Cryptocurrency Trading: Unveiling the Power of Digital Assets

Table of content

- Introduction: Unlocking the Potential of Cryptocurrency Trading

- Understanding Cryptocurrency Trading: Beyond Traditional Markets

- Leveraging CFDs: Long and Short Positions

- Cryptocurrency Markets: Decentralization and Transaction Verification

- Driving Factors Behind Cryptocurrency Market Movement

- Cryptocurrency Trading: Unveiling Opportunities in the Digital Realm

- Conclusion: Navigating the Ever-changing Waves of Cryptocurrency Trading

- Future Trends: Navigating the Evolving Cryptocurrency Landscape

- Decentralized Finance (DeFi): Revolutionizing Traditional Finance

- Non-Fungible Tokens (NFTs): Redefining Ownership and Creativity

- Scalability Solutions: Easing Blockchain Bottlenecks

- Interoperability: Bridging Blockchains

- Central Bank Digital Currencies (CBDCs): The Future of Money?

- Conclusion: Navigating the Ever-Changing Crypto Seas

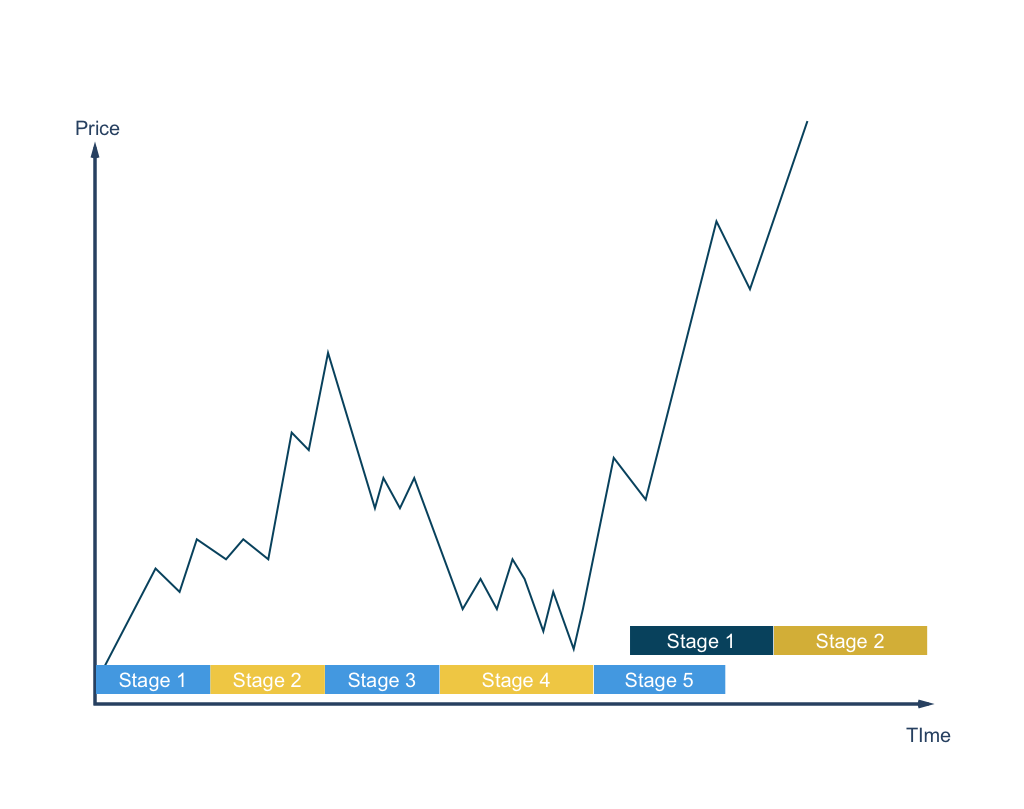

⚡️ How many stages are there in cryptocurrency?

