Crypto Options Trading: Call Put options

Table of content

- What are crypto options, and how do they work?

- Options for risk management

- Options Greeks: An Overview

- Understanding the trade of "naked" call and put options.

- Why on earth would anyone offer uncovered call and put options?

- What are the differences between crypto options trading and regular options trading?

- What platforms are available for crypto options trading?

- How prevalent are crypto options?

- What are the advantages of crypto options over other derivatives?

⚡️ Is it possible to trade cryptocurrency options?

Have you wondered if it's possible to trade cryptocurrency options? Well, the answer is yes! Not long ago, trading options were available only in traditional markets. But now, thanks to advancements in technology and finance, cryptocurrency traders can also access these lucrative opportunities.

⚡️ What are crypto options?

Derivatives and options are two separate yet related concepts that individuals often confuse. Cryptocurrency derivatives, or options as they're more commonly known, enable investors to buy or sell assets at a specific date in the future for a predetermined cost. These instruments are produced by issuers and purchased by traders; however, dealers cannot utilize them.

⚡️ Can I buy options on Etherium?

Acquire Ethereum in two methods: by trading on an exchange or through a peer-to-peer marketplace. If you have some Ethereum, make spot and margin trades on the sales to maximize your profits. Invest in an Ethereum derivative with a broker for greater returns over time.

⚡️ What is a safe way to buy cryptocurrency options?

If you're ready to take the plunge and begin investing in digital currencies, look no further than Bit.com, Deribit, and FTX – three excellent exchanges to get your new journey started!

Buying crypto option contracts may often be a relatively inexpensive, low-risk alternative to trading digital assets via futures or open-ended swaps.

An option is a contract that allows the purchaser to buy or sell an underlying asset at a predetermined price on or before the expiration date on the expiration day. Stock Options Trading gives the asset owner the right to sell it at a specific price, whereas a put option gives them the right to sell if its market value drops below a certain amount.

Similar to other derivatives, options are contractual agreements that allow investors to speculate on the future price of an underlying asset. These contracts can be settled in either cash (USD) or cryptocurrencies (bitcoin, ether, etc.).

Deribit, the world's largest crypto options platform, settles crypto options contracts in cash. OKEx, the second largest crypto options exchange, physically delivers crypto assets to investors upon exiting a trade. For example, when a trader successfully leaves the bitcoin options trade on OKEx, they receive their bitcoin profit at settlement.

What are crypto options, and how do they work?

There are two types of crypto options: European and American.

- American: The buyer can fulfill the agreement before it expires.

- European: The buyer can only perform the contract when it comes due.

Note that European-style options can only exercise at expiration but can still be sold or closed early if the buyer desires.

