Cryptocurrency ETFs: What They Are and How They Work

Table of content

⚡️ What's the biggest crypto-ETF?

The largest Cryptocurrency ETF is the $460 million Valkyrie Bitcoin Strategy ETF BTF, which has $24.10 million in assets.

⚡️ Is there an ETF for XRP?

Currently, no ETFs track Ripple because you don't want to use a digital wallet or accept these new regulations. You never know whether Ripple will rise as high as Bitcoin today, and you'll be able to thank yourself in a few years if it does.

⚡️ Does Vanguard have cryptocurrency?

Clients of Vanguard can purchase any OTC bitcoin or crypto funds, such as the Bitwise 10 Crypto Index Fund (BITW) or Grayscale Bitcoin Trust (GBTC), among others. Clients may also buy stock in publicly listed bitcoin mining firms like Riot Blockchain and Argo Blockchain.

⚡️ Which blockchain ETF is better?

✔️ The finest blockchain ETFs for May 2022

✔️ The Bats Global Index 500 (BATS) already has one index fund, the Bats Global Vectors Junior 20+ ETF (BGVK). The company's second new product is the BITQ.

✔️ The Global X Blockchain ETF (BKCH) is a fund that invests in the best-performing blockchain technology companies.

✔️ The BLCN is a stock-tracking fund that invests in broad U.S. equities, and similar companies traded on the Nasdaq Stock Market or the NYSE Arca, among other exchanges.

✔️ The Amplify Transformation Data Sharing ETF (BLOK) was also down.

Here are the top five best-performing cryptocurrency ETFs from 2019 to February 4, 2022. When making this list, we considered various aspects, like returns, fees, and assets.

Are you fascinated by cryptocurrency ETFs and their mechanics?

ETFs related to cryptocurrencies are the surefire way to invest in the digital currency. Unlike other methods, you don't need any actual coins or tokens – making them more secure and reliable for investors. Instead, they track the price of one or more cryptocurrencies and are backed by tangible assets. With this fund, you can have the opportunity to benefit from potential growth with minimal risk.

On October 19, 2021, the ProShares Bitcoin Strategy ETF ( BITO ) became the first crypto ETF. Until then, 13 new cryptocurrency ETF applications were pending SEC approval. The SEC has only authorized bitcoin cryptocurrency futures-based ETFs as of December 2021 because the United States remains in wait for a physically-backed cryptocurrency ETF.

Some ETFs give limited or indirect access to Bitcoin by investing in blockchain miners or firms that can benefit from blockchain technology. These crypto funds are often known as “blockchain ETFs.”

For those who prefer to avoid taking an active role in managing their digital assets, investing in a cryptocurrency exchange-traded fund (ETF) is another option. However, these investors must know that crypto-ETFs are high-risk investments with the possibility of large price fluctuations.

ETF evaluation for Cryptocurrency

This crypto-ETF list looks at performance from January 1, 2018, through February 4, 2022.

Expenses: When ETFs track the same index or commodity, the one with the lowest cost ratio generally outperforms those with higher costs. Investors should remember that today's crypto ETFs have more significant expenses than traditional ETFs that track a broad stock market index.

ETFs organized as fiduciary trusts offer an advantageous structure since they enable the fund to own a limited selection of assets while still adhering to diversification requirements. Some cryptocurrency ETFs are incorporated for tax efficiency purposes, while others are set up as registered investment companies.

Our research seeks to identify the most influential cryptocurrency ETFs. We have selected only those that aim to keep up with the value of one or more virtual currencies after deducting fund expenses and then explore related ideas from other fields in this article.

ETFs tracking the worth of cryptocurrencies are typically composed of cryptocurrency futures contracts and U.S. money-market instruments as an alternative to stocks or bonds.

It is essential to remember that cryptocurrency ETFs are only assured of sometimes following the cost of a singular digital currency or collection of cryptocurrencies. Investors should recognize that with futures markets, they can access the underlying asset without actually owning it. Before deciding to enter the futures market as a direct trader or invest in ETFs that contain future positions, it is essential to comprehend the disparities between both options.