The global economic order is a big challenge, but cryptocurrencies like bitcoin are attempting it. Paul Vigna and Michael Casey describe the five phases of crypto adoption and what it might imply for future finance.

⚡️ What is a bitcoin cycle?

What are 4-year bitcoin cycles, and why are they important? Every 210,000 blocks, the bitcoin reward ishalved. This takes around four years. The next halving is slated to happen in early 2024.

⚡️ What are the stages of a crypto bubble?

The past decade has seen a wild journey in the world of cryptocurrency, with stunning highs and devastating lows. Each time, the market has followed a similar pattern: rapid growth followed by a sharp correction. This cycle is often referred to as a crypto bubble.

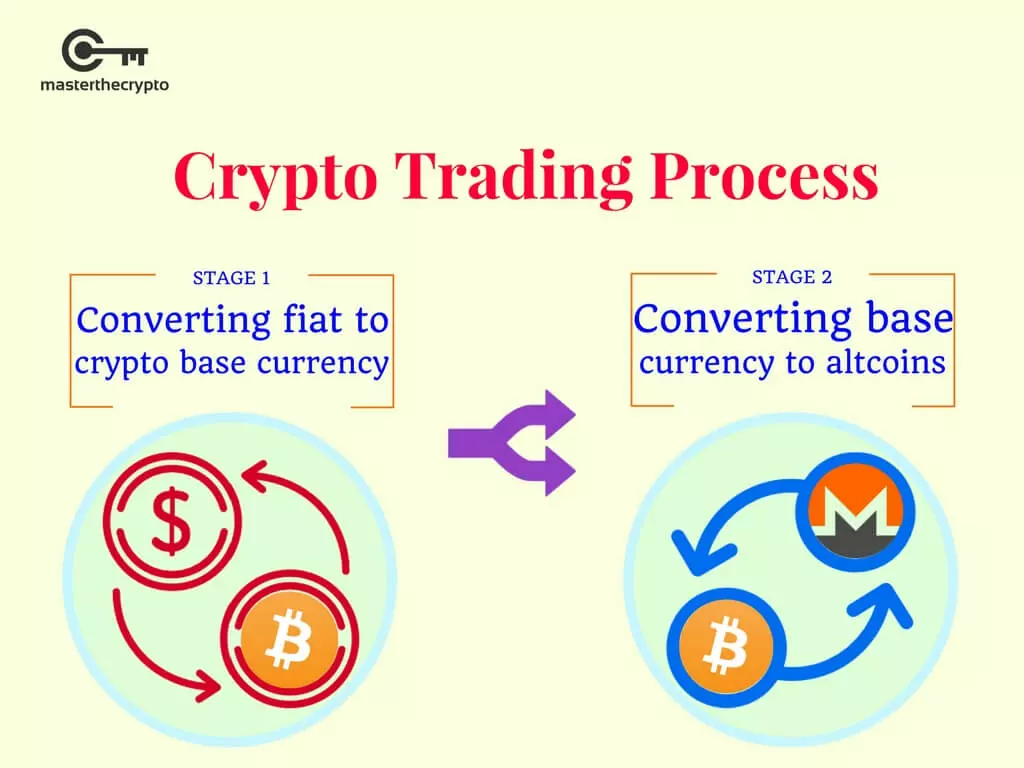

⚡️ What is the process of trading cryptocurrency?

Through the purchase and sale of digital assets, cryptocurrency trading presents an extraordinary opportunity to increase your earnings. Cryptocurrencies are volatile, so traders must be careful when entering and exit trades.

Introduction: Unlocking the Potential of Cryptocurrency Trading

In the dynamic world of finance, where innovation constantly reshapes traditional paradigms, cryptocurrency trading stands as a revolutionary force. The buying and selling of cryptocurrencies, the digital assets built on blockchain technology, have emerged as a new frontier for investors and traders. In this comprehensive guide, we will dive deep into the intricacies of cryptocurrency trading, catering to both beginners looking to grasp the basics and professionals seeking to refine their strategies and capitalize on market movements.

