Bitcoin (BTC) vs. Ethereum (ETH): The Ultimate Showdown

Table of content

- Over time, the price of Bitcoin (BTC) vs. Ethereum (ETH)

- Buy Bitcoins

- Ethereum is a virtual currency that uses blockchain technology to carry out intelligent contracts.

- Ethereum 2.0.

- Which cryptocurrency should I invest in, Bitcoin or Ethereum?

- Furthermore, investment experts wonder why you should pick one product over another.

- How to buy and trade cryptocurrencies like Ethereum to bitcoin

- Should I consider any additional cryptocurrencies?

- What algorithm to use for consensus?

⚡️ Which is better: BTC or ETH?

⚡️Is Ethereum destined to outshine Bitcoin in the cryptocurrency world?

⚡️ What kind of crypto will boom in 2022?

⚡️ What's the next hot cryptocurrency?

LuckyBlock began trading in January and has quickly achieved a valuation of $1 billion in a little over a month, according to a news release. It is expected to be among the most popular cryptocurrencies by early 2022.

Once thoroughly researched and evaluated the possible risks and benefits, you may choose which cryptocurrencies to invest in. Language code: EN-US Bitcoin and Ethereum have been highly recommended by experts for some time, with both recently reaching all-time highs. Although there is currently no volatility, it is crucial to stay knowledgeable about any market changes or fluctuations when making investments in case they occur in the future.

Though they are both top contenders in cryptocurrency, Bitcoin and Ethereum differ significantly. If you're new to cryptocurrency, both options could be significant depending on your goals. Evaluation is critical before diving into the deep end with one or the other.

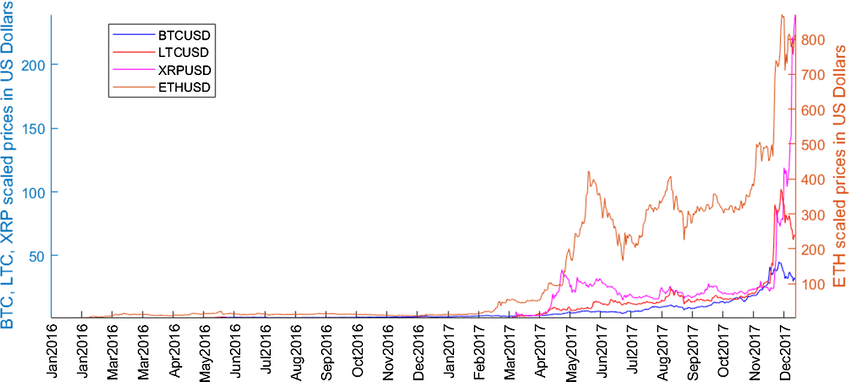

Over time, the price of Bitcoin (BTC) vs. Ethereum (ETH)

You should invest in something only after understanding it rather than following the crowd. Aside from technical distinctions, Bitcoin and Ethereum provide two distinct value propositions for investors, which may be the decisive factor in your decision.

If you're looking to invest in cryptocurrency, Dan Herron of Elemental Wealth Advisors believes that the choice comes down to assessing which is more valuable: Bitcoin or Ethereum. There are various options for different purposes, and individuals should select the one that suits their requirements and personal choices the best. Language Code for Output: English (United States)

Buy Bitcoins

Someone operating under Satoshi Nakamoto's pseudonym created Bitcoin, a digital currency, in 2009. The true identity of Satoshi Nakamoto remains unknown. Experts consider Bitcoin valuable because, like gold, it is rare and valuable.

Bitcoin is a digital currency gaining popularity, especially in emerging markets where governments still need to regulate currencies. It can be used to purchase items online or in person without high transaction fees. It's a secure transaction option for people who value security.

Thanks to its reliability and ease of use, Bitcoin is becoming increasingly popular as a preferred payment method globally.

Ethereum, a cryptocurrency proposed by Vitalik Buterin in 2013, has gained popularity and outperformed its competitors. It's unwavering reliability and superior performance have enabled Ethereum to be one of the most prominent digital currencies available today.

Bitcoin investments are comparable to gold or other alternative assets like art or horses, with more predictable returns, such as index funds. This is because there is a fixed number of bitcoins. Even if a firm creates more stock options, there will only be 21 million bitcoins.

Bitcoin is purchased because individuals buy diamonds, $100 bills, or a few gold coins in safety, according to Galen Moore, director of data and indexes at Coindesk. Even if the dollar's value drops dramatically, as during the Great Recession, bitcoin will continue to have its worth.

Ethereum is a virtual currency that uses blockchain technology to carry out intelligent contracts.

You won't find the words “digital gold” used to describe Ethereum. Ethereum is a software platform allowing developers to build other crypto-oriented apps. Developers must acquire and pay a network fee in ether bitcoin price, the native digital currency of Ethereum, to use Ethereum.

By placing your bet on Ethereum, you're hedging the future of their system. If developers continue to flock towards building applications with Ethereum, they'll need an influx of Ether coins to balance their costs. This swelling interest in ether results in a higher value for each cash; as more people want it and purchase it, its price will increase!

Sure, connoisseurs in the field have likened investing in Ethereum to purchasing a high-tech corporation. Still, while it may provide profits slower than Bitcoin or gold investments, these similarities remain.

Bill Noble, the chief technical analyst at Token Metrics, a cryptocurrency analysis firm, explains that “software platforms can also function as money; think of it like this – if Google were to be traded on the stock market, then you'd have a good grasp of what we're trying to say”.

If you're not a developer, purchasing Ether is like putting money on the fact that more and more people will utilize and develop Ethereum's capabilities.

Ethereum 2.0.

