BlackRock: Bitcoin is the Ultimate Investment Diversifier

BlackRock, the world's largest asset management firm, has released a detailed paper analyzing Bitcoin as a potential tool for diversifying traditional investment portfolios. The paper, titled “Bitcoin: A Unique Diversifier,” suggests that Bitcoin doesn't fit easily into the categories of risk-on or risk-off assets. Instead, it proposes that Bitcoin could serve as a hedge against problems like U.S. federal deficits and rising national debt.

Table of content

Bitcoin's Key Characteristics

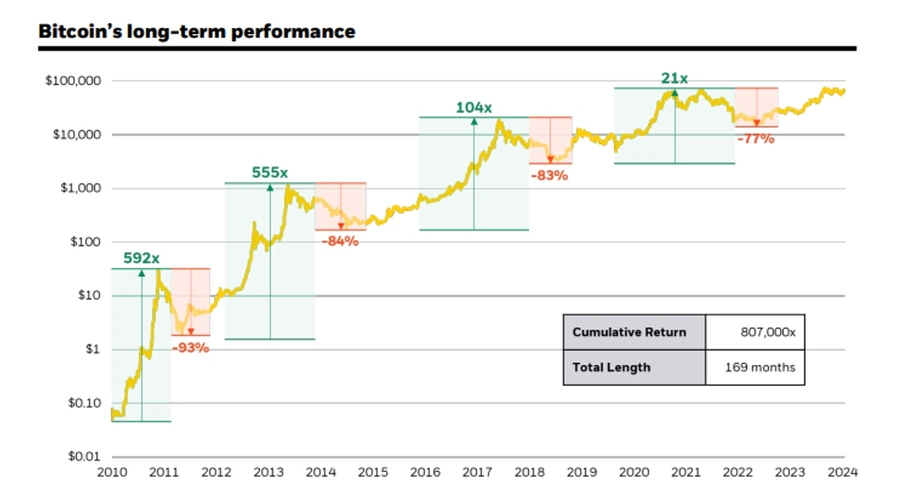

The authors examine Bitcoin's 15-year performance and compare its distinct characteristics with those of other asset classes. They point out that Bitcoin's fundamentals are different from most traditional investments, and in some cases, they even move in the opposite direction.

Despite Bitcoin's reputation for volatility, it has historically outperformed major asset classes. Because of this, some investors see it as a potential shield against global financial and geopolitical instability.

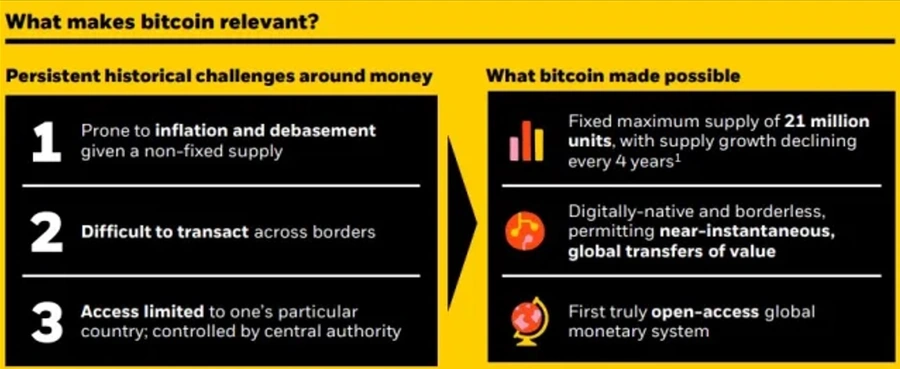

Bitcoin stands out because of a few key features. It has a capped supply of 21 million units, meaning there will never be more than that amount in circulation. It also enables international transactions and operates without the need for approval from any central authority, known as being “permissionless.” These qualities make Bitcoin a credible alternative to traditional monetary systems, which usually rely on centralized institutions like banks and governments.

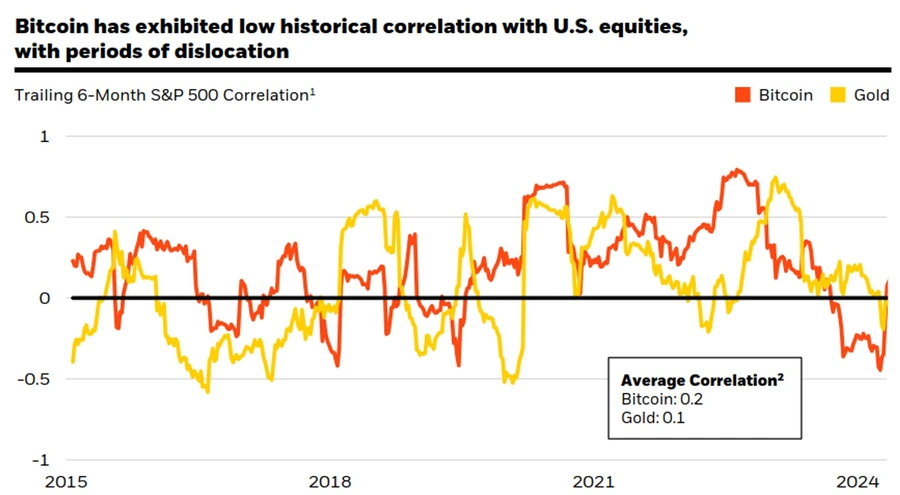

Low Correlation with Traditional Investments

BlackRock’s research also underscores Bitcoin's low long-term correlation with traditional assets like bonds and stocks. In investment terms, correlation measures how different assets move in relation to each other. Bitcoin's low correlation means that its price movements are often independent of the fluctuations in stocks and bonds. This characteristic makes it particularly valuable for diversification.

Historically, Bitcoin has delivered higher returns over time. In the past decade, Bitcoin has outperformed all major asset classes in seven out of ten years, with annual gains surpassing 100% in those successful years. However, it's important to note that Bitcoin has also experienced significant downturns. There have been four instances where its price fell by more than 50%, highlighting the potential risks.

Hedge Against Systemic Risks

The report describes Bitcoin as a “non-sovereign” asset, meaning it is not linked to any specific government or economy. It is also decentralized, which means no single entity, such as a government or central bank, has control over it. This decentralization could make Bitcoin an alternative to conventional financial assets.

According to BlackRock, Bitcoin's independence from any single country's economic conditions or centralized systems could make it more reliable during large-scale economic crises. These crises include banking collapses, currency devaluations, recessions, and other systemic risks that affect traditional financial systems.

The document states:

“Bitcoin, as the first decentralized, non-sovereign monetary alternative to gain widespread global adoption, has no traditional counterparty risk, depends on no centralized system, and is not driven by any one country’s fortunes.”

The paper also explores Bitcoin as a potential alternative to the U.S. dollar. This viewpoint comes from growing concerns among investors about the increasing deficits and federal debt levels in the United States. Similar worries exist in other countries facing high levels of public debt.

The authors highlight that, over the past five years, some investors have turned to Bitcoin as a “flight to safety” during times of global economic uncertainty. During such crises, investors typically look for assets that they believe will hold or increase in value when traditional investments are declining.

By acting as both a hedge and an alternative asset, Bitcoin is viewed by some as a safeguard against risks in the traditional financial system. Its unique nature and historical performance have made it a point of interest for investors looking to diversify their portfolios. However, the paper also notes that potential investors should carefully consider the risks, including Bitcoin's history of high volatility and the possibility of sharp price declines.