Understanding Cryptocurrency Trading: Beyond Traditional Markets

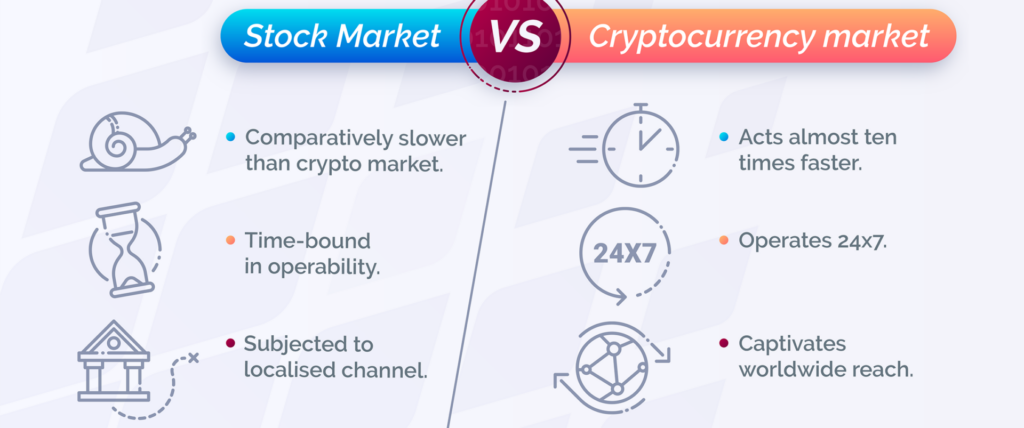

Cryptocurrency trading encompasses the art of speculating on the price movements of digital assets, such as Bitcoin, Ethereum, and an array of alternative coins. Unlike conventional markets, cryptocurrency trading operates on exchanges that facilitate peer-to-peer transactions, eliminating the need for a central intermediary. One significant facet of this trading approach is the utilization of Contracts for Difference (CFDs). These leveraged derivatives enable traders to speculate on price changes without owning the actual coins, a feature that distinguishes cryptocurrency trading from traditional ownership-based investment.

