Unlock the Power of RSI: An Overview of Using the Relative Strength Index

Table of content

- How to use the RSI crypto indicator

- When should we trust the RSI crypto indicator?

- There are five areas to address. Be sure to emphasize your key takeaways.

- What exactly are divergence and convergence?

- Why are convergence and divergence so effective?

- What is the significance of the RSI crypto indicator when making a trading decision?

- How is RSI Used in Day Trading?

⚡️ How is crypto RSI calculated?

The RSI, or Relative Strength Index, is an exceedingly helpful oscillator that assesses the potency of a cryptocurrency's price action. This index can detect when prices are either overbought or oversold and will register with 0% in these cases. To calculate the RSI you must separate out average losses from profits within any given period. Once accomplished, it'll become much easier to identify reliable trading opportunities for your crypto investment portfolio!

⚡️ How accurate is the RSI?

The Relative Strength Indicator (RSI)—often called the “momentum barometer”—is an invaluable tool for traders. It enables them to recognize potential buying opportunities throughout the day, even though there are just a few trading signals available each day and can be confusing at times.

⚡️ What is a better indicator than the RSI?

The MFI (cash flow index) indicator, like the RSI, takes into account volume as well. The MFI is less popular than the RSI but performs just as effectively and, in many cases, better.

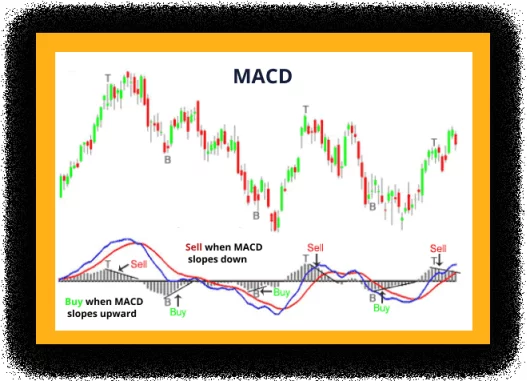

⚡️ Which is better than RSI or MACD?

The RSI indicator has been found to be superior to the MACD in terms of tradability. This is due, in large part, to the fact that the RSI signals fewer false trades than the MACD.

⚡️ Which indicator is the most accurate?

The STC indicator is a leading indicator that generates faster and more accurate signals than earlier ones such as the MACD because it incorporates both time (cycles) and moving averages.

The cryptocurrency market is a constant battle, and those who don't stay on top permanently lose. This RSI indicator tutorial will help you make profitable trades and hopefully leave you with a profit in the end.

Sure, a technical analyst may be able to understand candlestick patterns and support and resistance levels, but wouldn't it be nice if you could add another instrument to your arsenal?

If you answered yes, rejoice! The Relative Strength Index (RSI) is one of the most popular indicators to assist with trading. But there are many other beneficial ones too!

For traders, RSI proves to be an invaluable asset as it assists in recognizing when a digital currency is no longer trading at its “true” value. With this information, they can make wiser investment decisions and capitalize on potential gains. By utilizing RSI, investors can take advantage of the market before prices correct themselves and get an advantageous trading entry. With the volatility of cryptocurrency markets, having access to such a powerful indicator proves essential in successful investments.

Wells Wilder's invention of the Relative Strength Index (RSI) only occurred 40 years ago, which created difficulties for early 18th-century candlestick chartists. To figure out if an investment is overbought or oversold, this momentum indicator uses a somewhat complicated algorithm.

Thankfully, you can be an expert in the science of RSI or its mechanics to gain from it.

If you've been a model student, outperforming your peers and know you're capable of great things, this is for you:

RSI = 100 – 100 / (1 + RS)

RS = average of X closing periods up / average of X closing periods down

X = recommended using 14, but can also be a number of the trader's choice.

