83% of CEXs’ Tokens Launched in 2025 Trade Below Their Listing Price

New research shows that 83 percent of tokens launched by top centralized exchanges in 2025 are currently trading below their listing price.

Key Findings

- None of the exchanges included in the study recorded a positive performance rate above 20%.

- High volume exchanges showed no structural advantage in post-listing token performance.

- The data suggests that exchange listings function primarily as liquidity events rather than long-term value signals.

Table of content

Overview

Token listings on major centralized exchanges are widely perceived as a milestone that validates a project and supports sustained price appreciation. This perception continues to shape investor behavior across the crypto market. However, a comprehensive review of token launches in 2025 presents a sharply different reality.

An analysis of tokens listed on the top centralized exchanges shows that the overwhelming majority failed to maintain their listing price. In most cases, tokens began trading lower shortly after listing and continued to underperform relative to their initial valuation.

Data and Methodology

The study examined tokens launched during 2025 across the top 10 centralized exchanges by trading volume, as ranked by Cryptorank. These platforms account for the majority of global spot trading activity and provide a representative view of centralized exchange listing outcomes.

Each token was evaluated using Listing Return on Investment, defined as the ratio between the current market price and the price at which the token was initially listed. Tokens with a Listing ROI equal to or greater than 1 were classified as positive performers, while tokens with a Listing ROI below 1 were classified as negative performers.

The dataset includes all qualifying launches within the observed period, with no survivorship filtering applied.

Results Across Exchanges

The chart below shows the absolute number of tokens trading above and below their listing price for each exchange. In every case, the number of negatively performing tokens significantly exceeds the number of positive outcome

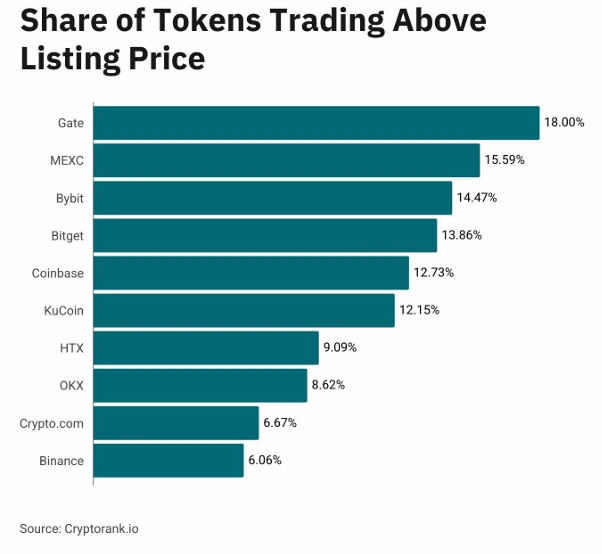

A second visualization illustrates relative performance differences between exchanges. The results show that no platform achieved a positive performance rate above 20 percent, reinforcing the consistency of post listing underperformance across the industry.

Gate recorded the highest share of tokens trading above their listing price at approximately 18 percent. MEXC and Bybit followed, each posting positive rates below 16 percent. At the lower end, Binance recorded the weakest relative performance, with roughly 6 percent of tokens trading above their listing price.

Interpretation

The findings indicate that centralized exchange listings tend to coincide with peak liquidity rather than the beginning of sustained price discovery. Tokens often experience heightened demand around listing events, followed by increased selling pressure as early participants realize gains.

Retail investors frequently enter positions after listing, when visibility and accessibility are highest. This timing aligns with increased exit activity from insiders, early investors, and market makers, contributing to sustained downside pressure.

The consistency of these outcomes across exchanges suggests that the pattern is structural rather than driven by exchange-specific factors.

Implications

These findings challenge the assumption that centralized exchange listings represent a favorable entry point for investors. Historical performance data shows that the probability of positive returns following a listing remains low, regardless of exchange size or market prominence.

For market participants, the results highlight the importance of reassessing listing events as risk points rather than validation signals. For analysts and researchers, the data underscores the need for closer scrutiny of token launch mechanics and post-listing market behavior.

Conclusion

In 2025, 83 percent of tokens launched by top centralized exchanges trade below their listing price. This outcome is consistent across platforms and independent of listing volume.

The evidence suggests that centralized exchange listings are more closely associated with value distribution than value creation. Any investment thesis that treats listings as inherently bullish must be reconsidered in light of these findings.

Gintautas Nekrosius, a Web3 growth, conducted this research and go to market leader with 8+ years of hands-on experience across token launches, GTM strategy, and ecosystem growth. He has worked directly on multiple token launches and market entries, contributing to over $100M in combined token sales, revenue, and fundraising outcomes.

His focus is on data driven launch strategy and sustainable token demand grounded in real post listing market behavior.