Leveraging CFDs: Long and Short Positions

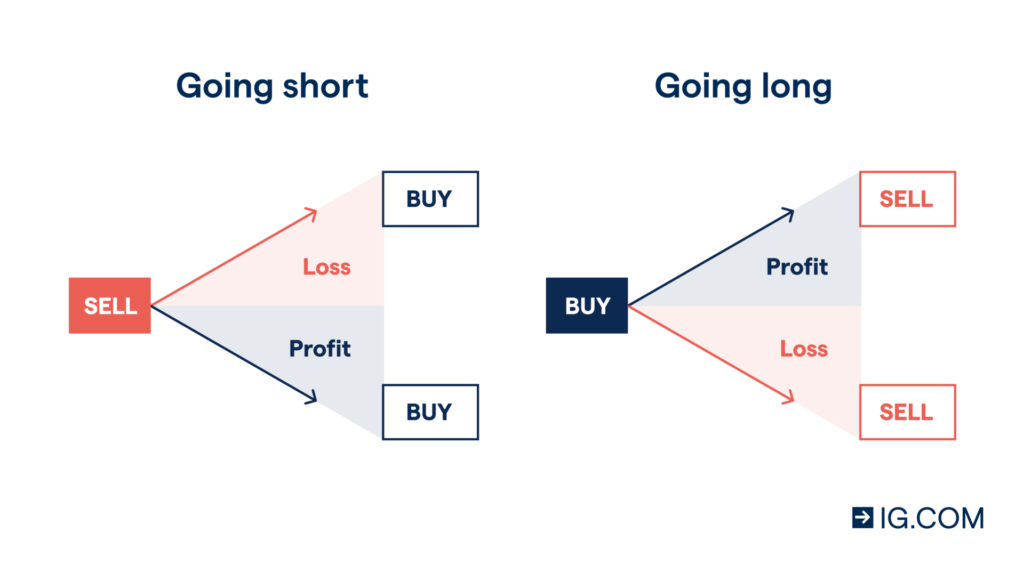

Central to cryptocurrency trading with CFDs is the concept of long and short positions. Going “long” involves speculating that the value of a cryptocurrency will rise, thus “buying” the market with the anticipation of selling at a higher price. On the other hand, going “short” entails speculating that the price will decline, allowing traders to “sell” the market and buy back at a lower price. This flexibility to profit from both upward and downward price movements is a unique advantage that cryptocurrency trading offers.

Here's how leveraging CFDs works in terms of long and short positions:

- Long Position: When a trader takes a long position in a CFD, they are speculating that the price of the underlying asset will rise. In other words, they believe the asset's value will increase over time. If the price does indeed rise, the trader can sell the CFD at a higher price than their entry point, thereby making a profit.Example: Suppose a trader believes that the price of Bitcoin will increase. They enter into a long CFD position for Bitcoin at a certain price. If the price of Bitcoin rises, the trader can sell the CFD at the new, higher price, thus realizing a profit.

- Short Position: Taking a short position with a CFD involves speculating that the price of the underlying asset will fall. This allows traders to profit from declining markets. Unlike traditional investments, where you need to own an asset to sell it at a higher price later, shorting through CFDs enables you to profit from a decrease in value.Example: If a trader expects the price of a specific altcoin to drop, they can take a short CFD position. If the altcoin's price does indeed drop, the trader can buy back the CFD at the lower price, making a profit from the difference between their initial short entry and the lower buyback price.

Leverage in CFDs: One of the key features of CFDs is leverage, which allows traders to control a larger position with a smaller amount of capital. Leverage magnifies potential gains but also increases potential losses. It's important to understand that while leverage can amplify profits, it can also lead to substantial losses, especially in highly volatile markets like cryptocurrencies.

Risk Management and Considerations: Leveraging CFDs, whether through long or short positions, requires careful risk management. Traders should have a clear understanding of the market, use stop-loss orders to limit potential losses, and avoid excessive leverage that could wipe out their capital. Additionally, the cryptocurrency market's volatility can lead to rapid price swings, which can impact CFD positions significantly.

Cryptocurrency Markets: Decentralization and Transaction Verification

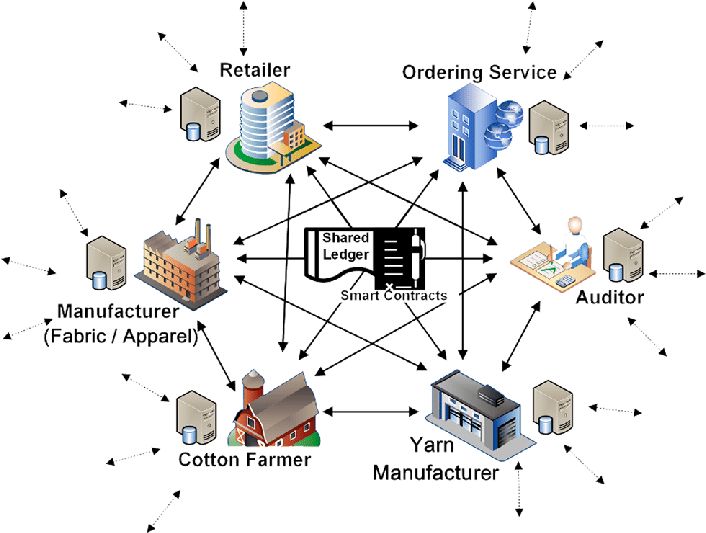

Unlike traditional financial systems governed by central authorities, cryptocurrency markets operate in a decentralized manner. Transactions are verified and recorded on a blockchain, a distributed ledger technology that ensures transparency and security. The process of “mining” is the backbone of this verification mechanism, involving computational power to validate transactions and add them to the blockchain. This decentralization not only enhances security but also eliminates the need for intermediaries, making transactions efficient and cost-effective.

