Crypto Hot Wallet vs Cold Wallet: Exploring the Differences

Have you ever wondered how to keep your digital assets safe? Enter the cryptocurrency wallet word – the high-tech protector of your virtual fortune. In this quick guide, we'll explore the differences between hot and cold wallets and give you the lowdown on securing your digital wealth.

Table of content

Key Factors:

- Choosing between hot and cold wallets is a matter of personal preference in cryptocurrency management.

- Cold Wallet Types: Hardware and paper wallets, with offline storage of private keys.

- Hot Wallets: Web, mobile, and software wallets cater to diverse user preferences, relying on Internet connectivity.

- Hot wallets prioritize quick access and convenience, making them ideal for active trading.

- Cold wallets prioritize heightened security and long-term storage.

Hot Wallets Explained

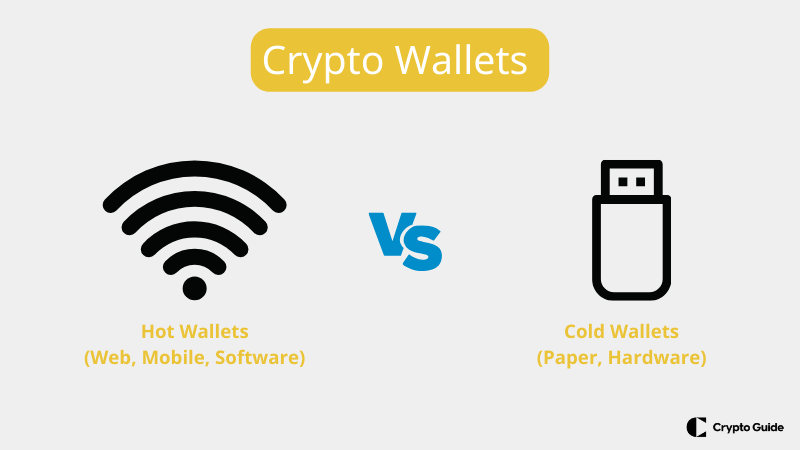

A hot wallet is a digital wallet connected to the internet, serving as a convenient means for managing and accessing cryptocurrency funds. Unlike cold wallets, stored offline for heightened security, hot wallets remain connected to the internet. The primary advantage of hot wallets lies in their accessibility, making them suitable for active traders and individuals engaging in regular cryptocurrency transactions.

How Do They Work?

Hot wallets work by being directly connected to the internet, allowing users quick and easy access to their cryptocurrency funds. When a user wants to send or receive cryptocurrency, the hot wallet communicates with the blockchain network through its internet connection. This communication ensures that transactions are swiftly verified and recorded on the blockchain, the decentralized ledger that keeps track of all cryptocurrency transactions.

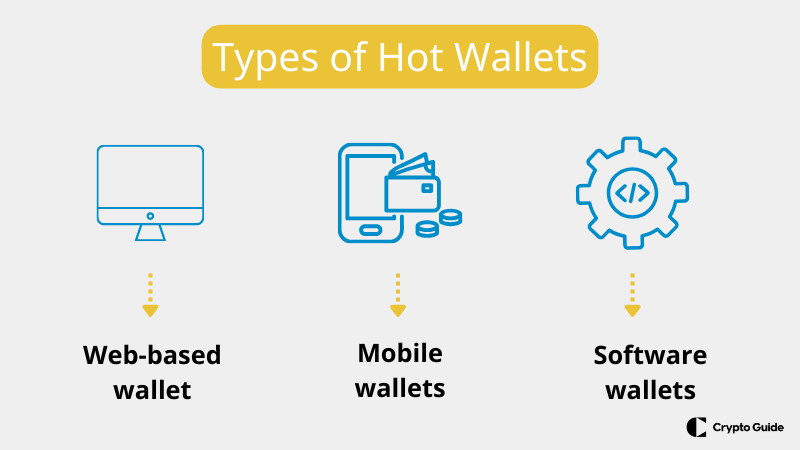

Types of Hot Wallets

Hot wallets come in various forms, including web-based, mobile, and software wallets, each catering to different user preferences and needs.

- Web-based wallets allow users to access their funds through a browser.

- Mobile wallets offer on-the-go convenience through smartphone applications.

- On the other hand, software wallets are installed on computers, providing a local interface for managing digital assets.

Note! The common thread among these variations is their reliance on an internet connection for functionality.

However, as a crypto expert would caution, the accessibility of hot wallets comes with increased vulnerability to online security threats. Users must be vigilant in implementing robust security measures to protect their assets. This includes utilizing two-factor authentication and encryption to fortify the wallet against risks such as hacking attempts or unauthorized access. Striking a balance between accessibility and security is crucial for individuals navigating the dynamic landscape of cryptocurrency, where the protection of digital assets is paramount.

