DeFi Comeback: Active Loans Soar to 2022 Levels

Decentralized finance (DeFi) is experiencing a resurgence. Key indicators, such as active loans and total value locked (TVL), have been on the rise since their lows in 2023. This suggests renewed interest and activity in the DeFi space.

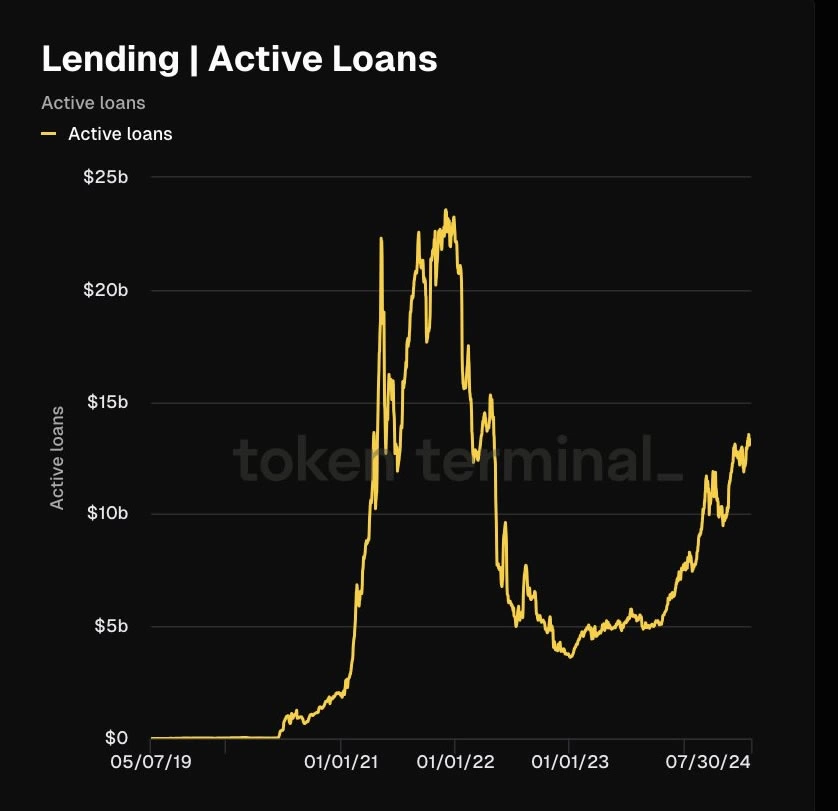

Token Terminal, a crypto market analytics platform, declared on July 31 that “DeFi is waking up again.” They backed up this assertion with various charts and statistics. One notable chart showed that active loans have climbed back to levels last seen in early 2022, now standing at approximately $13.3 billion.

DeFi lending allows investors to lend their cryptocurrency holdings to borrowers in exchange for interest payments. This lending and borrowing activity is a critical metric for assessing DeFi participation and the overall health of the market.

Active loans in the DeFi sector peaked during the 2021 crypto bull run, reaching $22.2 billion when Bitcoin and Ether prices soared to $69,000 and $4,800, respectively. However, this value fell to around $10 billion in March 2022 and further declined to $3.1 billion in January 2023.

Since hitting last year’s low, DeFi lending has made a significant recovery. Token Terminal noted that the increase in active loans might indicate rising leverage, often seen as a leading indicator of a bull market.

Similarly, DeFi’s total value locked also took a massive hit in 2023. TVL dropped 80% from its peak of $180 billion in November 2021 to about $37 billion by October 2023. Nevertheless, the sector has rebounded impressively, recovering approximately 160%, with TVL now around $96.5 billion, according to DefiLlama.

Additionally, DeFi TVL doubled in the first half of 2024, rising from around $54 billion to a peak of $109 billion in June. This growth highlights the sector's rapid recovery and renewed investor confidence.

On July 30, Taiki Maeda, founder of Humble Farmer Academy, commented on this revival. He stated that DeFi is entering a “renaissance” period after more than four years of underperformance.

He highlighted DeFi lending platform Aave as being “poised to outperform” due to the increasing supply of its native stablecoin GHO and the Aave DAO's efforts to reduce costs and introduce new revenue streams.

Despite these encouraging developments, CoinGecko reports that most DeFi-related tokens remain at bear market lows. This category of crypto assets has a market capitalization share of just 3.4%. Tokens from well-known DeFi platforms like Aave, Curve DAO (CRV), and Uniswap are still down more than 80% from their all-time highs, even though the broader crypto market is down just 22% from its 2021 peak.

Overall, while challenges remain, the recent data and developments suggest that DeFi is on a path to recovery and growth. This renewed activity could pave the way for a more robust and dynamic DeFi ecosystem in the near future.