Driving Factors Behind Cryptocurrency Market Movement

Cryptocurrency markets are influenced by a multitude of factors that shape price trends and market sentiment. Unlike traditional markets, cryptocurrencies are relatively immune to economic and political concerns due to their decentralized nature. However, several key factors significantly impact their prices:

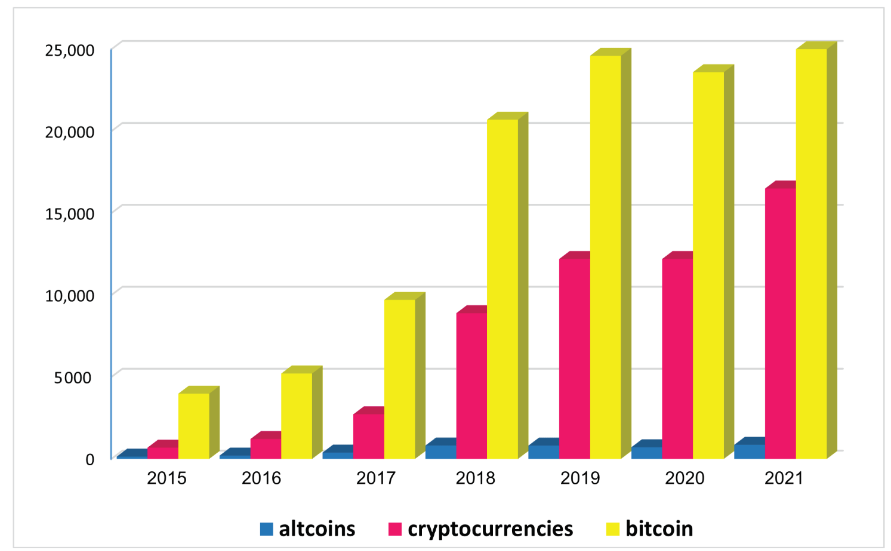

- Supply Dynamics: The total number of coins in circulation and the rate of issuance play a vital role in determining price movements. Limited supplies, as seen in Bitcoin's case, can create scarcity and potentially drive prices higher.

- Market Capitalization: The cumulative value of all coins in existence, coupled with how users perceive this value, affects market dynamics. Large market capitalization often signifies a more established and resilient cryptocurrency.

- Media Influence: Media coverage plays a pivotal role in shaping public perception of cryptocurrencies. Positive coverage can trigger bullish trends, while negative news can lead to temporary market downturns.

- Integration into Infrastructure: The ease of integration of a cryptocurrency into existing financial systems, online platforms, and payment gateways can significantly impact its adoption and value.

- Key Events: Regulatory updates, security breaches, technological advancements, and macroeconomic developments can send shockwaves through the cryptocurrency landscape, prompting both rapid rallies and sharp corrections.

Cryptocurrency Trading: Unveiling Opportunities in the Digital Realm

In the fast-paced world of finance, traditional concepts of currency and investment have taken a backseat to the rise of cryptocurrencies. With a meteoric surge in popularity, cryptocurrencies have captured the attention of both novice investors and seasoned professionals, offering a unique avenue for financial growth.

This comprehensive guide is your ticket to understanding the intricate art of cryptocurrency trading, catering to beginners seeking knowledge and experienced traders aiming to refine their strategies. Brace yourself for a journey into the heart of cryptocurrency trading, replete with insights, tips, and a comprehensive view of the landscape.