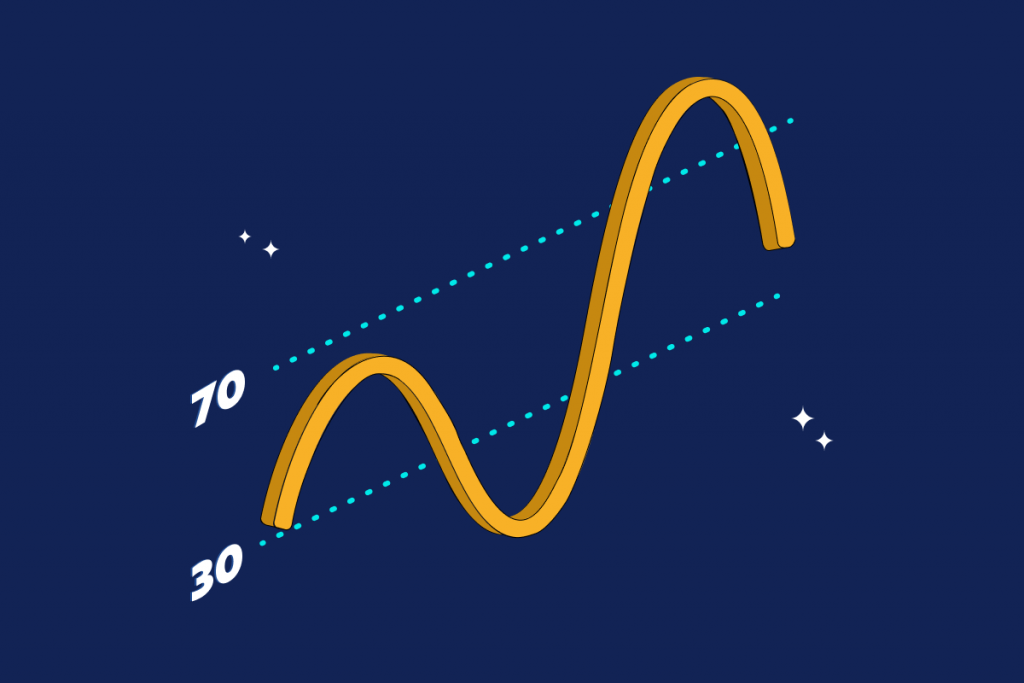

The indicator's formula produces a value between 0 and 100, which is shown on the chart as an oscillator wave pattern.

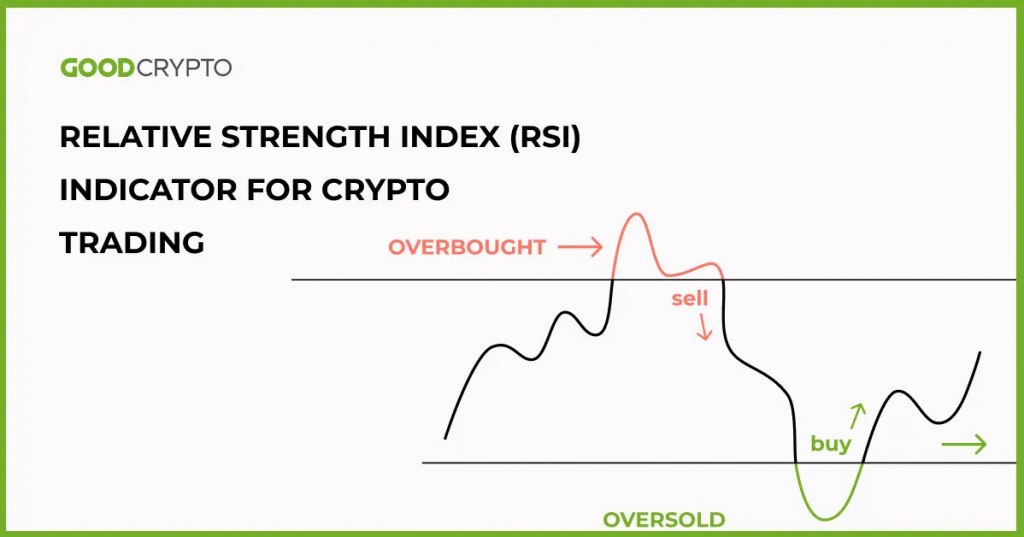

When the Relative Strength Index (RSI) hits below 30.00, it is a sign that the stock price has surpassed its expected performance based on past market history. This suggests that it may be undervalued or “oversold” and hence presents an excellent opportunity for savvy investors to acquire stocks at significantly reduced prices. In situations like these, a standard rally usually follows; known as an oversold condition. Nonetheless, once the RSI reaches back up to 30 again there is also a chance of further decline in stock prices . The most amazing aspect about the Relative Strength Index is not only how useful and applicable it can be but also just how trustworthy it’s been proven to be – with charts serving as testimony of its reliability!

How to use the RSI crypto indicator

When a stock's relative strength is overbought, it means that the market is ready to drop.

The RSI may assist in determining when an asset is cooling off for a brief time only.

Overbought states on the oscillator are a reflection of this period. The higher the RSI rises above 70.00, the more oversold the asset is, and the deeper the retreat can be.

