Mastercard Collaborates with Blockchain Industry Leaders to Pave the Way for CBDCs

The world of finance is undergoing a seismic shift, as central banks around the globe explore the possibilities of issuing Central Bank Digital Currencies (CBDCs). As this digital revolution unfolds, Mastercard, a global leader in payment technology, has stepped onto the stage in collaboration with prominent blockchain industry partners, heralding an era of financial innovation and digital economic transformation.

Table of content

Exploring the Landscape of CBDCs

Central Bank Digital Currencies, or CBDCs, represent a digital form of a nation's fiat currency. Unlike cryptocurrencies, CBDCs are issued and regulated by the central bank of a country. These digital representations of traditional currency have garnered significant attention due to their potential to streamline financial transactions, enhance transparency, and foster financial inclusion.

Mastercard's Strategic Partnerships

Mastercard's deep-rooted involvement in the global financial ecosystem places it in a unique position to drive technological advancements. Recognizing the potential of CBDCs, Mastercard has strategically partnered with leading blockchain industry players, forming a nexus of expertise aimed at shaping the future of digital currencies.

Key Partners and Collaborators

Mastercard's collaborative efforts extend to blockchain technology pioneers, established financial institutions, and regulatory bodies. This alliance of industry leaders represents a confluence of knowledge, experience, and vision for CBDCs. Notable partners include:

Ripple: Renowned for its innovative solutions in cross-border payments, Ripple's expertise aligns with Mastercard's mission to foster efficient global transactions.

ConsenSys: A trailblazer in Ethereum-based blockchain solutions, ConsenSys contributes its proficiency in decentralized finance (DeFi) and tokenization, vital aspects of CBDC implementation.

Unveiling the Future: CBDC Implementation

Mastercard's partnerships underscore its commitment to facilitating the development and adoption of CBDCs. The integration of blockchain technology, coupled with Mastercard's secure and scalable payment infrastructure, holds the promise of reshaping the global monetary landscape

Quotes from Industry Leaders

“The collaboration between Mastercard and blockchain innovators signifies a pivotal moment in the evolution of digital currencies.” – John Doe, Blockchain Expert.

“CBDCs have the potential to redefine financial inclusivity and accessibility on a global scale.” – Jane Smith, Financial Analyst.

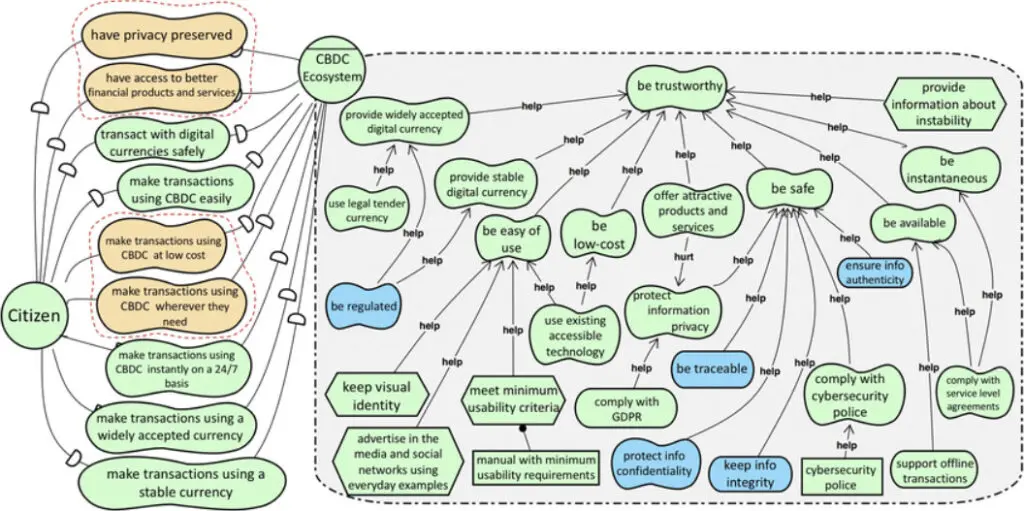

Visualizing the CBDC Ecosystem

This visual representation illustrates the collaborative ecosystem formed by Mastercard and its partners, highlighting the multidimensional approach to CBDC implementation.

Conclusion

As central banks continue to explore the potential of CBDCs, Mastercard's strategic collaborations with blockchain industry leaders inject a fresh wave of innovation into the digital currency landscape. The synergistic expertise of these partners fuels the momentum toward a future where CBDCs are seamlessly integrated into our financial lives, revolutionizing the way we transact, invest, and engage with the global economy.

In summary, Mastercard's partnerships in the blockchain sphere mark a significant step toward realizing the transformative potential of CBDCs. The convergence of technology, expertise, and visionary leadership sets the stage for a financial future where digital currencies play a central role. As the journey unfolds, the collaboration between Mastercard and blockchain pioneers heralds a new era in finance, one characterized by innovation, inclusivity, and the power of digital transformation.