| Trend | Description | Opportunities | Challenges |

|---|---|---|---|

| Decentralized Finance (DeFi) | Revolutionizing traditional finance through direct transactions, lending, borrowing, and trading. | Financial inclusivity, democratized finance. | Security concerns, regulatory issues. |

| Non-Fungible Tokens (NFTs) | Verifying ownership of digital assets, enabling monetization for creators and ownership in virtual worlds. | Creative monetization, redefined ownership. | Environmental impact, value sustainability. |

| Scalability Solutions | Addressing blockchain congestion with solutions like Ethereum 2.0 and layer 2 solutions. | Faster transactions, reduced fees. | Technical implementation, security. |

| Interoperability | Creating bridges between blockchains for enhanced efficiency, resource sharing, and expanded use cases. | Enhanced communication, resource sharing. | Technical challenges, security across networks. |

| Central Bank Digital Currencies (CBDCs) | Exploring digital versions of national currencies for cross-border transactions and monetary policy tools. | Streamlined transactions, financial inclusion. | Privacy concerns, impact on traditional finance. |

Additionally, the provided content can be expanded as follows:

In conclusion, the cryptocurrency landscape is a dynamic and ever-changing environment, shaped by trends such as DeFi, NFTs, scalability solutions, interoperability, and the exploration of CBDCs. As traders and investors navigate this space, staying informed about these trends is essential to make informed decisions that align with both opportunities and challenges presented by these developments.

As we navigate the uncharted waters of cryptocurrency trading, remember that knowledge is your most valuable asset. Whether you're dipping your toes in for the first time or refining your trading prowess, this guide has equipped you with a comprehensive toolkit to navigate the thrilling and sometimes tumultuous world of cryptocurrency trading. While the journey is rife with opportunities, it's crucial to approach it with diligence, continuous learning, and prudent risk management. As you ride the waves of innovation and potential, may your cryptocurrency trading journey be both prosperous and enlightening.

As the cryptocurrency market continues to evolve, it's crucial for both beginners and professionals to stay ahead of emerging trends that can shape the industry's future. Let's delve into some of the most exciting developments that are reshaping the landscape.

Decentralized Finance (DeFi): Revolutionizing Traditional Finance

Imagine a financial system where intermediaries are eliminated, and transactions are conducted directly between users. Welcome to the world of DeFi. This trend has gained substantial traction, offering a plethora of decentralized applications that enable lending, borrowing, trading, and yield farming without the need for traditional financial institutions. The potential to democratize finance and increase financial inclusivity has put DeFi in the spotlight. But, as with any innovation, DeFi comes with its own set of challenges, including security concerns and regulatory considerations.

Non-Fungible Tokens (NFTs): Redefining Ownership and Creativity

NFTs have caused ripples across the art, gaming, and entertainment sectors. These unique digital tokens are built on blockchain technology, verifying the authenticity and ownership of digital assets. Artists, musicians, and creators are leveraging NFTs to monetize their work directly and interact with their fan base. Additionally, NFTs are redefining ownership in virtual worlds, allowing gamers to truly own in-game assets. While NFTs offer exciting possibilities, questions about environmental impact and the long-term value of digital collectibles persist.

Scalability Solutions: Easing Blockchain Bottlenecks

As cryptocurrencies gained popularity, scalability emerged as a critical challenge. Blockchain networks like Bitcoin and Ethereum faced congestion, resulting in slow transactions and high fees. This prompted the search for scalability solutions. Ethereum's transition to Ethereum 2.0, employing a proof-of-stake consensus mechanism, aims to significantly enhance scalability. Layer 2 solutions, such as rollups, are also gaining traction, enabling faster and cheaper transactions while still benefiting from the security of the main blockchain.

Interoperability: Bridging Blockchains

In a multi-blockchain world, interoperability is key. Projects like Polkadot, Cosmos, and Avalanche are working to create bridges between different blockchains, allowing them to communicate and share data seamlessly. This can lead to increased efficiency, resource sharing, and expanded use cases for blockchain technology. However, achieving true interoperability requires addressing technical challenges and ensuring security across interconnected networks.

Central Bank Digital Currencies (CBDCs): The Future of Money?