The bitcoin RSI has signaled overbought situations four times in the past, as seen in the weekly chart above. After a strong RSI reading, prices were down 50-72 percent afterward. Traders who are fearful of missing out on gains should place stops below 120 to ensure they don't get caught up in a bust.

If you're ready to take the chance of making money on a fall, you can even create a short position. It's crucial to remember, though, that this figure should not be taken as gospel. In the previous example, when prices broke into overbought territory and subsequently returned to that level several times, BTC continued to rise. Even though the RSI reached a lower high after exceeding its prior peak, BTC rose even more. The divergency between RSI and price typically indicates a trend reversal, as was the case in both instances shown above.

When should we trust the RSI crypto indicator?

Signals will be more valuable if the price range is visible. A range indicates that the price is moving up and down in a certain area, creating resistance at the top and support at the bottom. When prices remain constant over time, it's called “sideways trading.” There won't be any significant drops or sky-high jumps – the value usually stays close to where it began.

The RSI becomes less reliable when prices are in a trend, as it can't accurately predict the peak or trough of a new high/low. Thus, we remain unable to determine how far up the market will soar nor how much further down it may plunge beyond these thresholds.

Technical traders frequently rely on the Relative Strength Index (RSI) to analyze any chart – including those of stocks.

To summarize, when the market is in a range, you may use the rsi crypto meaning indicator to buy low and sell high.

The stock is perhaps oversold.

The RSI can also signal when a sharply falling price can reach exhaustion, returning the “oversold” value. The lower the RSI falls below 30, the more oversold the asset is and the stronger the price reversal could be.

As you can see from the graph, when the RSI goes below 30 or is close to it, this signals that bitcoin is oversold. In 76-332 percent of cases in the months following this occurrence, the price of bitcoin rises. The RSI isn't the holy grail of the market, but the chart above indicates that it is more likely to provide accurate signals than not.

There are five areas to address. Be sure to emphasize your key takeaways.

After a significant price drop, there is typically a quick rise to follow. The term “rebound from oversold” refers to this phenomenon. Using RSI to time entries during an oversold bounce is one of the most effective techniques for making money on intraday timeframes.

Don't wait for the RSI to reach zero or 100 percent either. Values of more than 85 or less than 15 represent overbought/sold extremes.

What exactly are divergence and convergence?

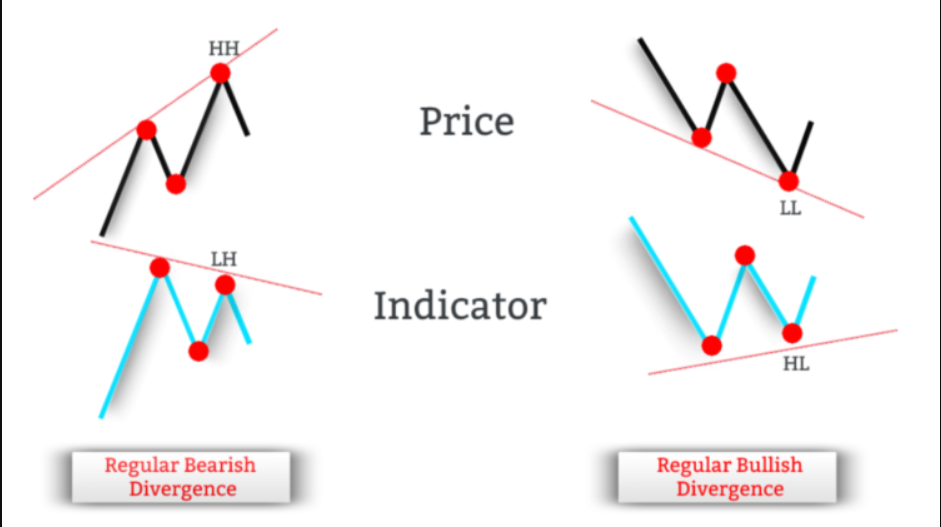

When the market price and RSI indicator are heading in a matching direction, it's called convergence. If they're moving away from each other, then divergence is taking place.

When a price makes a higher high or higher low, and the oscillator meanwhile generates a lower high or lower low, we have divergence.

When the price makes a lower high or low, as well as an upward trend in the oscillator, it's called convergence.

Why are convergence and divergence so effective?

Visualize the market reaching a peak. Following a minor retracement, the rate attains another high yet again; however, the RSI reveals an absence of strength suggesting that fewer people are eager to purchase it at this higher price and therefore more likely for it to fall in value.

