5 Advantages of Cryptocurrency: Why You Should Invest in Digital Money

Table of content

- Why is cryptocurrency a beneficial asset?

- 2. The blockchain technology that underlies bitcoin is inherently secure.

- 3. financial system

- 6. Secure and private

- 5 cons of cryptocurrency

- What is the most lucrative cryptocurrency to invest in?

- Pros and cons of Bitcoin

- What else should I know before trading cryptocurrency?

- Where can you buy and exchange cryptocurrency?

- Is it a good idea to invest in cryptocurrencies?

⚡️ Which cryptocurrency will explode?

✔️ Ethereum

Boasting an impressive 18.49 percent market share, according to CoinMarketCap, this product holds a dominant position in the market. Ethereum is the most volatile cryptocurrency on this list. If Ethereum explodes again in 2022, it will be a tremendous blast.

⚡️ What are the 4 types of digital cryptocurrency?

Cryptocurrency can be categorized into two distinct groups: coins and tokens.

✔️Ethereum is a groundbreaking, transformational platform that leverages smart contracts to build ultra-efficient decentralized applications. This pioneering technology allows users complete control over their data and removes any middleman from the equation. By leveraging this blockchain-based protocol, developers can create distributed apps that are secure, open-source, and highly reliable.

Intelligent contracts are apps on the Ethereum network that lives on their blockchain, similar to Bitcoin or other cryptocurrencies. Etheroll uses both Ethereum classic and coins, as well as altcoins. A currency is any cryptocurrency that runs on its independent blockchain.

Tokens.

✔️Bitcoin (BTC)

✔️Ether (ETH)

✔️Binance Coin (BNB)

✔️Tether (USDT)

✔️Sunny (sun)

✔️XRP (XRP)

⚡️What is mining?

Mining is the process of generating cryptocurrency using computer hardware. Central banks create conventional money.

⚡️What is cryptography?

Cryptography is the study of methods for secure communication that allow only the sender and intended recipient to read the message's contents. Derived from the ancient Greek word Kryptos, which translates to hidden or concealed, this term has been employed for centuries to refer to those mysteries challenging deduction.

They are subject to extreme fluctuations in value, with some experiencing sudden drops or spikes quickly. It can make them alluring to investors and speculators seeking quick returns, but it also implies that just as fast losses can be. As such, investing in cryptocurrencies should only be done by those willing to assume the associated risks.

It is critical to comprehend that neither the central bank nor government controls cryptocurrencies. It renders investors exposed to potential fraud or theft with no possibility of seeking compensation for their losses. Additionally, a cryptocurrency's value might be hard to forecast given that so many factors are in play and unpredictable.

Digital currencies have the potential to transform finance and revolutionize existing banking systems. However, before investing in any cryptocurrency, it is critical to consider both its benefits and drawbacks. So how do you identify which digital currency will be most profitable for your time and money? Studying the benefits of each digital currency, assessing risk levels involved in investments, researching market trends related to different cryptos, and consulting with financial experts specializing in cryptocurrencies are steps that help guide your decision-making process.

Don't be dissuaded from taking advantage of digital coins due to any misunderstanding about their worth. We have compiled all the pertinent facts surrounding cryptocurrency to ensure you are informed and well-equipped to make decisions. If some uncertainty remains, refer to our comprehensive guide on cryptocurrencies for beginners!