The top five best-performing cryptocurrency ETFs

- Invesco QQQ Trust ( QQQ )

- SPDR S&P 500 ETF ( SPY )

- Vanguard S&P 500 Index Fund ETF Shares ( VOO )

- iShares Core S&P 500 ETF ( IVV )

- SPDR Dow Jones Industrial Average ETF ( DIA )

The top five cryptocurrency ETFs by performance

The ProShares Bitcoin ETF seeks to profit from Bitcoin's price appreciation by investing in futures contracts. Innovative BITO has become the world's first ETF based on a crypto futures market, with over $1 billion in assets currently managed.

The Amplify Transformational Data Sharing ETF (BLOK)

The Amplify Transformational Data Sharing ETF actively invests in companies developing or utilizing blockchain technology. BLOK is the optimal selection for those seeking to venture into Cryptocurrency, boasting more than $600 million in assets and a meager expense ratio of 0.65%.

The First Trust Index Based on CBOE Bitcoin Futures (CFBT)

The First Trust Index Based on CBOE Bitcoin Futures is an index fund that tracks the performance of bitcoin futures, with a CFBT expense ratio of 0.50%. This makes it the only ETF offering exposure to bitcoin futures.

The VanEck Vectors Bitcoin Strategy ETF (KBWB)

The VanEck Vectors Bitcoin Strategy ETF is an index fund that tracks the performance of Bitcoin. KBWB has an expense ratio of 0.55% and is the only ETF offering bitcoin exposure.

The Global X Blockchain Thematic ETF (BLOC)

The Global X Blockchain Thematic ETF is an actively managed fund that invests in companies.

The ProShares Bitcoin Strategy ETF (BITO) has underperformed the U.S. dollar bitcoin benchmark price. Because bitcoin futures ETFs track contracts that speculate on the future price of the digital currency rather than the current or “spot price” of the asset itself, tracking the benchmark may be difficult.

Despite being the inaugural Bitcoin ETF to be approved, BITO's stock prices have lagged behind those in the S&P 500 index since its launch.

We've already discussed BITTREX in detail.

The platform has a taker fee of 0.25% and a maker fee of 0.15% on all trades. Bittrex also has mobile app support for Android and iOS devices so you can trade on the go!

For those looking for a reliable gateway for trading over 200 digital assets, Bittrex. Not only does it offer some of the lowest two-way commissions on the market – 0.25% taker commission and 0.15% doer commission – but its mobile app for Android and iOS provides an extra level of convenience! Start trading with Bittrex today and see why many crypto traders trust this reliable platform!

Bitcoin ETF (BTF) gives investors access to the cryptocurrency market.

The ETF currently offers an S&P 500 equivalent of 1.8% per year return without buying or selling bitcoin. The Bitcoin Strategy ETF is an actively managed Nasdaq-listed fund that invests in bitcoin futures. The fund is currently up over 30% since inception.

The VanEck Vectors Bitcoin Strategy ETF (KBWB) is an index fund that tracks the performance of Bitcoin. KBWB has an expense ratio of 0.55% and is the only ETF offering bitcoin exposure.

The BTF, which trades under the ticker “VIP,” has lagged behind the benchmark Bitcoin price in terms of performance. This is because bitcoin futures ETFs track bets on the future value of bitcoin rather than its current or “spot” price.

The BTF, like other crypto ETFs that invest in bitcoin futures agreements, has underperformed compared to the S&P 500 index throughout much of the year through 2022.

For those keen to capitalize on the movement of Bitcoin futures, ProShares Bitcoin Strategy ETF (BITO) provides a cutting-edge way for investors to gain exposure to this revolutionary digital asset. This exchange-traded fund permits you to track performance with ease and confidence. BITO has an expense ratio of 0.50% and is the only ETF that offers exposure to bitcoin futures.

