What is a Rebase/Elastic Token and How Does It Work?

Table of content

- Why do we need elastic supply tokens?

- Are there any negatives to using elastic supply tokens?

- What is a rebound?

- What factors influence the projected price?

- Using rebasing to combine bonds

- A list of popular rebases projects is provided.

- Wonderland (TIME).

- High Rebase Reward

- Who exactly controls Rebase tokens?

⚡️ Is it possible to make money on a rebase token?

When he obtains a large amount of funds, he may earn more per day and distribute extra tokens to these stackers as rewards. Obviously, Olympus DAO OHM is the most popular rebase since it is the most frequently forked project from Olympus DAO, however most staking advantages function and function similarly.

⚡️ What is rebase in stacking?

The Rebase Finance platform is a ground-breaking project that allows for automatic stacking and compounding of interest with an infinite APY of 300,000 percent. Users may earn $REBASE rewards in the form of interest payments straight into their wallet by simply purchasing and keeping rebase crypto in their wallet.

⚡️ What is AMPL cryptocurrency?

What is Ampleforth (AMPL)? It's a kind of Ethereum currency with an automatically adjusted negotiable offering.

⚡️ How does an elastic token work?

The circulation supply (or reloading) token expands or shrinks due to changes in the price of the cryptocurrency. This increase in or reduction in supply is accomplished using overbasis.

A cryptocurrency that has a supply that regulator its price is called a rebase or elastic token. Rebase tokens are often connected to another asset and, much like stablecoins, are controlled by an algorithm. Unlike stables, however, Rebase doesn't rely on reserves; instead, it burns tokens in circulation or creates new ones instantly to maintain the peg.

A rebase token’s supply is extremely uncertain, but its price tends to remain constant as long as it tracks the value of another asset.

Most cryptocurrencies' codes don't take into account the price when they're created, which determines how new coins are made and existing ones destroyed (minting and burning). When a block is verified by bitcoin miners, a new bitcoin is generated. There’s no other way to make a bitcoin and there isn’t any method to eliminate it. Bitcoin is produced in such a manner that mining participation and the addition of fresh tokens into circulation are encouraged, not price manipulation. Therefore, bitcoin is unlike any other asset that came before it.

An example of a relabeling token is Ampleforth (AMPL). The supply of the currency is changed every 24 hours to keep the price close to $1.

The value of each wallet holding AMPL will increase proportionally with the number of its assets. This implies that everyone still has the same amount of AMPL. Fundamental economic forces will drive the price back down toward the goal as more tokens are produced.

Conversely, smaller investors are more susceptible to making costly mistakes. When the price of Bitcoin falls below a particular level tough times for smaller bitcoin holders sets in, who may be forced to sell their assets at bargain prices. Although the price of each AMPL token has been halved, you can still expect to yield roughly a dollar for every token you possess.

The Doge Killer, also known as “dog killer” (LEASH) in the Shiba Inu ecosystem, was created to track dogecoin's price at a rate of 1/1000. This means that if DOGE increases up to $0.01, LEASH will increase its value to $0.001 – an impressive gain! It has since become one of the most successful tokens from this system and continues offering great opportunities for those who trust it with their investments.

Dogekiller’s price surged to $0.35 on January 12th as the news of its existence and potential value began to spread, before crashing back down to around $0.05-$0.06 in the following days as people sold off their dog killer tokens.

This allowed investors in dogecoin to influence the price of Shiba inu without having to invest directly in the token, which drew more people into the system.

The project was eventually shut down, although the LEASH tokens were never “withdrawn.” Instead, they are now a savings coin that is adjusted by supply and demand, much like most other cryptocurrencies.

Why do we need elastic supply tokens?

The price of these coins will not change because the supply does. Elastic supply tokens are frequently compared to Stablecoins since they have a reputation for maintaining a consistent worth. Despite their similarities, it is important to note that there are stark differences between the two.