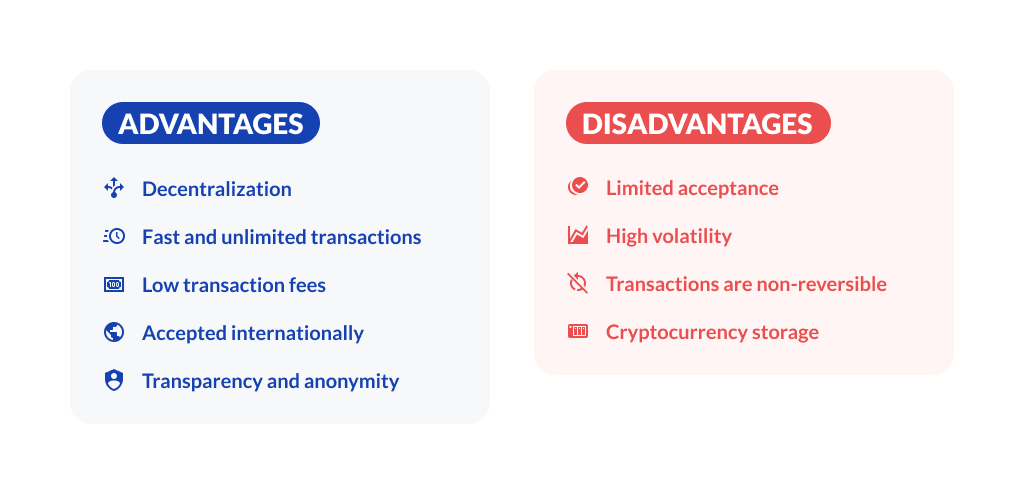

Why is cryptocurrency a beneficial asset?

Bitcoin has revolutionized international trade and commerce, with seemingly no bounds to its potential. Even though cryptocurrencies are a new development (bitcoin was created in 2009), they will continue to improve and improve our world. With the potential for enormous earnings, 24/7 trading, and a secure and transparent infrastructure, the crypto world offers many advantages—if you know how to use it correctly.

The danger is great, and there is potential for significant gains.

There are now more than 10,000 cryptocurrencies available, each with its features. However, all cryptocurrencies share some characteristics, such as their propensity for significant price swings (and drops). The price of goods largely depends on how many coins miners produce and the market demand for those coins.

These market forces may produce enormous profits. For example, Ethereum's price roughly doubled from July 2021 to December 2021, providing true wealth for investors who bought early.

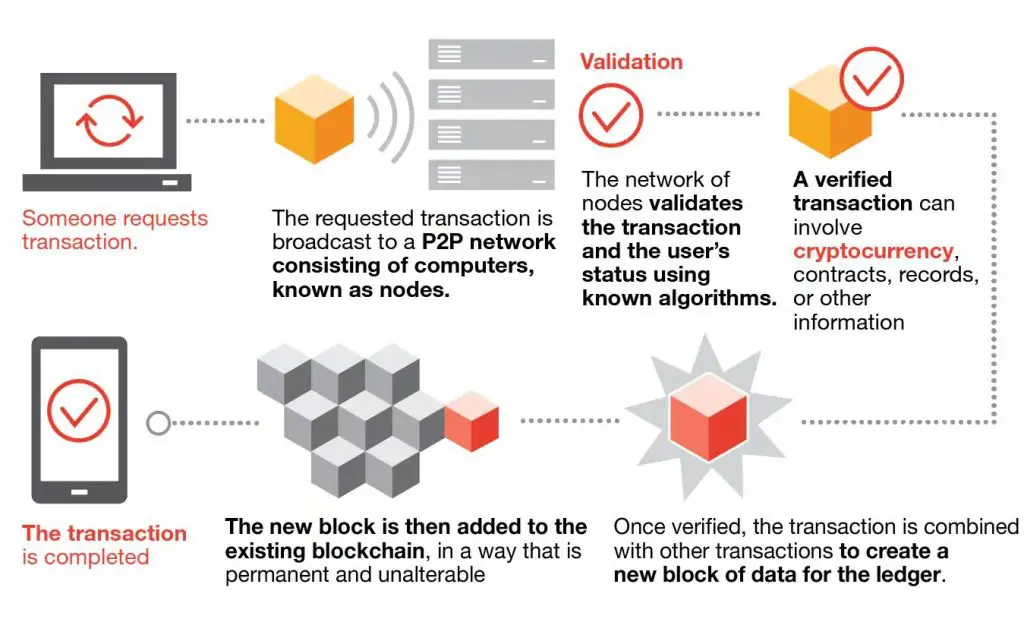

2. The blockchain technology that underlies bitcoin is inherently secure.

The blockchain technology that underlies Bitcoin is inherently secure. The blockchain is an excellent example of decentralized data storage. It tracks every transaction made on the network, which means that once it enters the blockchain, it cannot change it. The chain is maintained across numerous computers throughout the web, making it very safe from hackers trying to tamper with it.

