4 Hedging Strategies for Cryptocurrency

Table of content

- Adding new types of cryptocurrency to your investment portfolio

- Crypto trading tips

- DeFi Bet Token

- Using cryptocurrency derivatives can protect your deals from sudden market changes.

- Top crypto hedging strategies

- 2. The future is bright.

- 3. Perpetual swaps

- Why should you invest some money in cryptocurrency hedge funds?

⚡️ How do you hedge cryptocurrency?

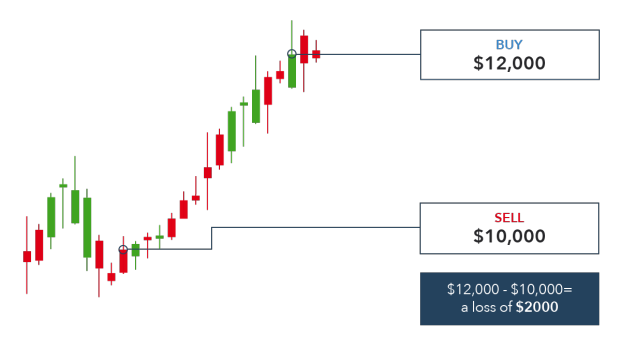

For example, a cryptocurrency trader can capitalize on changes in the market by “buying low and selling high.” This involves taking advantage of price fluctuations by first selling Bitcoin at its higher rate and then buying it back when the cost has decreased. This offsets profit or loss on the exchange, which can add to sizable gains over time. Opening trades in this manner is known as hedging bitcoins or any other cryptocurrency.

⚡️ What is a cryptocurrency hedge fund?

A hedge fund that invests in bitcoin . Crypto hedge funds, like traditional hedge funds, invest in cryptocurrencies as well as blockchain derivatives and futures while venture capital and private equity for blockchain startups.

⚡️ How do you hedge your portfolio?

Investing in various options is one of the most reliable, lasting ways to achieve financial stability. Overall volatility is reduced by keeping uncorrelated assets in a portfolio and equities. Alternative assets tend to lose less value during a bear market, so a diversified portfolio will have lower overall losses.

⚡️ How do you hedge against a market crash?

If you're bonded to some of your higher-risk assets, purchasing put options is the greatest method to protect against potential market losses. Put options give you the choice to sell when the safety level reaches a certain low point.

For any aspiring investor, the key to maximizing your investments is secure storage of your crypto assets. But there are other easy-to-use methods for further increasing those potential gains!

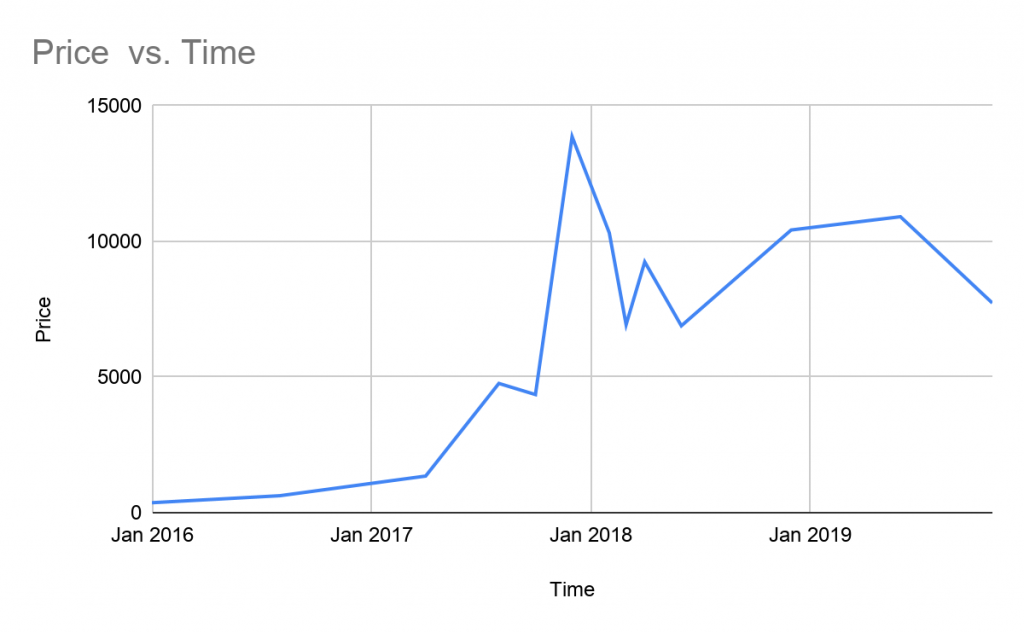

Over the course of just five years, interest in cryptocurrencies has skyrocketed amongst American investors; ownership rates have exploded from 1% to 13%. It appears this trend is not slowing down anytime soon, with industry experts forecasting that by 2021 up to 26% of Americans could own digital assets!

Many first-time investors entering the market wish to maximize their crypto assets' potential returns by learning how to make the most of them. To get your journey underway, here are four expert tips to keep in mind!