Stablecoins are currencies that maintain a stable value by linking them to the price of another commodity in the real world. The rate of sustainable growth for supply tokens is determined by the target price, which is established through the time-varying supply of tokens.

Elastos uses the same basic architecture as stablecoins, with the exception that elastic supply tokens do not necessarily try to eliminate volatility. Rather than seeking to suppress it, they strive to bring its value down to the level that would realize their intentions for the token.

The project’s overall supply is altered to ensure that when the price rises, so do the quantity supplied. As the supply increases, each token’s value drops.

Similarly, when the price falls, so does the overall supply of the project, resulting in an increased price. As you can see, this

Are there any negatives to using elastic supply tokens?

Investing in elastic-priced tokens can be risky, as the likelihood of incurring losses is higher. It’s true that you may see improved returns but it comes with the risk of heightened financial loss. If a token's price decreases and then subsequently relisted at a lower cost, your net worth could decrease due to both an inevitable dip in value and the need to purchase more tokens for equivalent shares.

Another disadvantage of investing in elastic supply tokens is that they are an experimental asset, raising the possibility of coding errors in the project's smart contract code.

Here are a few examples of elastic offer tokens.

- Ampleforth (AMPL).

- Yam Finance (YM).

- BASE protocol (BASE)

- DEFI 100 (D100)

What is a rebound?

When the price of an elastic token surpasses its targeted rate, it is said to be a positive relabel. On the other hand, when its value falls below that same target point, it can then be referred to as a negative relabel. For example, we have 50 A tokens with a target rebase price of $1. If the token value rises 20% to $1.2 and the rebase increases the quantity by 50%, then the new total supply will be 75 A.

When management token holders cast their votes in a good relabeling situation, they may get a share of the profits. Furthermore, positive relabeling does not adversely affect liquidity suppliers or token holders .

What factors influence the projected price?

The target price is calculated by projects, which establish a modest token price as a guide to moving closer to the intended value. Rebase makes elastic-price tokens a synthetic commodity with an unpredictable value and a supply bias toward stability. To prevent market exploitation, the amount of tokens created is determined by market demand and supply.

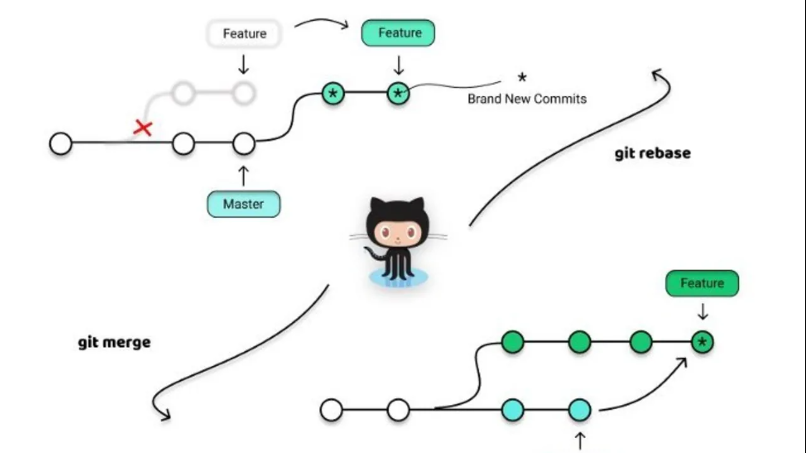

Using rebasing to combine bonds

Rebasing increases or reduces the amount of currency in circulation straight to a user’s address to stimulate demand. Bonds are bought and changed for an algorithmic asset in a market model that supports the asset ratio.

The third aspect is stacking, in which assets are secured to provide liquidity and incentive demand. Users can acquire bonds using stablecoins, and stackers may get the issued tokens by rebasing them. Rather than renting liquidity, the bonding process gives the protocols command over most of it.

A list of popular rebases projects is provided.

This ancient settlement is full of rich, textured history.

Ampleforth is a synthetic asset that provides uncorrelated returns in the DeFi space. AMPL employs Chainlink’s oracle for relabeling. The objective price is $1.009 relative to the 2019 CPI in US dollars, according to the white paper. Reloading occurs every day at 2:00 UTC.