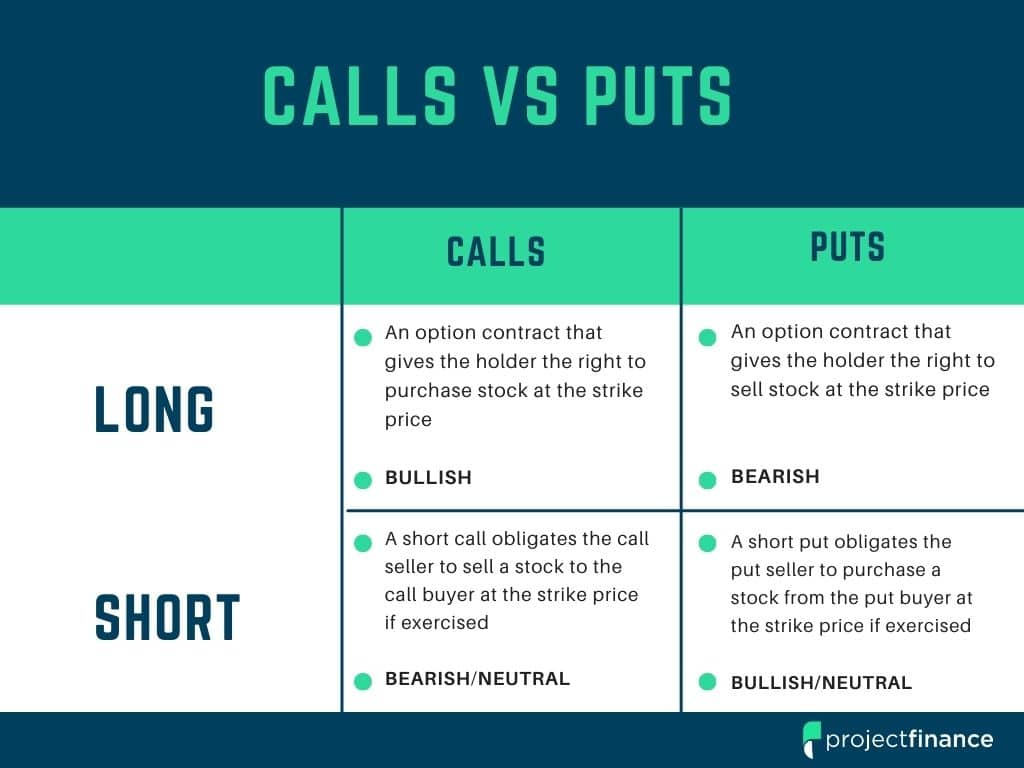

There are two distinct sorts of options: call and put.

- Call: The right to acquire the underlying asset

- Put: The right to sell the underlying asset

Trading options involves a straightforward process: the option seller creates either a call or put contract with a designated expiration date. The agreement must be exercised at a predetermined price before expiration to execute the trades.

This message discusses the strike price of an option, which represents the price at which the option holder can either purchase or sell the underlying asset. When a call option is exercised, the seller must sell the underlying asset to the buyer at the strike price. Conversely, a put option grants its holder the right to sell an asset at a predetermined price, and if exercised, the buyer is obliged to buy the underlying asset from the seller at the specified strike price.

Trading crypto options requires a contract on the crypto options exchange. An option buyer may order their desired option, and the seller can accept it by selling to them.

A premium is the cost of exercising an option, much like insurance. For instance, when someone purchases a put to guard against falling prices in an asset, they are essentially promising the seller that if it drops below the strike price, they can buy back their support at a predetermined value. It ensures both parties' protection; everyone gets what they want from any transaction.

The premium cost is determined by the contract's remaining duration, implied volatility (the anticipated standard deviation of the underlying asset's price over the start and end dates of the contract), interest rates, and current market conditions.

The current price of the underlying asset has an impact on the premium value of an option.

- In the Money (ITM): When a call is in the money, it implies that the strike price is lower than the current value of the underlying asset. When a put's strike exceeds its current price, it's in the money.

- In-the-money (ATM: When the strike is equal to or greater than the current price for a call or a put, it's considered an at-the-money call or put.

- Out of the Money (OTM): When the strike price is higher than the underlying asset's current price for a call, it's called a “call spread.” It happens when the strike of a put is lower than the current market price.

When a call option has an intrinsic value, i.e., the strike price is lower than the underlying asset's current market value, its cost is more expensive since it already holds some worth. As such, when it expires, there is no assurance that its price will remain above the predetermined amount and be implemented, similar to put options which are also pricier if they're “in the money.”

Bob believes that the value of one bitcoin will be much higher than it is presently by the end of February. To cash in on this, he buys 10 European-style call options with an exercise price of $36,000 and a premium of 0.002 bitcoins per the contract that expires on February 28th.

0.002 bitcoin at $34,000 = $68 when Bob purchased the call options. 10 x 68 = $680.

Based on the agreement's terms, Bob can receive 0.1 Bitcoin for every $36,000 he invests. In other words, when February ends, Bob can purchase one entire Bitcoin by investing $360,000 ($36k x 10 = 1).

In Scenario A, at expiration, the Bitcoin price is $40,000. Bob utilizes his option to buy Bitcoin and makes a profit of $4,000 ($40,000 – 36,000 = $4,000). Subtracting his premium from the result of $3,320 gives him just over half of that sum or a 50% return on his investment.