The First Trust Index Based on CBOE Bitcoin Futures (CFBT) is an index fund that tracks the performance of bitcoin futures, and CFBT has an expense ratio of 0.65%. It's currently the only ETF offering exposure to bitcoin futures.

The Global X Blockchain Thematic ETF (BLOC) is an actively managed fund that invests in companies driving innovation in the blockchain space. BLOC has an expense ratio of 0.75% and is the only ETF offering blockchain technology exposure.

A fund that covers the top 10 cryptocurrencies by market capitalization

The Bitwise 10 Cryptocurrency Index is a benchmark that tracks the top ten cryptocurrencies, including Bitcoin. BTW aims to track an index of the top ten most valuable cryptocurrencies and then screen and monitor them for particular dangers, weighted by market capitalization, every month.

BITW is a crypto-ETF because it does not purchase bitcoin futures contracts. Investors should also remember that BITW is formed as a partnership so that investors will get a K-1 at the end of the tax year. Investors should double-check that they understand the fund's tax implications—Furthermore, the expense of 2.50%.

The Amplify Transformational Data Sharing ETF (BLOK) is an ideal investment for anyone interested in blockchain technology. BLOK has a low expense ratio of 0.70% and is the only fund that offers exposure to this cutting-edge field.

Vanguard S&P 500 ETF (VOO) is your ideal option! Stocks comprised in the renowned S&P 500 index, all at an incredibly competitive expense ratio of just 0.04%. VOO alone is your go-to option if you want to invest directly in this widely followed benchmark!

The Invesco QQQ Trust (QQQ) is an index fund that tracks the performance of the NASDAQ-100 index, and it has an expense ratio of only 0.20%. It's also the only exchange-traded fund (ETF) that offers exposure to the NASDAQ-100 index.

The iShares Russell 1000 ETF (IWB) is an index fund that tracks the performance of the Russell 1000 index. IWB has an expense ratio of 0.15% and is the only ETF that offers exposure to the Russell 1000 index.

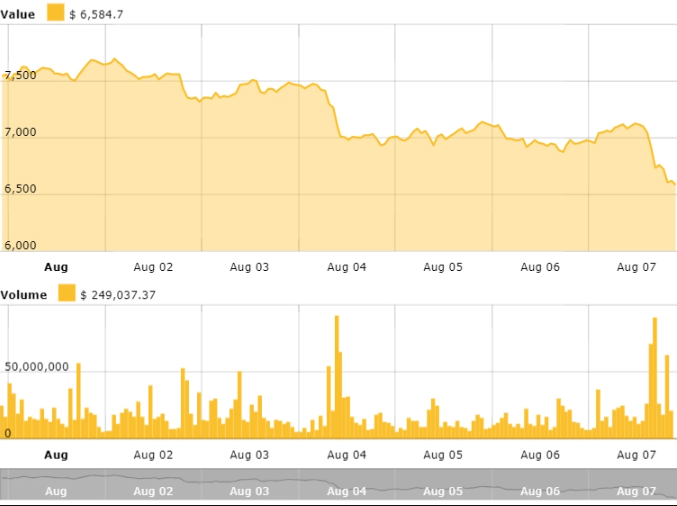

The performance of the ETF that tracks the Bitwise 10 Cryptocurrency Index

Bitwise's 10 Crypto ETF has underperformed the bitcoin price in U.S. dollars. This is because BITW is a vehicle that tracks an index of cryptocurrencies other than bitcoins. As a result, investors can compare and contrast BITW to bitcoins in U.S. dollars, but they should not expect performance to mirror that benchmark.

BITW has drastically declined compared to the S&P 500 Index from 2021 until February 4, 2022.

For 2020 to date, the BITW has experienced a significant decrease of -53.13%, while the S&P 500 Index has had an impressive surge up +11.77%.

Over the past twelve months, BITW is down -51.72% while the S&P 500 Index is up +17.01%.

