What is crypto Ripple?

Table of content

- What is crypto Ripple, and what does it stand for?

- How to Mine crypto Ripple (XRP) in 2022

- Ripple's advantages

- Ripple's drawbacks

- What you can accomplish with Ripple and XRP

- What is the distinction between Ripple and bitcoin?

- DOES RIPPLE USE BLOCKCHAIN TECHNOLOGY?

- What are the factors that influence Ripple's pricing?

- What makes the XRP Ledger so efficient?

⚡️ How does ripple cryptocurrency make money?

Ripple charges a fee for each transaction. XRP is sold, payment commissions are earned, investment earnings are received, and loan interest payments are made by Ripple. In 2012, Ripple was founded as one of the most prominent blockchain and crypto projects. The firm has collected more than $293 million in venture capital funding.

⚡️ What is the essence of cryptocurrencies?

Cryptocurrency is a decentralized virtual currency that does not rely on banks to verify payments. It's a peer-to-peer system that allows anybody with an internet connection to send and receive money.

⚡️ What are the best coins to mine?

For example, Peercoin and Bitcoin Cash are among the top 5 cryptocurrencies mined, according to Coin Warz, a portal that evaluates the feasibility of mining various coins. Furthermore, Vertcoin, Ethereum Classic, and Ravencoin are among the most profitable crypto coins to mine.

⚡️ How is Blockchain used?

Blockchain is a relatively new technology that has grown in popularity alongside the cryptocurrency industry. Today, it's not just a fad in the financial world. Blockchain is already being utilized to store and process personal information and identification in marketing and computer games.

Ripple's XRP cryptocurrency is an unparalleled network and payment system designed to revolutionize transactions across the world. With its technology, users can securely and swiftly transfer money from any place in the world without a hitch. Ripple has crafted a revolutionary currency that makes it easy for anyone anywhere to transfer payments at a fraction of the cost associated with traditional methods.

Right from the start, Ripple was crafted as an efficient and trustworthy substitute to SWIFT (the international interbank transfer network), providing a dependable way of processing settlements between substantial financial institutions. As Pat White, CEO of Bitwave stated: “Ripple is the ultimate solution for money transfers worldwide.”

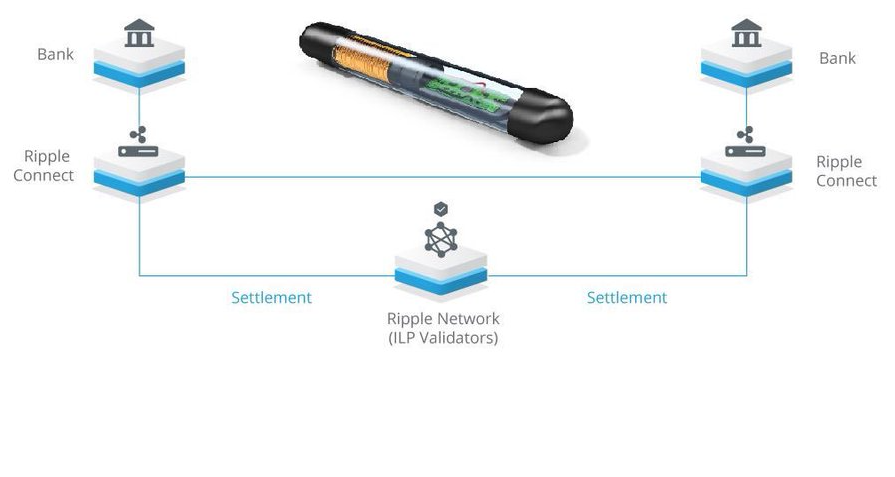

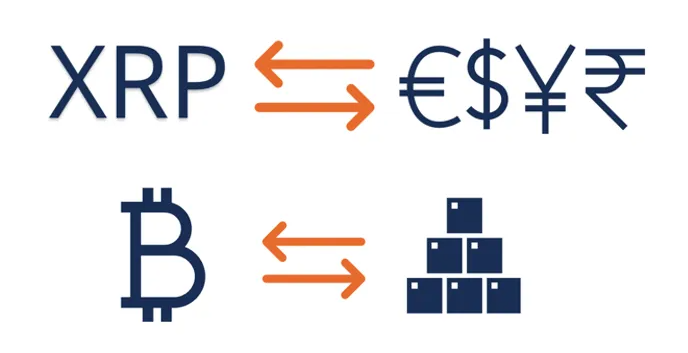

Ripple crypto compares acts as a go-between for two parties in a transaction since the network can quickly verify that the trade has gone correctly. Ripple may help with various fiat currencies and digital coins like bitcoin, to name one example.