In Scenario B, at expiration, the Bitcoin price is $32,000. The contract becomes worthless, and Bob loses his entire premium of $680.

Options for risk management

Those interested in investing in Bitcoin or other cryptocurrencies but feel uneasy about the excessive volatility of the market can reduce their risk by hedging with options and protecting themselves against potential shifts.

To mitigate the risk of a market crash and protect your Bitcoin holdings, one alternative is to purchase put options instead of selling your Bitcoin outright. This strategy allows you to limit your potential losses to the premiums paid for the possibilities rather than risking the entire value of your Bitcoin investment.

Options provide a way to reduce the money needed for investment, which frees up capital to gain yields in other areas.

Options Greeks: An Overview

The Greek variables in options trading influence the premium required for an option. These symbols, which originated from the “Black-Scholes Model,” a mathematical formula developed in 1973 by economists Fisher Black, Myron Scholes, and Robert Merton from Harvard, play a significant role in the options market. The model was developed to standardize option pricing for institutional investors and is still widely used today. The message is in U.S. English. It was no precise technique for valuing each option contract before the Black-Scholes model.

This method is utilized to value European-style options today. Instead of using the previously employed cumulative prospect function approach, alternative pricing methods like the binomial model are utilized, especially for U.S. options that allow early exercise.

The Black-Scholes model, on the other hand, has a more straightforward formula: n = E / (1+r)n.

C0 = S0N(d1) – Xe-rTN(d2),

where d1 = [ln(S0/X) + (r + σ2/2)T]/ σ √T

and d2 = d1 – σ √T

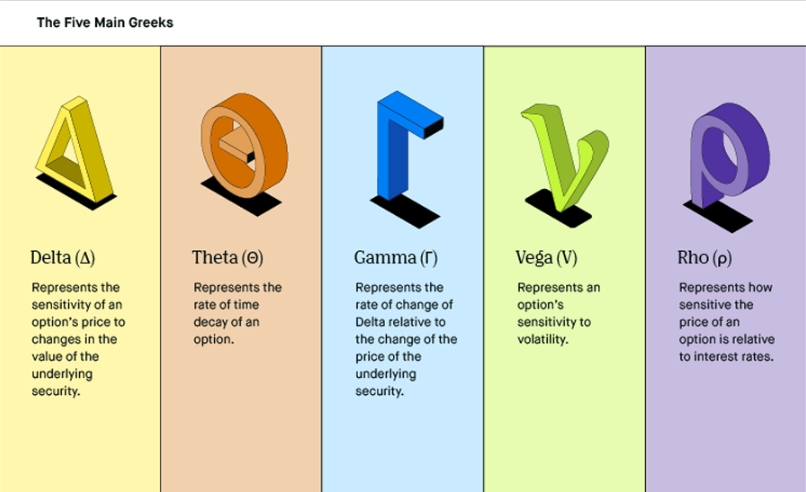

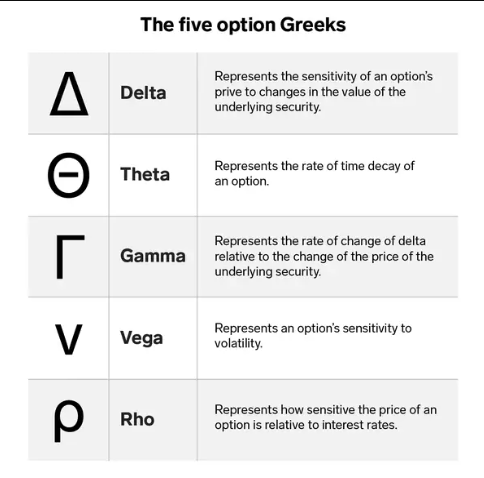

The Greek letters (Θ), (Δ), (Γ), and (V) represent the ten factors.

