Why Solana (SOL) Price Bounced Back Above $140?

Solana's native token, SOL, experienced an 8.5% price increase on March 24, reaching $142, marking its first time hitting this level in two weeks. This rally mirrored the broader cryptocurrency market's gains as traders became more optimistic, anticipating a lower risk of economic downturns. The rising appetite for risk was also visible in the memecoin market, with several memecoins rising by more than 12% since March 23.

Aside from the broader market rally, SOL had its own factors contributing to the price boost. Notably, network activity saw a rise, and US President Donald Trump was a notable contributor in the memecoin space. Furthermore, growing interest from top traders on exchanges and the increasing chances of a Solana exchange-traded fund (ETF) approval suggested further potential for SOL's price growth.

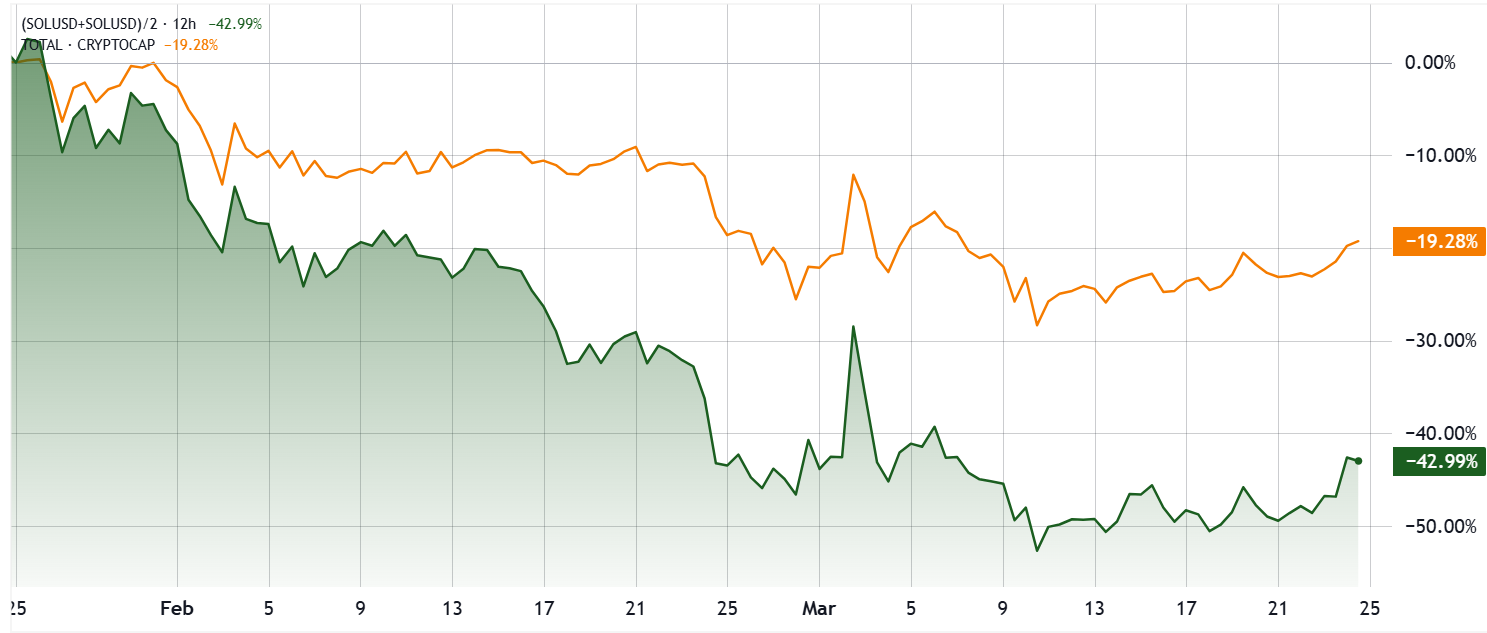

Despite the recent surge, SOL has underperformed the broader crypto market by 23.7% over the past two months. This downturn can be linked to a 93% drop in Solana's network fees, a decline that likely started with traders' disappointment in the memecoin sector, which then spread to the decentralized application (DApp) market.