When customers make a transaction on the network, the network takes a little fee in XRP, a cryptocurrency.

“The regular transaction fee on Ripple is set at 0.00001 XRP, which is tiny in comparison to the high fees charged by banks for cross-border transactions,” says El Lee, an Onchain Custodian board member.

TYPES OF CRYPTOCURRENCIES – WHAT ARE THEY AND HOW THEY DIFFER

What is crypto Ripple, and what does it stand for?

Crypto Ripple is a revolutionary and open-source, distributed payment protocol that allows fast and cost-effective global payments. By connecting users directly to banks through its extensive network of participants who exchange IOUs (I owe you) in various currencies, it eliminates the need for any third party intermediaries like banks or other payment processors. Additionally, this innovative platform provides a decentralized exchange facility for exchanging fiat currency with digital assets such as Bitcoin – making international transactions more efficient than ever before!

By removing the middleman, Ripple can provide faster and more cost-efficient payments across borders. In addition to faster and cheaper payments, Ripple also offers improved security over traditional payment systems by allowing users to control their funds. Crypto Ripple is powered by a digital currency called XRP, which is used to pay transaction fees and provide liquidity on the network. The XRP token serves as an anti-spam mechanism, discouraging malicious actors from abusing the system.

You may invest in XRP, use it to trade other cryptocurrencies, or utilize it to pay for network transactions.

The XRP blockchain, unlike most other cryptocurrencies, differs significantly in how it works. Other cryptocurrencies make their transaction registers and validation procedures available to anybody who can solve complex math problems fast. Transactions are secure since the majority of leveraged investors must consent to verification before they may be included.

The Ripple XRP network decentralizes things to a certain extent, using the following consensus method:

- While anybody may download the verification software, it maintains distinct lists of nodes that individuals can choose to confirm their transactions based on who they believe is the least likely to cheat.

- Validators keep track of their lists, which they update every three to five seconds after new transactions occur. If there is a discrepancy, they will stop and investigate the reason for the mismatch. This allows the network to safely and quickly verify transactions, giving it an edge over other cryptocurrencies like bitcoin.

- “Confirming bitcoin transactions might take several minutes or hours, and they usually have a high transaction price,” Lee explains. “Transactions in XRP are confirmed in four to five seconds at a lower cost than those of bitcoin.”

How to Mine crypto Ripple (XRP) in 2022

Mining is a distributed verification system employed by most blockchain-based cryptocurrencies. It serves to speed up transactions while also providing the mechanism for adding new money into the network – typically as a reward to validators for their efforts in supporting the network. For example, Bitcoin has a limit on the number of tokens, which will be produced, of 21 million.

While Bitcoin and Ethereum mined their coins before making them available to the public, Ripple did this differently by “pre-mining” 100 billion units of XRP.

Ripple benefits from XRP in circulation; this is a motivation for it to help the cryptocurrency expand and be successful over time. Another portion of XRP is kept on reserve for regular sales to the market cap ripple.

Understandably, this has generated worries that large quantities of XRP might be released at once, undermining the value of other XRPs already in circulation.

The company overcame the uncertainty by providing several measures (trust, regular release, etc.) but the success was fleeting. In 2020, the firm ran into trouble with the US Securities and Exchange Commission (SEC) because it classified mining as pre-mining.

Ripple's advantages

- Settlements are immediate. Transaction confirmations are very quick. Compared to the days it might take banks to execute a wire transfer or the minutes or even hours it takes to verify bitcoin transactions, they happen quickly.

- Ripple has extremely low fees. The cost of executing a transaction on the Ripple network is just 0.00001 XRP, which is a tiny fraction of a penny at current exchange rates.

- XRP users can buy and sell XRP by using the same network of exchanges that already function in other countries, allowing for a global exchange network. The Ripple network isn't limited to XRP transactions. It may also process transactions involving other fiat currencies and cryptocurrencies.