Adding new types of cryptocurrency to your investment portfolio

Diversifying your crypto-asset portfolio is a savvy way to minimize risk and maximize potential gains. Diversification or asset allocation is the term used in crypto trading tips for this concept. If the market falls, the aim is to diversify your assets and average out your losses.

Investing $1,000 into cryptocurrencies is a risky gamble for Bob and Alice alike; however, the odds are in favor of Alice suffering more extensive losses if her sole asset dips. On the other hand, the market could go either way for both investors when it rises. Therefore, diversifying investments may be worth considering to mitigate potential financial loss should one's assets plummet in value.

Today's market presents tremendous potential for both gains and losses. When investors begin to diversify their portfolios by investing in several types of cryptocurrencies, this strategy can provide a financial advantage during market downturns but also carries inherent risk.

Here are a only a few of the many varieties of cryptocurrency available:

- Bitcoin price spikes.

- Non-exchangeable tokens or NFTs

- Ethereum smart contract technology (ETH)

- Uniswap (UNI) is a decentralized VPN that works worldwide

- Payment Coins: Light coin (LTK)

- Cryptocurrency: BitcoinDark (DCR)

Although diversifying investments can help to reduce risks and losses, it may also unfortunately lead to reduced returns.

Crypto trading tips

Copy-trading is a mode of investing that entails replicating the investment choices of an expert investor. For example, eToro, Cosmetics, and 3Commas all have this ability.

It's easy to get started:

- Follow traders based on things like prior success, the number of followers, and overall risk rating (how risky the invested assets are).

- To do so, navigate to your user profile and click the “Account” link.

- When traders buy or sell a cryptocurrency, your portfolio does the same.

This is a completely automated approach to trading cryptocurrencies that does not require any study or monitoring of the market.

You can decide what percentage of your portfolio to delegate to each trader after you've already selected them. If you intend to invest $1,000 in two individual traders, dividing your money evenly between them is best. Allocate 10% of the investment amount for one trader and put the remaining 90% towards another. This way, both will benefit from an equal share of capital. By investing in different areas/Multiple traders, creates balance within your portfolio. Plus trades are executed automatically as soon as you finalize your investments. It's important to remember that you always have the opportunity to add more money to a performing trader or replace them entirely.

Professional traders will inevitably make mistakes. You can't predict a trader's success or the future course of crypto assets, so it's critical to establish a loss limit. This is an automated order that stops your copy crypto trading tips if you lose a specific amount or the value of the asset drops.

DeFi Bet Token

This is where the technical stuff begins.

In the context of DeFi staking, “staking” refers to locking your crypto assets into specialized standalone platforms known as “decentralized applications.” To earn yearly interest, you must stake your funds in a DeFi staking pool.

Decentralized finance, or DeFi, is a branch of the cryptocurrency sector that converts conventional financial services such as credit and insurance into blockchain-based apps. The primary distinction is that instead of being controlled or maintained by any single entity, these decentralized financial applications are run by their own user communities and via automatically executable computer programs known as “smart contracts.”

These articles can be a great starting point if you're diving into decentralized apps and smart contracts!

The 5x/10% plan is a wonderful strategy to get paid for your stored assets if you intend to acquire solely cryptocurrencies and keep them for an entire year. Investing in this manner is similar to depositing money into a savings account, aside from one significant distinction: you could make up to five or even ten times more than the measly 1% return traditional banks offer!

While not all cryptocurrencies can be staked, there is a list of compatible assets located on this page. When participating in DeFi platforms, users need to be aware of several other risks in addition to those already present when cryptocurrency trading. Some examples are listed below:

- There are no regulations on Decentralized Networking Devices (DNDs), which means any governments may not back them.

- The value of a staked asset may drop, in which case you would have to wait until it recovers to earn your interest.

- There is always the risk that the platform on which you're staking could fail or become insolvent.

- Before investing, research and only stake what you can afford to lose.

- Hedging your crypto investments is a smart way to protect your downside while still enjoying the upside potential of the market. By diversifying your portfolio, copy-trading, and using DeFi staking platforms, you can minimize risk while maximizing returns. So get out there and start hedging.

Before you entrust your money to Defi betting software, be sure to do your homework.

Using cryptocurrency derivatives can protect your deals from sudden market changes.

What exactly is hedging?

The goal of hedging is to reduce the risk and losses that may occur as a result of market price fluctuations. It involves establishing two trades in the same direction as you expect the market to move, one in the opposite direction.

This is the second backup trade you put in place if the market goes against you, which is meant to compensate for the losses of your first trade.

The futures market is a popular method for crypto investors to hedge their bets. When two parties agree to trade a certain asset at a specified price and date, this is known as creating a long or short position in the futures market.

- Long position: You feel that the price of an asset will rise in the future, so you agree to buy it at today's worth at a set time.

- A negative price: when you think the value of an asset will go down, you agree to sell it at today's price in a set period.