Standard Protocol

The basic protocol is linked to the overall cryptocurrency market’s capitalization in order to track overall trends in the cryptocurrency market. The inclusion of a wider range of assets is beneficial since it provides investors with more access. The underlying token’s intended value has been determined on a tiny percentage of the whole crypto market, which is decentralized and resilient.

MDPL is the maximum feasible tree height.

RMPL was derived from AMPL and uses random resizing with a goal price of $1. The process of rebasing a project takes no more than two days. When the price rises above $1.05 or falls below $0.95, the rebasing procedure is activated. Unlike AMPL, which employs arbitrage events as its target

Here’s where to buy it and how much you’ll pay.

The Yam Finance project was created as a betting system, reloading mechanism, and management system. The platform purchases YCRV tokens in the form of good rebasing for its treasury management. YAM is refreshed twice a day at 8:00 UTC and 20:00 UTC, giving you ample time to adjust your strategies accordingly. A flaw was discovered in the initial version that might have collided with the YFI token.

As a result, the protocol promised to enable users to convert their YAM to YAMv2. After the audit is finished, users will be able to exchange their tokens for YAMv3 using a smart contract.

If you’re having a hard time deciding, take the following factors into account:

The REB (Reserve) price forecast is $1. This cutting-edge project is expected to launch later this year, offering a carefully planned reloading feature at an attractive price point of only $1. The scheme was originally introduced in 2020, and it has had 2 million tokens in circulation since then. According to the protocol’s description, it is immune to inflation and has a built-in mechanism to stabilize the value.

BASED.

Synthetix’s dollar-linked coin is priced in US Dollars and has an elastic supply mechanism called STABLE, which aims to increase the synthetic currency’s base price to $1. Every day at 5:00 a.m. UTC, when the price of Synthetix’s stable dollar-linked coin rises or lowers by 5%, the network. The project’s original timetable had a goal of $100 million, but it was increased to $200 million during the crowd sale.

Perceptions of the future are influenced by images seen in the past (e.g., before and after pictures).

Olympus DAO is a decentralized financial system that aims to create stable coin assets linked to cryptocurrencies. Users are encouraged to deposit or sell their collateral in the Olympus treasury for OHM tokens at a discount using stacking and linking.

The problem that stablecoins like the ones used by Olympus DAO solve is the frequent market turmoil. The existing stablecoins are linked to the US dollar. Olympus DAO’s cryptocurrency reserve is used to issue OHM tokens, unlike other decentralized initiatives. Zeus, a pseudonym for a person, created the project.

Wonderland (TIME).

The Wonderland currency is a decentralized reserve asset system built on the Olympus DAO. The protocol includes several reserve assets, such as liquidity tokens, for each unit of a native TIME token. To ensure that TIME retains its natural value, the model has been set up.

TIME tokens are burned if the maximum amount is not reached when TIME falls below the guaranteed amount. Wonderland users have the option of tying and stacking models, with tying creating new tokens and their purchase from the treasury at a discount. Stacking, on the other hand, allows users to earn interest through compounding.