- XLM is a cryptocurrency that large banks use. Major businesses are also utilizing Ripple as a transaction system. Santander and Bank of America are two firms that use this network, showing that it is already more widely accepted in the institutional market than most cryptocurrencies.

Ripple's drawbacks

- Some of the reasons cryptocurrencies have become so popular is that they are decentralized, giving individuals more control over their money. The Ripple system might be somewhat centralized due to the default list of validators, which goes against the anti-centralization philosophy.

- Large numbers of XRP were pre-mined, which could create situations where Ripple's non-circulating holdings are released all at once in a way that drives down the value of XRP.

- The SEC has taken action against XRP. In December 2020, the SEC filed a lawsuit against Ripple, alleging that because it has the authority to offer XRP at any time, it should have registered it as a security. The company has denied the accusations.

What you can accomplish with Ripple and XRP

You may utilize XRP in the same way you would any other digital currency, for transfers or as a potential investment. The Ripple network may also execute various transactions, such as currency exchange.

For example, you can save time and money by changing dollars for euros through the Ripple network instead of a bank or money transfer company. This is because the fees tend to be high when going through banks and money transfer firms. Also, it's faster to go through the Ripple network.

What is the distinction between Ripple and bitcoin?

Bitcoin is the most popular digital currency, but Ripple offers many advantages over it. Here are a few key distinctions between them:

- Technology: Bitcoin is a cryptocurrency that was created in 2009 by someone using the alias Satoshi Nakamoto. It's based on blockchain technology, which records a complete record of verified transactions. Ripple, on the other hand, uses its proprietary technology known as the Ripple Protocol Consensus Algorithm (RPCA).

- Mining: Miners verify bitcoin transactions and create new bitcoins in the network. Ripple performs an unusual distributed consensus mechanism that verifies transactions using a network of servers, all of which are pre-mined.

- Transaction times: Ripple can process 1500 transactions per second and scale up to 50,000 transactions per second, comparable to Visa. Bitcoin's transaction rate is three to six transactions each second.

- It is important to note that there is only 21 million Bitcoin in existence, while Ripple has 100 billion pre-mined XRP tokens.

DOES RIPPLE USE BLOCKCHAIN TECHNOLOGY?

Ripple differs from bitcoin in that it uses its proprietary technology, the Ripple Protocol Consensus Algorithm (RPCA), instead of blockchain technology. Bitcoin transactions are verified by miners and then recorded to the existing blockchain. Ripple also employs checking servers and a consensus mechanism, but it does so with its proprietary technology, the Ripple Protocol Consensus Algorithm (RPCA).

What are the factors that influence Ripple's pricing?

Ripple's price is influenced by a variety of factors, including:

- Regulation: Cryptocurrencies are not regulated by governments or central banks, so they are mostly free from government and bank intervention. If governments and central banks begin regulating cryptocurrencies in the next several years, this may affect the price of Ripple.

- Technology: Ripple's use of blockchain technology to make global payments possible distinguishes it from other cryptocurrencies. Several large banks have expressed interest in Ripple's system, which could cause its value to rise or fall.

- Good press for Ripple technology will likely lead to a favorable price impact.

What makes the XRP Ledger so efficient?

For cryptocurrency users familiar with average transaction costs, XRP's $0.0013927 may appear to be quite low. The top two cryptocurrencies by market capitalization, Bitcoin and Ethereum, have often had all-time highs surpassing $50.

Though it shares some similarities with Bitcoin, the XRP Ledger is its own blockchain network that uses public and private cryptographic keys as well as digital signatures to validate transactions.

Proof-of-work (PoW) consensus algorithms require a great deal of specialized computing hardware, but the ConsenSys Quorum platform doesn't use PoW. Rather, it relies on a network of “unique nodes” to efficiently agree on which transactions can be processed in the network. Permissioned servers maintain a Node List that helps the network achieve consensus through a Federated Byzantine Agreement consensus mechanism.

If 80% of these unique nodes agree that a transaction is valid, it will be processed according to the rules set by the XRP Ledger. This system is more reliable than those used by other cryptocurrencies and some people worry that this makes it less decentralized and harder to access.

Ledger versions on the XRP Ledger work similarly to blocks on the Bitcoin blockchain as each ledger version contains a full state of all balances present on the network. Therefore, servers can quickly synchronize with any new updates made to the network.