- Theta: This is the period until the option expires. The greater the price of a call option, the longer it has before expiring. It indicates that

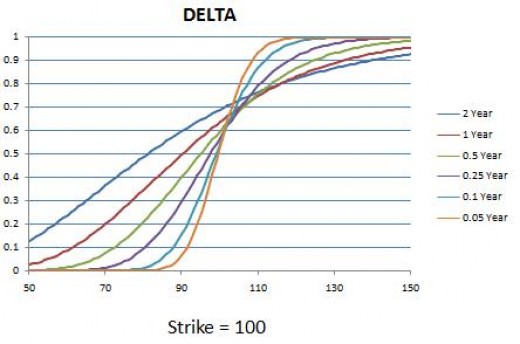

- Delta: Calculates how much the option's price has changed due to changes in the underlying asset's price. Consider it to be the chance of a vote being in the money at expiration. When an option is in the capital, its delta is 0.5. It also implies that if the underlying's price rises $1, the call option will rise $0.50 as well. The delta for a call option increases as volatility rises, and vice versa for a put option's delta. The delta is calculated between 0 and 1 for calls, while puts are estimated between 0 and -1.

- Gamma: This measures how the delta of an option changes in response to changes in the underlying asset's price. Gamma is highest when the underlying is at the money and decreases as it moves further away from the strike price. For example, if a call option has a gamma of 0.25 and the underlying asset increases $

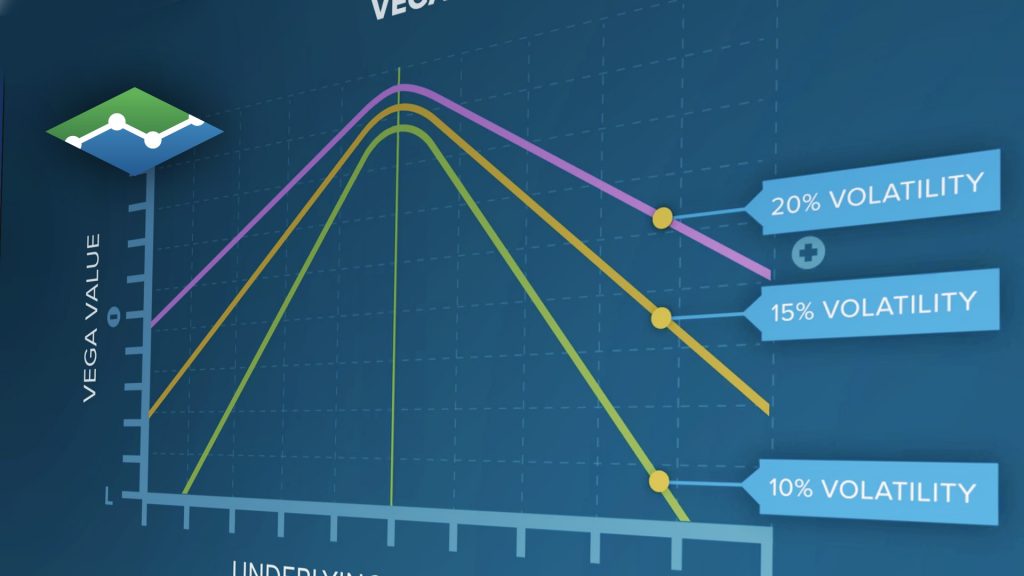

- Vega: This refers to the amount that an option's price changes in response to a change in volatility. Vega is highest when the underlying asset is at the money and decreases as it moves further away from the strike price. For example, if a call option has a vega of 0.20 and volatility increases by one percentage point, the option's price will increase by $0.20.

- Rho: The sensitivity of an option's price to changes in interest rates. If the interest rates go up by one percentage point, the price of a call option having a rho of 0.25 will go up by $0.25.

Understanding the trade of “naked” call and put options.

What does it imply to be “naked” with alternatives? It involves opening an option position without creating an opposing (“covered”) work on the underlying asset.

Someone selling a call promotes the underlying asset if they aren't also buying it. Someone selling an uncovered put has a long position in the underlying asset if that put seller is not also selling the product.

It's important to know that selling uncovered calls (to buy) and puts (to sell) is a far riskier kind of options strategy and could result in significant losses.