Picture this scenario: an apple seller in a market hikes the cost of their apples, yet as customers become aware of the new prices, fewer people are enticed to buy. To attract more buyers, the vendor is forced to lower their rates again.

Technical analysis requires you to look for possible signs of price change and wager based on your prediction. However, this isn't an exact science; remember that the readings could be mistaken occasionally.

To bolster the legitimacy of your verdict, you should obtain corroboration from multiple sources. When utilizing an RSI indicator, discrepancies will become more apparent when the line dips below 30. By amalgamating these signs and signals, you can be much certainr of a pricing turnaround. Spotting divergence or convergence requires keeping vigil for highs and lows which is precisely what we are doing as we investigate Bitcoin’s RSI chart just beneath this text!

What is the significance of the RSI crypto indicator when making a trading decision?

In a trending market, there are overbought and oversold signals that indicate whether prices will rise or fall.

When the market is in a range, one of the strategies described above on the crypto RSI chart is to examine overbought and oversold indications. There's no assurance you'll spot an absolute bottom or peak; it's just as likely that the market will continue to drop even after you've recognized an oversold signal.

The RSI is insufficient on its own, therefore it is not advised to develop a trading strategy based solely on this indicator. Nonetheless, it aids in making judgments and obtaining information, which is quite beneficial. To confirm the presence of signals and make more informed trading decisions, you may use various types of moving averages and Bollinger Bands in conjunction with

Strategy #2: Base trading on bullish or bearish divergence and convergence.

The second approach, trading based on divergence, is more intriguing. You may seek divergence in the RSI momentum indicator when you observe a retest, such as in the formation of a price bottom or top.

Seeing a double top on your chart is a signal that you should anticipate selling. On the other hand, when you notice an occurrence of a double bottom appears, it's time to place your buy order and get ready for the profits! Your stop-loss can be located below the previous low if you are confident in your prediction that there won't be any upcoming lows – with this precautionary measure, even in case of incorrect analysis which might lead to unwelcome losses, at least they will not extend too far beyond what was initially assumed.

If a divergence appears, it means the price is departing from its indicator's movement. The most prevalent way to use this tactic is by waiting for confirmation of direction; if you observe bullish convergence, wait until the price records a new peak and if bearish divergence transpires, await for the value to hit a lower low.

Of course, you can also trade the divergences without waiting for confirmation. For example, if you see a bullish divergence and the price is close to the support level, you may buy immediately with a stop-loss order set below the support.

When trading cryptocurrencies, it is essential to deploy stop-loss orders to limit potential losses. After all, the cryptocurrency market carries various risks that should be considered at all times.

You should be aware of false signals when trading based on convergence or divergence. A wrong call occurs when the price makes a new high or low, but the indicator does not confirm it. In such cases, you should wait for the hand to catch up with the price.

Utilizing stop-loss orders and assessing each trade scrupulously is pivotal to trading success. Learning from your missteps and continually monitoring your development can help you reduce losses while augmenting the likelihood of future achievements.

RSI is a popular technical indicator that is used by traders to analyze price data and make decisions about when to buy or sell a security. RSI is calculated using a simple formula that measures the magnitude of recent price changes to assess whether a security is overbought or oversold. The indicator ranges from 0 to 100, with readings below 30 indicating an oversold condition and readings above 70 indicating an overbought condition.

How is RSI Used in Day Trading?

If you want to know how to use the RSI indicator for day trading, it's important to understand that day trading strategy means opening and closing trades within the same calendar day. Successful day traders don't simply take many trades throughout a single day) but rather they focus on quality (taking only those high-probability short-term trades that are most likely to succeed). By using an RSI trading strategy, investors can more easily identify and capitalize on intraday opportunities regardless of whether the overall market is trending up or down.

RSI is frequently used by traders to help identify overbought and oversold signals. The default RSI setting is 14 periods, but day traders who want more frequent signals may opt for periods as low as 6 or 9 instead. These levels should ideally correspond with support and resistance levels in the market; thus, buy orders are placed off a support area when the RSI reading falls below 30 in a ranging market, whereas sell orders occur from a resistance area when the RSI goes above 70.

By analyzing the RSI settings, traders can figure out which market is good to invest in. For example, if there's an uptrend, a trader will buy after a pullback that has been identified as oversold by the RSI reading. If it’s a downtrend instead, then the trader will sell after retracement–which would be considered overbought according to the RSI reading.

When day trading, it is crucial to use RSI in conjunction with other technical indicators, such as moving averages. By doing so, you will be able to filter out the best-quality signals and confirm solid trading opportunities.