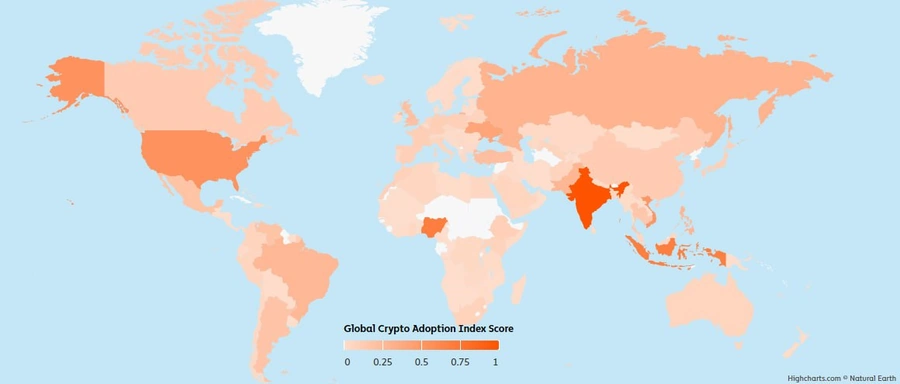

Crypto Adoption 2024: India and CASO Nations Lead the Charge!

The 2024 Global Crypto Adoption Index reveals that the Central & Southern Asia and Oceania (CSAO) region continues to lead in cryptocurrency adoption. This region has established itself as the frontrunner in the global crypto landscape. The index ranks countries based on their level of cryptocurrency use and engagement, taking into account various aspects of crypto transactions and decentralized finance (DeFi) activities.

Global Crypto Adoption Index 2024: Overview

The ranking system is based on four key metrics: the total value of cryptocurrency received by centralized services, the volume of retail crypto transactions under $10,000, the transaction volume in decentralized finance (DeFi), and retail DeFi activities. By analyzing these factors, the index provides a comprehensive view of how countries are embracing cryptocurrencies.

Seven of the top 20 countries for crypto adoption come from the CSAO region, solidifying its position as the most influential and active area for cryptocurrency usage. According to the Chainalysis report, the CSAO region stands out for its high activity in local crypto exchanges, merchant services, and the fast-growing decentralized finance sector.

Top 20 Crypto-Adopting Countries: 2024 Index Revealed

India, a major player in the CSAO region, ranks first overall in the Global Crypto Adoption Index. It leads in both the total value of cryptocurrency received by centralized services and the value of retail transactions through centralized services. India’s large population, growing technological infrastructure, and increasing interest in digital currencies have contributed to its leadership position. Nigeria takes the second spot in the global ranking, showing strong performance in retail transactions through centralized services and decentralized finance.

Nigeria has become a key hub for cryptocurrency in Africa, driven by its younger population and the need for alternatives to traditional financial services. Indonesia ranks third overall, excelling in decentralized finance activities and retail DeFi transactions, highlighting the country’s growing engagement with decentralized platforms.

The seven CSAO countries featured in the top 20 for global crypto adoption are India, Indonesia, Vietnam, the Philippines, Pakistan, Thailand, and Cambodia. Each of these countries has seen significant growth in cryptocurrency use, driven by factors such as the need for financial inclusion, technological adoption, and government policies that are either neutral or supportive of crypto.

In addition to these CSAO nations, other major players in the top 20 include Nigeria, the United States, Ukraine, Russia, Brazil, Turkey, the United Kingdom, Venezuela, Mexico, Canada, South Korea, and China. Each of these countries has shown varying levels of cryptocurrency adoption based on local economic conditions and regulatory frameworks.

One of the surprising insights from the report is the United States’ position. While the U.S. holds the fourth spot overall in the ranking, it performs poorly in retail transactions through centralized services. This indicates that while the U.S. has a strong presence in large-scale cryptocurrency transactions and investments, retail adoption is lagging behind. China, despite its stringent regulations on cryptocurrencies, still ranks twentieth overall. This is notable given the country’s efforts to limit crypto activity through legal and regulatory measures.

In summary, the 2024 Global Crypto Adoption Index shows a clear trend: developing economies are outpacing developed nations when it comes to adopting cryptocurrencies.

This shift can be attributed to several factors, including the need for financial alternatives in regions with less access to traditional banking, the rapid growth of mobile technology, and the increasing use of cryptocurrencies for remittances and small-scale transactions. In contrast, developed economies tend to have more established financial systems, which may slow the adoption of alternative digital currencies. Nonetheless, the growing interest in DeFi and the broader crypto market suggests that adoption will continue to rise across the globe.