High Rebase Reward

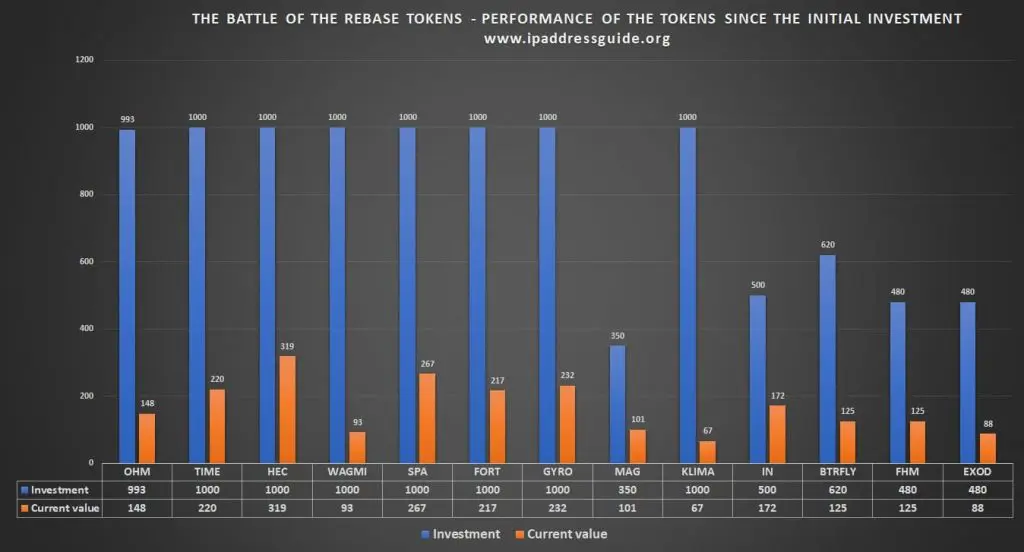

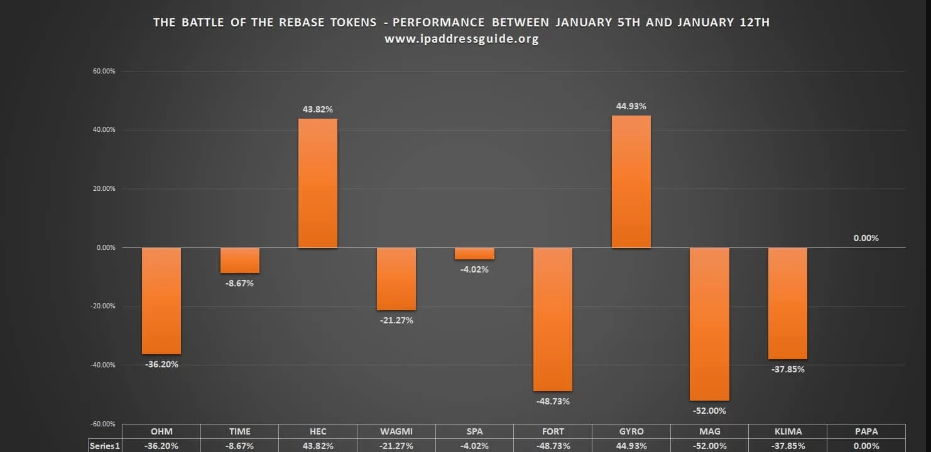

At the moment, Olympus Forks offer investors very high annual percentage yields (APYs). These APYs can be remarkably high, even as much as 50,000%, and upwards! When rebasing occurs,the value of the rebase tokens goes up accordingly. However, the increase is not backed by any substantial growth in the treasury, which leads to a dilution. This scenario causes a downward selling pressure as the tokens are minted and pegged to $1 by its treasury. However, the same $1 backed tokens are sold into the open market for their true value, which generally causes a decrease in demand (and price) for that token.

Who exactly controls Rebase tokens?

A Decentralized Autonomous Organization (DAO) is a self-governing entity, operating without any centralized leadership or control. decisions are made democratically by the community according to a set of rules enforced on a blockchain. The majority of rebase tokens are governed by DAOs. Staking rewards is a way for the rebase token to distribute profits from the treasury to those who stake it.

For example, Olympus DAO sends tokens to the staking contract instead of returning sOHM. This would increase the ratio of OHM staked to sOHM outstanding, and result in a price adjustment upwards (or “rebase”) to correct for the difference. For example: if there are 500k OHM staked and 500k sOHM outstanding, and the protocol generates $5k profit for the day, it can use those profits to mint 5k new OHM tokens. It sends that OHM to the staking contract; there are now 505k OHM staked and 500k sOHM outstanding. In order for sOHM supply to increase by 5k, or 1%, so that it can return to balance, So, sOHM is rebased up by 1%.”