Utilizing blockchain technology allows each transaction to be tracked and easily verified. It makes it almost impossible for money launderers and other financial criminals to get away with their unlawful conduct.

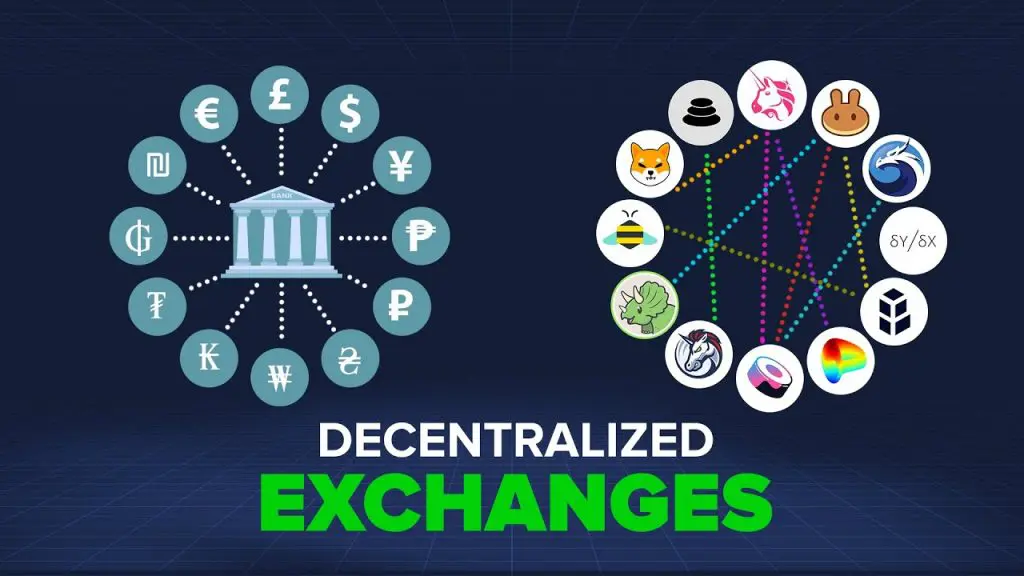

3. financial system

Our financial system, on the whole, revolves around third-party intermediaries who execute transactions. It indicates that any successful transaction necessitates relying on one or more of these third parties. Blockchain and cryptocurrencies offer an escape. Anybody can view them anywhere, so you may participate in financial markets and conduct transactions without relying on third parties.

4. Investment opportunities in cryptocurrency are always available.

Cryptocurrencies have the advantage over banks of always being open. Cryptocurrencies are created, and transactions are recorded around the clock, which means you can trade whenever you want without waiting for Wall Street to open.

This shift has been so influential that even traditional stock exchanges are now exploring trading equities outside regular business hours. Cryptocurrency could be your perfect solution if you want to profit without the classic 9-5 job. Bear in mind that it may require some time before tangible results appear; however, why not take your chances?

5. Cryptocurrencies offer a potential solution to combat inflation

Unlike traditional currencies, the value of cryptocurrencies is determined by global market forces, not connected to any particular economy or nation. But what about the inflation of cryptocurrencies themselves? As an investor, you may sleep well for the most part. Because there are a finite number of coins, the quantity accessible cannot get out of hand, preventing inflation.