Central banks around the world are exploring the concept of CBDCs, digital versions of national currencies. These CBDCs could streamline cross-border transactions, enhance financial inclusion, and provide central banks with new tools for monetary policy. However, their implementation raises questions about privacy, security, and potential impacts on the traditional financial system.

The world of cryptocurrency is one of constant evolution, with new trends and innovations reshaping the landscape. Whether it's the decentralized revolution of DeFi, the creative opportunities unlocked by NFTs, or the pursuit of scalability and interoperability, staying informed is essential. As you explore the depths of cryptocurrency trading, keep an eye on these trends and their potential impact on your trading strategies and investment decisions.

Resources:

- Blockchain Technology Explained: A Comprehensive Guide

- Technical Analysis in Cryptocurrency Trading: Strategies for Success

- Cryptocurrency Regulation: Navigating the Legal Landscape

- Safeguarding Your Crypto Assets: Best Practices for Security

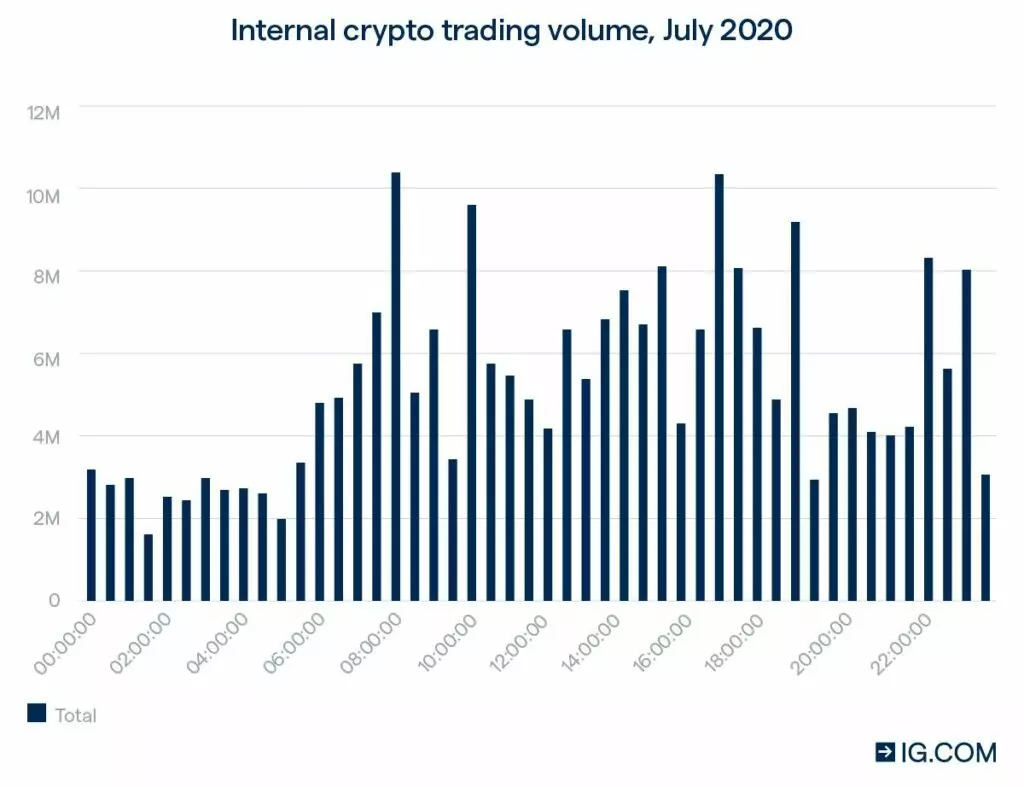

Note: Throughout the article, you can incorporate visual aids such as charts depicting cryptocurrency market trends, screenshots of trading platforms, and diagrams illustrating blockchain technology. These visuals will enhance the reader's understanding and engagement. Additionally, consider embedding interactive elements like live price trackers or simulated trading scenarios to provide a hands-on experience.