Pros and Cons of Hot Wallet

| Pros of Hot Wallets | Cons of Hot Wallets |

| Accessibility: Quick access for managing and trading. | Vulnerability to Threats: Increased susceptibility to online security threats. |

| Convenience: Ideal for active traders and frequent transactions. | Security Concerns: Requires vigilant security measures against hacking. |

| Real-Time Transactions: Swift communication with the blockchain network. | Balancing Act: Crucial to strike a balance between accessibility and security. |

| Variety of Forms: Web-based, mobile, and software options cater to user preferences. | Risk of losing your assets by connecting your wallet to untrusted platforms. |

| User-Friendly Interface: Provides an easy-to-use interface. | – |

| Two-Factor Authentication: Utilizes two-factor authentication for enhanced security. | – |

Cold Wallets Explained

In contrast to hot wallets, a cold wallet is a digital wallet designed with a focus on heightened security by storing cryptocurrency offline. These wallets operate independently of internet connectivity, providing additional protection against online vulnerabilities. This offline storage makes cold wallets particularly suitable for individuals prioritizing the long-term security of their digital assets.

How Do They Work?

Cold wallets keep the user's cryptocurrency keys and data entirely offline. They generate and store private keys, crucial for authorizing transactions, in an environment without internet access. Because cold wallets are not connected to the internet, they are inherently less susceptible to cyber threats like hacking. When a user needs to make a transaction, they can use a separate device with internet connectivity to create and sign the transaction, ensuring the security of the cold wallet.

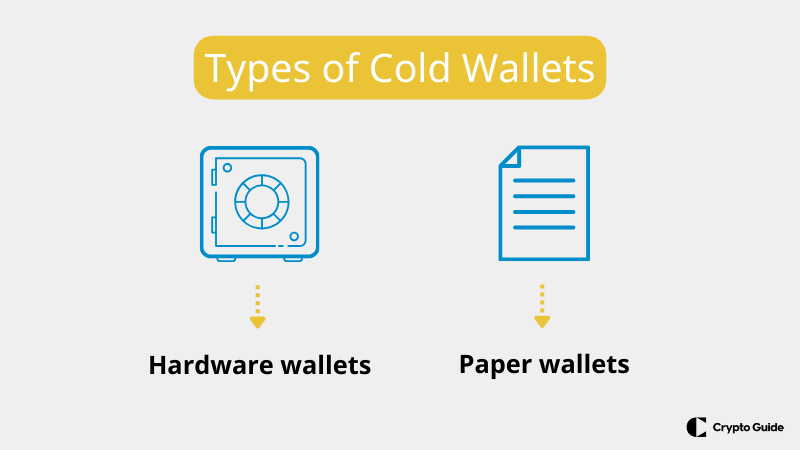

Types of Cold Wallets

Cold wallets manifest in different forms, with hardware and paper wallets being the primary types.

- Hardware wallets are physical devices that securely store private keys and require a computer or mobile device connection when initiating transactions.

- Paper wallets involve printing or writing down the private key and public address on a physical medium, ensuring complete offline storage.

Note! Cold wallets offer enhanced security by remaining entirely disconnected from the internet, storing private keys offline, and refraining from interacting with smart contracts. This characteristic further insulates them from potential online threats and malicious activities associated with intelligent contract interactions.

It's crucial to highlight that while the offline nature of cold wallets provides a robust defence against online threats, users must exercise caution, ensuring the safekeeping of physical cold wallet devices or paper documentation to prevent any potential loss or damage.

Pros and Cons of Cold Wallet

| Pros of Cold Wallets | Cons of Cold Wallets |

| Enhanced Security: Offline storage and no internet connectivity protect against cyber threats. | Cost: Some types may have a higher initial cost. |

| Protection from Online Threats: Immune to online vulnerabilities due to complete disconnection. | Transaction Process: Requires a separate device with internet connectivity for transactions. |

| Long-Term Storage: Ideal for securely storing digital assets over an extended period. | Risk of Physical Loss: Physical nature poses a risk of loss or damage. |

| Variety of Options: Comes in different forms, offering flexibility in offline storage. | Learning Curve: Setup and use may be more complex. |

FAQ About Hot Wallet vs Cold Wallet

Are hot wallets better than cold wallets?

The superiority of hot or cold wallets depends on individual preferences and needs; hot wallets offer quick access, while cold wallets prioritize heightened security.

Which is safer, a hot wallet or a cold wallet?

Cold wallets are generally considered safer due to their offline storage, providing enhanced protection against online threats compared to hot wallets.

Can I use both a hot and a cold wallet?

Yes, using both hot and cold wallets is feasible and often recommended. Hot wallets are for frequent transactions and accessibility, and cold wallets are for secure, long-term storage.

Why are hot wallets free and cold wallets aren't?

Hot wallets are free as they operate online, while cold wallets incur a cost, averaging around $180, due to their additional security measures, such as offline storage.

What is the primary difference between hot and cold wallets?

Hot wallets are connected to the internet, allowing quick access for active trading, while cold wallets prioritize heightened security by storing cryptocurrency offline.

How do cold wallets handle transactions without internet connectivity?

Cold wallets generate and store private keys offline. When a transaction is initiated, a separate device with internet connectivity is used for verification.

Can I transfer funds between hot and cold wallets?

Users can transfer funds between hot and cold wallets, providing flexibility based on their transactional and security requirements.