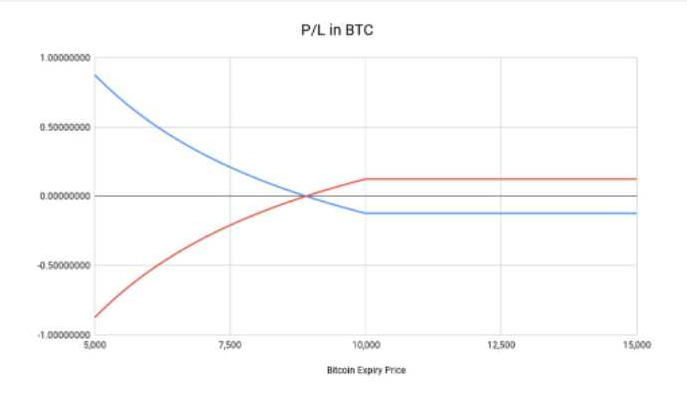

The option seller will generally own the underlying asset to cover losses if the price goes against them. Assume that, as in Scenario A, a trader who created Bob's options contract decided to acquire one bitcoin at the time the agreement was established ($34,000). He made $2,680 as a result:

- Bitcoin's value has increased tenfold since its inception, with a yearly 10-year trend indicator of approximately 9 percent.

- Since the option seller must sell Bob $40,000 worth of bitcoin at an exercise price of $36,000, their profit is -$4,000 (because the option buyer must buy back the $36,000 value of bitcoin at an options payout price of $38,500).

- Premium gain: $680.

(6000 – 4000) + 680 = 2680

If the writer of the option had purchased and stored his Bitcoin, he would have earned a profit of $6,000.

Let's assume that the writer of the option didn't acquire a single bitcoin when the call contract was established. They would have had to go to a cryptocurrency exchange and purchase one bitcoin for $40,000 to settle the contract at expiration, losing $3,320.

-$4,000 (the option buyer has to purchase one bitcoin at the settlement price of $40,000 and sell it for $36,000).

$680 becomes your profit in this situation.

-4000 + 680 = -3320

Why on earth would anyone offer uncovered call and put options?

The main appeal of selling uncovered options is that the seller does not need to put any of his money upfronts. Furthermore, with only three possible outcomes, each option trade has only three possibilities.

The underlying instrument's price rises, allowing Bob to make money (a profit) and causing the writer of the option to lose money.

Because the underlying price does not change, a buyer decides against executing the contract.

The underlying asset's price drops against the buyer, so they refuse to fulfill the contract.

The seller of the options would benefit from two of the three scenarios. The seller must calculate the risks (based on the underlying asset's volatility) associated with receiving premiums without putting money down upfront to cover the call and put options developed.

What are the differences between crypto options trading and regular options trading?

Traditional options vs. cryptocurrency options The primary distinction between trading conventional call option calculator and cryptocurrency options are that the crypto market is open 24 hours a day. In contrast, traditional financial markets are only operational Monday through Friday from 9:30 a.m. to 4 p.m. Eastern time. The volatility of cryptocurrency markets means higher profit opportunities and risk may exist.

What platforms are available for crypto options trading?

There are a few different platforms that offer cryptocurrency options trading. These include:

- Deribit

- FTX

- OKEx

- Binance

- Huobi

How prevalent are crypto options?

Although crypto options may not be as well-known as the typical trading option, their presence is gradually becoming more widespread. It is likely because although cryptocurrency markets are somewhat new and unpredictable, they can prove significantly profitable if you understand them correctly – an advantage far outweighs any risks associated with this type of investment. As a result, numerous platforms have now begun offering crypto options for traders eager to use these potentially lucrative opportunities in the cryptocurrency market.

What are the advantages of crypto options over other derivatives?

Crypto options have a few advantages over other derivatives. These include:

- Unlike regular options, which only can trade during traditional market hours, these options can change 24 hours a day.

- They tend to be more volatile, providing more profit opportunities.

- They require a higher level of understanding, which can lead to greater profits for those willing to learn about them.

Despite these advantages, crypto options are not without risk. The volatility of the underlying assets means there is the potential for significant losses and large gains. Those considering trading crypto options should ensure they understand the risks involved before doing so.