Whereas specific cryptocurrencies, like Bitcoin, follow a universal cap, others, such as Ethereum, have an annual limit. Regardless, keeping inflation in check via this method is effective.

6. Secure and private

The decentralized nature of blockchain technology makes cryptocurrencies a more secure transaction method than traditional electronic means. The ledger for these transactions is recorded with cryptographic code, making it difficult to decipher. In addition, cryptocurrency users are unidentifiable due to the pseudonymous nature of the account names. It ensures that any stored data related to a profile cannot be linked back to the user. Consequently, privacy and security concerns have always been paramount issues about cryptocurrencies.

5 cons of cryptocurrency

Digital cryptocurrency is often associated with glamour and success. However, some drawbacks exist before investing in this newly popularized market. While specific issues may be manageable, others may be more complex.

1. It takes time and effort to understand cryptocurrency.

Digital cryptocurrency might need help to grasp. Unless you're a digital native, cryptocurrency (not to mention blockchain) may appear strange. Investing your trust in something you are not familiar with is a potentially dangerous bet.

Many internet sites can assist you (including N26's blog series on cryptocurrency). Despite that, allocating some time and energy toward understanding cryptocurrencies' positive and negative aspects is imperative.

2. Cryptocurrencies may be a highly speculative investment.

A digital cryptocurrency price might fluctuate wildly (allowing investors to profit!) while, at the same time, it can quickly plummet to frightening depths. Subsequently, if you're searching for a reliable income source, there might be better choices than this one.

Unlike stable and secure markets like the stock or commodities market, cryptocurrency relies on speculation. Because of its small size compared to other financial needs, digital cryptocurrencies are more volatile. Their prices may drop as a result.

3. Cryptocurrencies have a long-term investment.

Whereas classic stocks and bonds may provide rapid returns, investing in cryptocurrencies is a marathon – not a sprint. Typically, individuals make cryptocurrency investments to accumulate wealth gradually.

To reap substantial returns, investors should plan to hold their cryptocurrency for a minimum of several years. Additionally, investors should plan to diversify their cryptocurrency portfolio to reduce the risk of substantial losses from any single investment. Investors should take the time to research and grasp cryptocurrency basics before investing. They can make informed decisions while selecting which digital currency they'll support by becoming proficient with the technology behind them and staying up-to-date on related news.

Gold has proven to be an incredibly dependable and solid store of worth for millennia. Cryptocurrencies are an entirely revolutionary idea that people must learn how they may fare in the future

4. Cryptocurrencies face struggles when it comes to scalability.

Cryptocurrencies face struggles and mainstream acceptance. Countless initiatives have been set in motion to address these issues, yet only a few have yet to gain real traction.

One of the biggest hurdles preventing cryptocurrency acceptance is its scalability issue; networks become overburdened when users exceed certain limits.

These delays and high rates ultimately impede the user's experience. Further, most people still need to become more familiar with cryptocurrencies and how to use them, which has hindered their widespread acceptance.

5. Newcomers to crypto are prone to security problems.

While cryptocurrencies do not have the dangers of working with central intermediaries, they may still have security issues. As a cryptocurrency holder, you could be robbed of your financial freedom and all the resources accompanying it if someone manages to get their hands on your private key.

Then there's hacking, phishing, and all the other attempts to gain control by unlawful means. It is something seasoned investors keep an eye on, but new investors will likely be caught in their traps.

6. Vulnerable to hacks:

Even though cryptocurrencies are secure, the exchanges they go through often need to be more confident. Most store user data to correctly figure out their ID, but this information is commonly stolen by hackers who can access many accounts.

After gaining access, these hackers can quickly transfer money from those accounts. As a stark warning, Bitfinex and Mt Gox were hacked in the past, resulting in millions of dollars worth of The occurrence of Bitcoin theft serves as a crucial reminder to protect our cryptocurrency investments by implementing all necessary precautions.

Even though most exchanges have tight security now, there is always a chance for another hack.

