What Is DAO (Decentralized Autonomous Organization)?

Built on blockchain technology, a DAO operates through smart contracts that automatically execute decisions based on pre-established rules.

In this article, we will explore what DAO is, how it works, and its potential to revolutionize business, governance, and various industries.

Table of content

What is DAO Exactly?

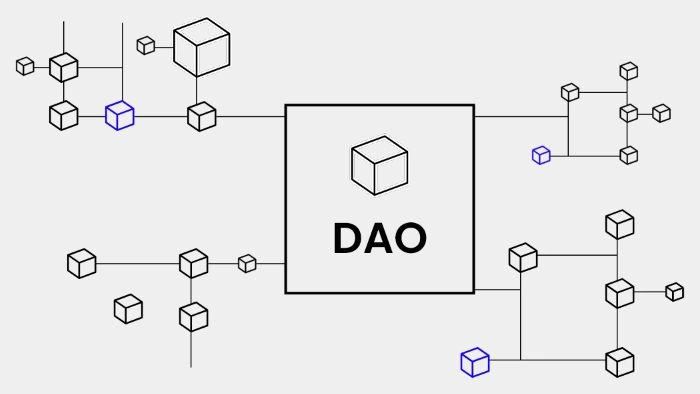

Decentralized Autonomous Organizations (DAOs) are a different way of managing projects and communities without a central authority. Instead of relying on traditional leadership structures, DAOs use blockchain and smart contracts to enable decentralized decision-making.

Rules, operations, and funds are controlled by community members rather than a single entity.

The question “What is DAO?” can be answered in many ways because DAO relies on many more functions than one. DAO operates entirely on a blockchain, making it secure, transparent, and resistant to external interference. Members hold governance tokens, which they use to vote on proposals.

Doesn't matter it’s funding a new initiative, changing existing rules, or distributing resources, decisions are made collectively based on the majority vote.

What Does DAO Stand For?

DAO meaning is to promote decentralized governance. They let people from different parts of the world to collaborate and make a decision together without the need for developers or other people.

This creates an open, democratic environment where every member's vote carries weight.

Key characteristics of DAOs include:

- Decentralization – No single entity has control over decision-making.

- Transparency – Every transaction and rule is recorded on the blockchain.

- Automation – Smart contracts execute agreements automatically.

- Community-driven – Members collectively participate in voting.

How Do DAOs Operate?

DAOs function using blockchain technology and smart contracts, which define the rules and automate decision-making.

Here’s a closer look at how they work:

Smart contracts are the core of any DAO. These self-executing algorithms determine the DAO's regulations while operating on a blockchain. A smart contract operates autonomously after deployment, guaranteeing that every choice is carried out precisely as intended.

For example, if a proposal passes with the required majority vote, the smart contract will automatically execute the decision, whether it involves releasing funds or implementing changes.

Governance tokens play a big role in DAOs. Members hold these tokens, which give them voting power. The more tokens a person has, the greater their influence in decision-making. Contributions, investments, and other forms of participation in the DAO ecosystem can all result in the acquisition of tokens.

Funding and treasury control are also vital components of DAOs. Many DAOs have treasuries that collect funds through token sales, membership fees, or simply volunteering.

Examples and Case Studies

A number of DAOs have drawn notice for their creative methods and systems of governance. ConstitutionDAO, a group of cryptocurrency enthusiasts who tried to buy a rare copy of the U.S. Constitution, is among the more well-known examples. Through crowdsourcing, they gathered more than $40 million, but they were unsuccessful in the auction.

One of the first decentralized venture capital firms was another early DAO, which was simply known as The DAO. But a huge security flaw resulted in a cyberattack that cost millions of dollars in lost revenue. This event drastically changed Ethereum's network and brought attention to the dangers and hacks of smart contract errors.

The governance of contemporary DAOs is much more organized. For example, MakerDAO manages the DAI stablecoin and uses decentralized decision-making to guarantee its stability. Another example is Decentraland, where users own virtual land and use a DAO to influence the platform's evolution.

One of the first decentralized financial platforms, BitShares, introduced novel governance mechanisms that served as the paradigm for numerous other initiatives.

Benefits and Advantages of DAOs

- Equity and Diversity: DAOs encourage inclusivity by giving all members a voice, fostering diverse ideas and fair participation.

- Transparency: All decisions and transactions are recorded on the blockchain, providing a verifiable and accountable record for all members.

- Community Ownership: All members participate in governance, promoting a sense of ownership and greater engagement.

- Lower Administrative Costs: Smart contracts automate processes, reducing the need for middlemen and cutting operational costs.

- Global Accessibility: DAOs allow for global participation, enabling collaboration across borders and cultures.

- Innovation and Flexibility: DAOs, driven by community input and blockchain technology, can easily adapt and innovate.

DAO Challenges and Drawbacks

- Slow Decision-Making: Collaborative voting can delay decision-making, slowing down the organization's overall operation.

- Inefficiencies: Without centralized leadership, reaching consensus on key issues can be challenging, leading to prolonged discussions and reduced productivity.

- Security Vulnerabilities: Smart contracts are vulnerable to hacking and code errors, as seen with The DAO's famous security breach, potentially resulting in large financial losses.

- Legal and Regulatory Issues: DAOs are often not recognized as legal entities in many countries, leading to questions around accountability, taxation, and potential government scrutiny.

- Whale Influence: In some DAOs, large token holders (whales) have disproportionate control over decisions, undermining the decentralized governance model.

Legal and Regulatory Considerations

Regulatory frameworks for DAOs remain unclear, with different jurisdictions adopting varying stances. Some governments see DAOs as innovative governance models, while others view them as potential risks. Key regulatory concerns include:

- Legal status – Some jurisdictions recognize DAOs.

- Liability issues – No clear recognition.

- Taxation challenges – Unclear how transactions should be taxed.

- Government oversight – Regulators may impose restrictions.

Decentralized Autonomous Organization Bottom Line

The structure and governance of enterprises have fundamentally changed as a result of DAOs. By doing away with centralized authority and embracing openness, they provide a fresh approach to overseeing group decision-making. They have many benefits, such more openness and community involvement, but they also have drawbacks, like security flaws, decision-making delays, and unclear legal status.

DAO meaning will probably grow more complex and well-liked as blockchain technology develops further. They still have a lot of promise, though, and are still an experimental and developing idea.

FAQs on What is DAO

What makes a DAO different from a traditional organization?

A DAO operates without a central authority, relying on smart contracts and community voting, whereas traditional organizations have executives and hierarchical management.

How do people participate in a DAO?

Participants hold governance tokens, which allow them to vote on proposals and influence decisions within the DAO.

Are DAOs legally recognized?

Legal recognition varies by country. Some jurisdictions accept DAOs as legal entities, while others do not have clear regulations, making compliance challenging.

Can a DAO be hacked?

Yes, DAOs are vulnerable to smart contract bugs and security breaches. The DAO hack of 2016 is a well-known example where millions of dollars were lost due to a vulnerability in the code.

How are decisions made in a DAO?

Decisions are made through a voting process where members propose ideas and vote using governance tokens.

What are some well-known examples of DAOs?

Notable DAOs include MakerDAO (governing the DAI stablecoin), Decentraland (virtual land governance), ConstitutionDAO (an attempt to buy a U.S. Constitution copy), and The DAO (one of the first DAOs, which suffered a major hack).