SOL Still 52% Below Its All-Time High

Currently, SOL is trading 52% below its all-time high of $295, despite remaining the second-largest blockchain in terms of total value locked (TVL) and ranking third in on-chain volumes. To put this into perspective, BNB is trading 20% below its all-time high, and XRP is 28% under its peak. While Tron and BNB Chain present competition in on-chain volumes, Solana still holds an edge in terms of smart contract deposits, with $6.8 billion in TVL, surpassing BNB Chain's $5.4 billion. Solana's key highlights include the Jito liquid staking solution, Kamino lending and liquidity platform, and the Jupiter decentralized exchange.

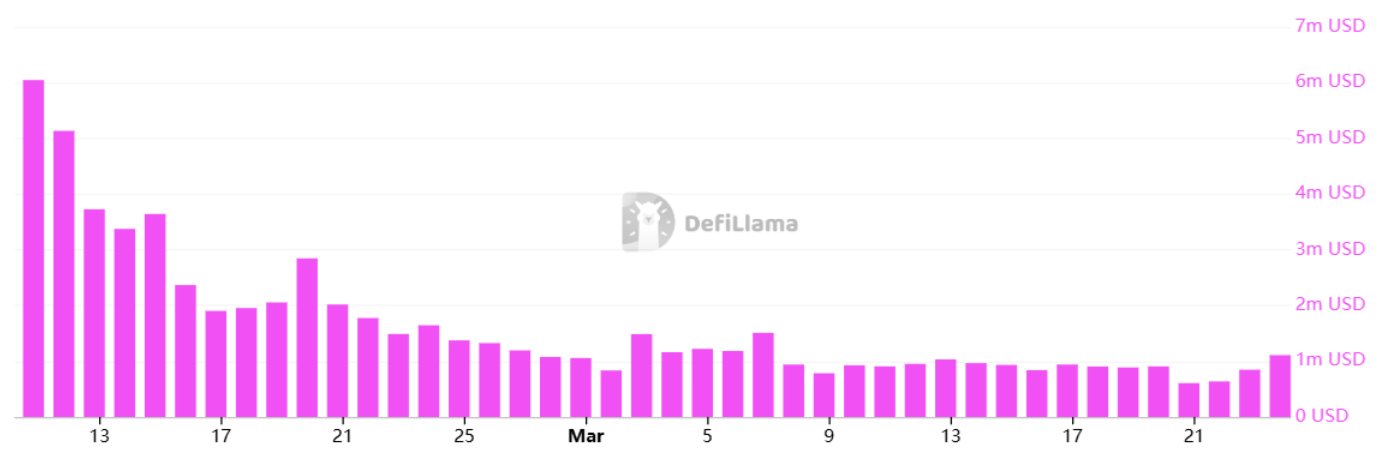

Additionally, Solana’s fees have recently exceeded $1 million per day, surpassing the Ethereum base layer, while Solana’s revenue has also reached its highest levels in two weeks. Although still below levels seen two months ago, the uptick in network activity suggests that Solana may have reached its bottom, with numbers continuing to improve steadily. In contrast, Ethereum saw under $350,000 in fees on March 23, leading to an increase in ETH supply, as its built-in burn mechanism couldn't offset weak blockchain activity. Solana’s 7.7% native staking reward rate also exceeds the equivalent 5.1% inflation rate, according to StakingRewards data.

Solana ETF Approval and Trump’s Tweet Add Momentum

Despite recent weakness, top traders on Binance have increased their long (bull) positions on SOL, according to CoinGlass data. On March 23, the long-to-short ratio on Binance surged to 2.40, the highest in over two months. Part of this momentum stems from the anticipation surrounding the potential approval of a spot Solana ETF in the US.

The US Securities and Exchange Commission (SEC) is expected to provide a final ruling on the ETF by the end of the year, as per Matthew Sigel, VanEck’s head of digital asset research. While success is not guaranteed, the approval of a spot Solana ETF could elevate SOL’s standing, especially among institutional investors, by adding legitimacy to the asset.

Additionally, a social post over the weekend by President Trump, which mentioned the TRUMP memecoin, generated a buzz in the memecoin space. In the Solana ecosystem, Fartcoin surged by 15% on March 24, Dogwifhat (WIF) increased by 12%, and Pudgy Penguins (PENGU) rose by 12% as well.

In conclusion, SOL presents significant potential for further price gains, especially considering the network's high TVL, revenue from fees, and its strong position in comparison to competitors. Additionally, the bullish sentiment from whales using leverage adds to the positive outlook.

Blockchain Expert