Deciding Factors: Cold Storage vs Hot Storage Crypto Wallet

When deciding between a cold vs hot wallet, various factors come into play, influencing users based on their specific needs and preferences.

Here's a short table with Hot and Cold wallet comparisons. Below the table, you will find a further explanation.

| Factors | Hot Wallet | Cold Wallet |

| Price | Free and accessible. | The average cost is around $180. |

| Better for | Everyday use and quick access. | Long-term storage and secure investments. |

| Cybersecurity | Average due to continuous internet connection. | Excellent, offline storage for added security. |

| Loss Protection | Generally good with backup phrases. | Average; device loss may mean irretrievable assets. |

| Ease of Transfer | Excellent, quick connections. | Average, extra step for online connection. |

Price

- Hot Wallets: The first consideration is the Price, where hot wallets stand out for being readily accessible and free, catering to users looking for a cost-effective solution.

- Cold Wallets: On the other hand, cold wallets, typically in the form of hardware wallets, come with an average price tag of around $180 (f.e. Trezor costs $179, Ledger – cheaper), reflecting a more substantial investment for those prioritizing the added security associated with long-term storage.

Better for

- Hot Wallets: Moving on to functionality, hot wallets prove advantageous for their convenience. They are well-suited for individuals actively engaging in trading and frequent transactions, providing quick and easy access to cryptocurrency funds.

- Cold Wallets: Conversely, cold wallets are suitable for long-term storage, offering a robust solution to safeguard digital assets over an extended period, especially appealing to those adopting a more patient and secure investment approach.

Cybersecurity

- Hot Wallets: Cybersecurity considerations play a pivotal role in the decision-making process. Due to their continuous connection to the internet, hot wallets maintain an average level of cybersecurity.

- Cold Wallets: In contrast, cold wallets demonstrate an excellent security profile, benefitting from offline storage of private keys, which shields them from potential online threats, making them a preferred choice for those prioritizing the safety of their digital assets.

Loss protection

- Hot Wallets: Loss protection becomes a critical factor. Hot wallets generally offer protection through backup phrases, allowing users to recover their funds even if the device is lost or damaged.

- Cold Wallets: Cold wallet also has a 12- or 24-word seed, so that if you lose your wallet and later buy another one, you can log in to your wallet on the blockchain.

Ease of transfer to exchanges

- Hot Wallets: Hot wallets excel in this aspect, boasting excellent ease of transfer that lets users quickly connect to online exchanges for trading activities.

- Cold Wallets: In contrast, cold wallets exhibit average ease of transfer, requiring an additional step to join online, either through Bluetooth or USB. This added layer, while enhancing security, may be perceived as less convenient for those actively involved in frequent trading.

How to Choose a Crypto Wallet?

Now you know the difference between cold and hot wallets, but what else do you consider when choosing a crypto wallet?

- Consider Security Features

Prioritize security features such as two-factor authentication, encryption, and backup options. Security is paramount in protecting your private keys.

- Research Different Wallets

Explore various wallet providers and their reputation in the crypto community. Look for user reviews, security audits, and the wallet's track record.

- Evaluate User-Friendliness

Choose a wallet with an interface that suits your preferences. Some wallets are designed for beginners, while others offer advanced features for experienced users.

- Check Supported Cryptocurrencies

Ensure that the wallet supports the cryptocurrencies you intend to use. Different wallets cater to other digital assets.

- Examine Compatibility

Check if the wallet is compatible with your devices and operating systems. Some wallets are designed for specific platforms, while others offer cross-platform compatibility.

- Assess Backup and Recovery Options

Look for wallets that provide secure backup and recovery options. In case of device loss or failure, having a reliable backup ensures you can regain access to your funds.

- Evaluate Customer Support

Consider the level of customer support provided by the wallet provider. Responsive and helpful support can be crucial in case of any issues or concerns.

- Review Fees and Costs

Be aware of any fees associated with the wallet, such as transaction fees or subscription costs. Compare these with the features and security offered.

- Test with Small Amounts

Before committing large sums, test the wallet with a small amount of cryptocurrency to ensure its functionality aligns with your expectations.

Hot Wallet vs Cold Wallet: So Which is Better?

In conclusion, choosing between a hot and cold wallet ultimately hinges on individual preferences and priorities.

For those prioritizing a secure and robust solution for long-term storage, a cold wallet emerges as the preferred choice. The offline storage of private keys and emphasis on heightened security make cold wallets a reliable option for individuals looking to safeguard their digital assets over an extended period.

On the other hand, if convenience and immediate access to cryptocurrency funds are paramount, a hot wallet is the more suitable option. Designed for active traders and those engaging in frequent transactions, hot wallets provide quick and easy access, making them a practical choice for users who prioritize seamless interactions with their digital assets.

Final Thoughts on Hot Wallet vs Cold Wallet

Choosing between a hot and cold wallet depends on your needs. Cold wallets are best for long-term storage and heightened security, keeping private keys offline. Hot wallets, however, offer convenience and quick access, ideal for active trading and frequent transactions. For more insights, check out our review on the best crypto wallets to suit your needs.