Ethereum 2.0 is coming soon, with its release planned for the second quarter of 2020! This extreme version will employ Proof-of-Stake (PoS) rather than the outdated PoW, and many cryptocurrency experts and investors have widely anticipated it.

Eloise Marquesoni, a crypto entrepreneur and speaker, proclaims that the blockchain technology underlying Ether is on the cusp of undergoing an eagerly anticipated upgrade. This could be just what's needed to draw in more institutional investors ready to put money into this network – potentially driving up Ethereum’s price.

Although Bitcoin is the most valuable cryptocurrency by market worth, Marchesoni foresees Ether taking its spot once the infrastructure update known as a “merger” concludes. This will signify an end to proof-of-work for Ethereum.

One of the most significant obstacles for Ethereum lies in its energy consumption. It is good news that Ethereum 2.0 is anticipated to be less environmentally harmful than other cryptocurrencies currently in the market. The Ethereum Foundation is confident that transitioning to Proof of Stake (PoS) could reduce power usage by a staggering 99.95 percent – an ambitious prediction set to come true once it was released in 2022! Make no mistake: this new version of Ethereum promises to be one of the most sustainable crypto options around!

Which cryptocurrency should I invest in, Bitcoin or Ethereum?

Cryptocurrency trading is a gamble, and with Bitcoin and Ethereum having similar risks, the potential for success remains to be determined. Despite this, experts agree these two digital currencies are the best on offer; they're great choices if you want to jump into cryptocurrency investments. But some suggest depositing your funds in a 50-50 split between both coins if you still need to gain experience in this market.

Despite Bitcoin being the more established form of cryptocurrency, many individuals argue that Etherium's technological potential surpasses this.

“Given that item like NFT are incorporated with the Ethereum blockchain, I would probably place my money in Ethereum because it has the most growth potential among existing cryptocurrencies,” Ryan Sterling, CFP and founder of Future You Wealth, adds. “Moreover, Ethereum is gaining a lot of traction.”

According to Vision Subramaniam, founder and financial planner at Capitale, the Ethereum network's upcoming upgrade may bring more attention to Ethereum in the months ahead, so he is sticking with it for now. He also understands both cryptocurrencies' potential. “I think we're still relatively early on in the adoption curve, and I believe that both Bitcoin and Ethereum will have a place in the future,” Subramaniam says.

Furthermore, investment experts wonder why you should pick one product over another.

“If I had to pick only one, I wouldn't ask ‘Which one?' but rather, I'd take both,” says Teresa Morrison of Beckett Collective.

“In general, I'd invest in both,” says Jeremy Schneider, creator of the Personal Finance Club on Instagram.

How to buy and trade cryptocurrencies like Ethereum to bitcoin

Even if you intend to invest in Bitcoin and Ethereum, your financial objectives and experience with cryptocurrencies may influence your spending on each coin. Subramam recommends a 60/40 split if you split your investment, while Sterling advises a 50/50 split.

If you're ambitious and interested in exploring new investment opportunities, have you considered market-cap-weighted portfolio investing? According to Schneider, one approach is to allocate funds based on each asset's market capitalization. If you initially invested $100 in Bitcoin and Ethereum (BTC and ETH), your investment would be split with $60 going toward Bitcoin and $40 going toward Ethereum.

To diversify your coins down the line, Schneider recommends this approach. To illustrate, a portfolio comprising ten $100 coins based on market capitalization could look like this:

- Bitcoin (BTC) 54.4%

- Ethereum (ETH) 21.9%

- Tether (USDT) 4.9%

- Binance Coin (BNB) 4.3%

- Cardano (ADA) 3.7%

- Dogecoin (DOGE) 3.2%

- XRP (XRP) 3.1%

- US Dollar Coin (USDC) 1.8%

- Unisvop (UNI) 1.0%

No matter what investment strategy you're pursuing, diversifying your portfolio is paramount. According to financial experts, it is recommended to limit cryptocurrency investments to 5% of your total holdings' value.

Should I consider any additional cryptocurrencies?

According to the professionals we spoke with, it is not for novices. Experts say that altcoins are even more unpredictable than Bitcoin and Ethereum.

“It's sort of like a penny stock game,” says Nate Neary, CFP and founder of Modern Money Management. “Every winner has a long line of losers behind it. Your guess is just as valid as anyone else's.”

Sterling firmly believes that Ethereum will outshine Bitcoin and other cryptocurrencies in the future, as he is convinced most of them will become obsolete within two decades. He asserts, “I'm certain these crypto assets will follow a similar trajectory as the dot-com boom; they'll be practically valueless by 2041.”

Subramaniam states that Bitcoin and Ethereum will both be essential future components.

Even if you need more time to commit financially to altcoins, keep an eye on them. According to Morrison – “It's worth taking notice of other crypto coins as they continue their advancement. You can never tell which ones will become the major influencers in the future”.

Before investing in Bitcoin or Ethereum, conduct thorough research and invest only an amount you feel comfortable with. You can support both, but the decision should be made after careful evaluation.

What algorithm to use for consensus?

Bitcoin employs a proof-of-work algorithm to verify transactions. However, Ethereum aims to shift away from this method and transition to a proof-of-stake algorithm.

A Denial of Service (DOS) attack is a method where a computer system is flooded with pointless requests to make it stop functioning correctly.

POS systems do not use miners. Instead, they have validators who keep some of their Ethers in the blockchain as a share of the ecosystem. These validators bid on which blocks to add to the chain next. When a block is added to the chain, they receive a reward of 32 Ethers depending on how much they bet earlier, but that reward can be taken away if it is proven that a particular validator did so intentionally.