according to IntoTheBlock. According to the data provider, this clearly indicates “long-term confidence” in Ethereum's future.

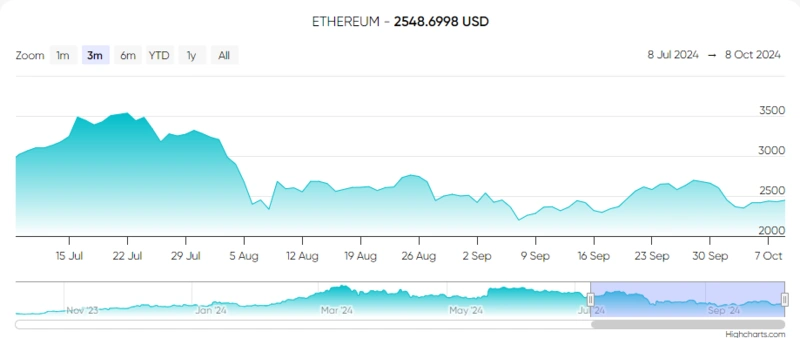

The values of cryptocurrency assets have decreased despite the growing interest in ETH staking. Despite ETH's impressive performance in the first half of 2024, there were some difficulties with the token's price in October.

ETH hit an annual high of over $4,000 on March 12. However, since Then, the asset's price has dropped 40%, currently at about $2,400.

Reducing The Requirements For Solo-Staking

In the meantime, Vitalik Buterin, a co-founder of Ethereum, recently endorsed decreasing the conditions for solo staking.

On October 3, Buterin participated in a conversation regarding solo staking on X. The co-founder of Ethereum understood how crucial it was to reduce the minimum amount of ETH needed for investors to profit from staking alone.

Users with less money can use staking pools, but holders who wish to stake independently need 32 ETH, or over $80,000. Buterin acknowledged in a post that this might discourage more people from participating in staking.