What is the most lucrative cryptocurrency to invest in?

No one cryptocurrency is significantly better than the others. It depends on personal taste, but there are a few things to remember. Consider your risk tolerance; could you lose a substantial portion of your investment if the coin you pick dropped in value?

Do you make money solely with Bitcoin or intend to pay in it too? Are you seeking a cryptocurrency to invest in that will turn a profit or one that offers positive social and environmental returns? Choosing the market leader, Bitcoin, is a straightforward approach. It is the first decentralized currency and the most comprehensive data set that investors must assess.

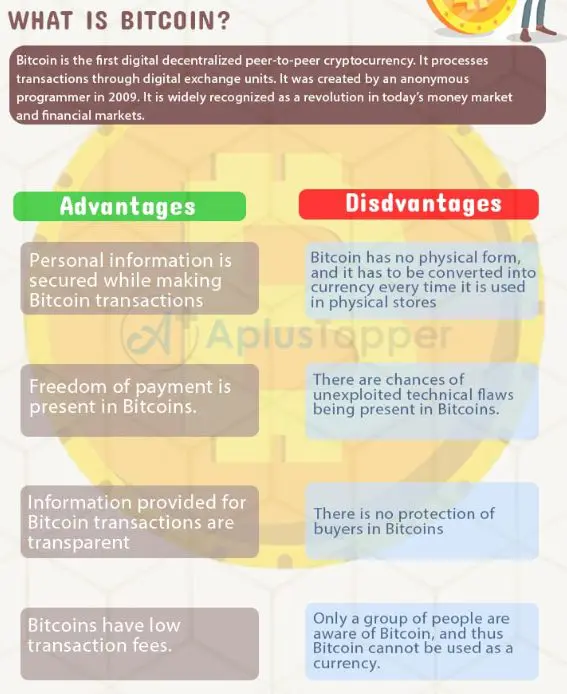

Pros and cons of Bitcoin

Bitcoin, commonly referred to as BTC, has many distinct advantages that set it apart from other forms of currency. It has a cap of 21 million coins and is unlikely to experience inflation, ensuring that investors get value for their money. And bitcoin is the most popular cryptocurrency for transactions. Of course, it has its drawbacks.

When Bitcoin's blockchain reaches a capacity of seven transactions per second, it begins to slow down (a severe problem when you consider that Visa handles almost 1,700 transactions per second!). Because it is the most well-known cryptocurrency, hackers and scammers from all walks of life target it as a critical objective. Check out our blog post What is Bitcoin

What else should I know before trading cryptocurrency?

Cryptocurrencies may be a minefield for newcomers. Adjusting to this subject can be difficult; the unfamiliar language may prove trying for many. Trading cryptocurrencies comes with benefits and drawbacks, just like everything else. We can show you the advantages and disadvantages of cryptocurrency if you want to pay for everyday purchases using bitcoins or add another currency to your investment portfolio.

Where can you buy and exchange cryptocurrency?

Although numerous digital marketplaces facilitate the trading of Bitcoin and other virtual currencies, only a few stand out. Robinhood and Sofi Active Investing enable users to buy or sell cryptocurrencies quickly. For those looking for a reliable platform to purchase, sell, transfer, and store digital currency companies, Coinbase is a trendy choice.

These five straightforward steps will show you how easy it is to purchase and trade cryptocurrencies.

- Choose a trading system or exchange. Create a business “wallet” to store your cryptocurrency.

- Enhance the safety and speed of your payments by connecting a debit card to your account!

- Decide on the cryptocurrency you want to purchase.

Is it a good idea to invest in cryptocurrencies?

Before investing in cryptocurrency, prospective buyers should know its dangers. Whether a cryptocurrency is wise depends on the investor's investment goals and risk tolerance. Investing in cryptocurrency presents the enticing potential for significant returns while carrying a substantial risk of complete capital loss.