Futures crypto trading tips is a highly speculative and hazardous activity that novices should not participate in. While there is no limit to how much money you can make with futures trading (there's no such thing as an infinite amount of profit), it has an endless amount of risk.While this implies that at times you will owe the exchange more than you originally deposited, the amount you can lose is theoretically infinite.

Top crypto hedging strategies

As a trader, you can use the below four strategies to protect your cryptocurrency assets against market volatility.

1. Short selling

Short selling can become a lucrative money-making opportunity for traders who think their asset's worth is about to fall. This investment strategy involves traders offloading their current assets and returning to buy them back at a lower cost when the price drops. By doing this, investors can maximize their profits and increase their purchasing power.

When you need to safeguard your downside risk from a long position in the same cryptocurrency or related ones, short selling is an ideal option. Short selling helps mitigate any long exposure while margin trading provides more flexibility and power with increased borrowing capability, although it might make things more intricate as it could boost your liquidation price.

2. The future is bright.

Futures contracts are financial pacts between two or more parties to purchase and sell an asset at a pre-established date. Futures can trade before the specified date in secondary markets. These contracts are called derivatives, including Contracts for Difference (CFDs), Options, and Swaps. Investors who believe a stock is overpriced and due for a pullback can open a short position. In secondary markets, they can earn money from the investment and reinvest when the price falls.

Cryptocurrency futures enable investors to maintain advantageous positions in the market, thereby allowing them to realize maximum returns from their investments.

Futures contracts are the perfect investment for those seeking to safeguard their assets from market unpredictability and secure profits in an unstable environment. By locking your investments away for a pre-determined time frame, you can substantially limit your exposure to crypto volatility.

3. Perpetual swaps

Perpetual swaps are a revolutionary form of derivatives that give investors the freedom to purchase or reap profits from an underlying asset without any rigid deadline. Investors can choose when to close their position, providing them unparalleled flexibility and control over their investment journey.

Perpetual swaps can be a tremendous boon for investors, offering them additional leverage to capitalize on price movements while keeping their current spot market position. This allows savvy traders to exploit fluctuating markets without committing new capital or downsizing existing holdings. Plus, perpetual swaps use a funding rate system regularly provides discounts when holding the place – this fee is deducted from your initial margin deposit. Ultimately, this maximizes your budget and keeps more money in your pocket!

Retail investors are finding immense value in the perpetual swap strategy because it lets them secure positions without setting an expiration date. Its popularity has steadily increased, making it the go-to choice for many crypto traders to maximize their purchasing power.

The perpetual swap incentive structure provides an extra push for traders to buy the asset when prices are low to restore balance in the market. Funding rates are designed intentionally with the goal of cost stabilization at heart.

4. Options

Options also act as derivatives in the cryptocurrency market. By options, investors can bet on the underlying asset's increase, decrease, or volatility without actually buying or selling it. This allows for hedging in cryptocurrencies by limiting downward losses that may occur during a decline in the market.

With a put option, the investor is betting on a price drop, and the option's value will increase if the underlying asset falls below its exercise price. This provides a high level of leveraged protection against downside risk at a relatively low cost.

Hedging is not immune to risk like any other financial strategy, and there's no guarantee it will make your investment successful. If done correctly and the timing is ideal, hedging can generate profits by allowing you to buy at a lower price. However, without proper application, hedging can also result in substantial losses.

When an investor has a large portfolio, the advantages of hedging are more beneficial than not hedging; therefore, crypto investors should hedge their bets, especially swing traders.

What is a Short Hedge?

If you’re seeking to protect your current investments from any potential losses, consider employing derivatives and shorting an asset. This strategy involves selling the investment for a pre-set price, shielding it against further devaluation.

Why should you invest some money in cryptocurrency hedge funds?

Volatility characterizes the cryptocurrency market, which means that the cost of any digital currency can vary drastically over time. For instance, between January and April 2021, Bitcoin rose exponentially, with a 125% increase in value, only to later dip by 54%. Fortunately, it recovered shortly after going up 59%. This volatility serves as a reminder of how quickly prices may change in this space.

With the everchanging cryptocurrency market, it is risky to invest due to its unpredictability and the uncertainty of which direction prices may take. However, hedging your bets by investing in multiple crypto assets can mitigate some losses should the market take a negative turn.

As the cryptocurrency market continues to grow and transform, you have an array of chances to generate a profit from your investments. Outlined are only a few techniques to extend your money's reach and optimize growth potential, depending on how daring you feel. It is always important to keep in mind the age-old investing proverb: If there are worries of potential losses lurking at the back of your head, then do not take any chances. The best option when times get tough is to downsize or close your position rather than completely closing it out. Remember, you should only invest and trade with an amount that won't break the bank if something goes wrong!

The content is for educational purposes only and should not be considered investment advice. Nothing mentioned in this piece of writing constitutes a call, proposal, or offer to buy or sell any crypto asset. crypto trading tips in any financial market have inherent risks and may result in the loss of your funds. Before putting money into anything, you should always do significant.