Analyst Predicts Bull Market as Bitcoin Futures Soar!

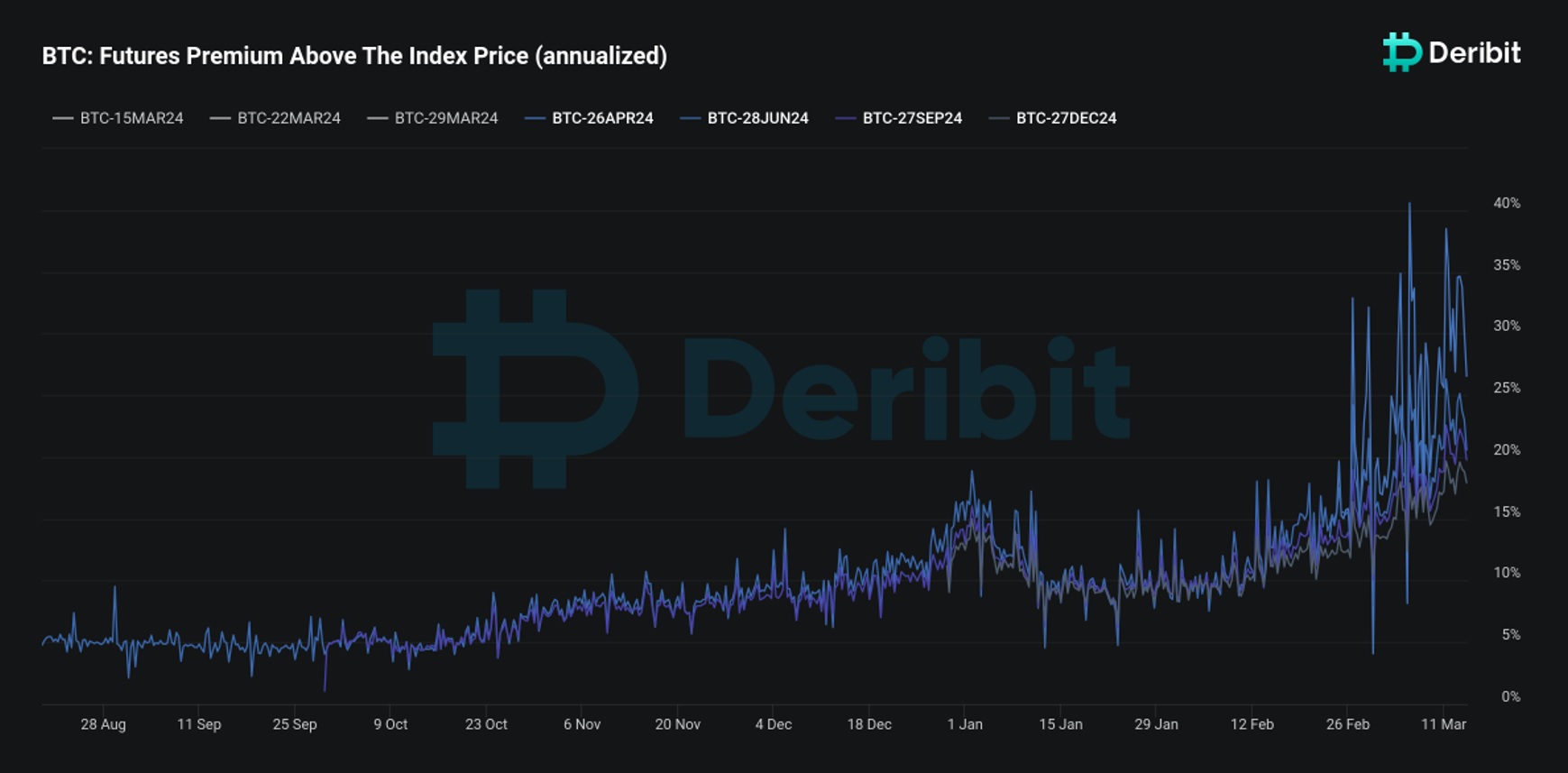

The gap between bitcoin futures and its current market price, known as the bitcoin futures basis, has widened significantly, reaching heights not observed since the cryptocurrency's record-setting surge to over $68,000 in the latter part of 2021.

Luuk Strijers, the Chief Commercial Officer at Deribit, revealed that “Currently, the basis oscillates between 18% to 25% on an annualized basis, a range previously seen only in the year 2021.”

Furthermore, Strijers elaborated on how the increased annualized basis offers derivatives traders an opportunity to secure considerable profits. This is achieved through the simultaneous purchase of bitcoin in the spot market and the sale of futures contracts at a premium. This strategy results in a guaranteed dollar profit upon the contract's expiry, independent of bitcoin's price fluctuations.

Strijers highlighted that the notable gap between bitcoin's spot and futures prices is indicative of the market's robust momentum, propelled by the recent approval of ETFs and anticipations surrounding the forthcoming bitcoin halving event.

“The fact that this yield is so incredibly high is a very bullish indicator and driven by the daily new money flowing into the system because of the spot bitcoin ETF approval and the expected impact of the bitcoin halving,” he stated.

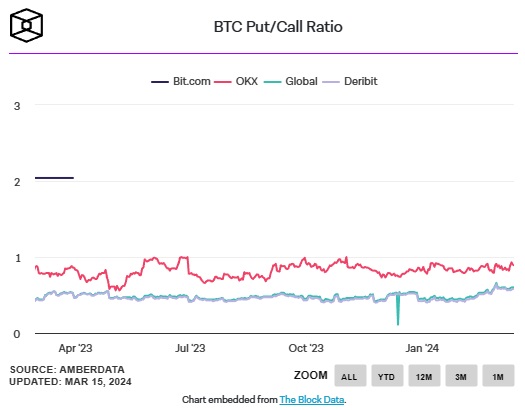

Bitcoin Options Put-Call Ratio

In the realm of bitcoin options, Strijers pointed out a significant tilt towards call options over puts as the March expiry approaches, signalling a bullish outlook among traders.

“Overall the put-call ratio for bitcoin is now 0.59, so six puts for every ten calls, while moving further out, for June this drops to 0.32. So only three puts for every ten calls,” Strijers explained. This skew towards call options, as opposed to puts, suggests that optimism prevails among derivatives traders regarding Bitcoin's future price movements.

A put-call options ratio below one is generally interpreted as a sign that call option activity surpasses that of puts, implying a bullish sentiment in the market. Traders purchasing call options are typically optimistic about the market's direction, whereas those buying puts are considered bearish. According to data from The Block, Deribit currently dominates the Bitcoin options market, hosting approximately 90% of all open interest, with today's put-call ratio recorded at 0.58.

Bitcoin recently retreated from a new all-time high surpassing $73,000, reached in early trading on Thursday.

This correction in price over the last 24 hours led to a significant number of long position liquidations on centralized exchanges, exemplifying the market's volatility. According to CoinGlass, this movement resulted in over $278 million in Bitcoin position liquidations, with the bulk ($225 million) consisting of long positions.