The Van Eck SolidX Bitcoin Strategy ETF ( XBTF )

The VanEck Bitcoin Strategy ETF (ticker VBST) is an actively managed exchange-traded fund investing in bitcoin futures contracts to grow capital. Although XBTF has the lowest expense ratio among bitcoin-cryptocurrency ETFs, it does not outperform other category leaders.

XBTF has an expense ratio of 0.50% and is the only ETF that offers exposure to bitcoin futures contracts.

The Amplify Online Retail ETF (IBUY)

The Amplify Online Retail ETF (ticker IBUY) invests in companies that derive significant revenues from online retail activities. IBUY provides exposure to companies that drive innovation and growth in online retail.

IBUY has an expense ratio of 0.60% and is the only ETF that offers exposure to online retailers.

The First Trust Dow Jones Internet Index Fund (FDN)

The First Trust Dow Jones Internet Index Fund (ticker FDN)

When measured in U.S. dollars, the VanEck Bitcoin Strategy ETF (XBTF) lags behind the benchmark bitcoin price. This is because these types of ETFs track contracts that bet on the future value of bitcoin, not the current or “spot” price of bitcoin itself.

Compared to the impressive performance of the S&P 500 index, XBTF and other bitcoin ETFs that hold bitcoin futures contracts have lagged significantly in recent weeks.

Compared to the S&P 500, XBTF has encountered an astonishing 53.13% plummet year-to-date compared to the 11.77% rise of its counterpart.

Over the past twelve months, XBTF is down -51.72% while the S&P 500 index is up +17.01%.

The First Trust Dow Jones Internet Index Fund (FDN) is an index fund that tracks the performance of the Dow Jones Internet Index. FDN has an expense ratio of 0.47% and is the only ETF that offers exposure to the Dow Jones Internet Index.

Global X Blockchain and Bitcoin Strategy ETF (BITS)

The Global X Bitcoin Strategy ETF, an actively managed exchange-traded fund that invests in a mix of blockchain technology enterprises and bitcoin futures contracts to achieve capital growth, is the newest offering from Global X.

The Global X Blockchain and Bitcoin Strategy ETF is an actively managed exchange-traded fund that invests in a mix of blockchain technology firms and bitcoin futures contracts to gain capital appreciation.

The fund's expense ratio is 0.65%.

The Reality Shares Nasdaq NexGen Economy ETF ( BLCN )

The Reality Shares Nasdaq NexGen Economy ETF, an exchange-traded fund that invests in companies leading the charge in developing and utilizing blockchain technology, is one of the newest funds to hit the market.

Reality Shares Nasdaq NexGen Economy ETF is an exchange-traded fund that invests in companies leading the charge in developing and utilizing blockchain technology. The fund's expense ratio is 0.70%.

The SPDR S&P Kensho Final Frontiers ETF ( XKFF )

The SPDR S&P Kensho Final Frontiers ETF, an exchange-traded fund that invests in companies involved in space exploration and other cutting-edge industries, is one of the newest funds to hit the market.

The SPDR S&P Kensho Final Frontiers ETF is an exchange-traded fund that invests in companies involved in space exploration and other cutting-edge industries. The fund's expense ratio is 0.45%.

Investing in cryptocurrency ETFs can be a volatile proposition.

Since cryptocurrencies are still a new asset class, the ETFs focused on them need to be more mature too. Given this, there are typically lots of fluctuations in not just cryptos themselves but also the companies working on their development.

Only bet a small amount of money, and remember the long-term effects of blockchain technology.

The Bottom Line

Cryptocurrency ETFs allow investors to participate in the rapidly growing digital asset market. ETFs give you exposure to a variety of assets and strategies.

These ETFs, ranging in expense from 0.45% to 0.70%, could be inexpensive ways of accessing the crypto space; however, it is critical to remember that these products are exceedingly new and therefore carry a high-risk factor. To protect themselves before investing, potential investors should conduct comprehensive research beforehand.