Cryptocurrency Swing Trading: What is It and How to Get Involved

Table of content

- What is swing trading cryptocurrency, and how does it work?

- Day-trade and swing-trade cryptocurrency.

- Strategies for swing trading cryptocurrencies

- Trading strategies using cryptocurrency for swing traders

- Technical Analysis

- Pros of Trading in Crypto Using Swing Techniques

- Cons of Swing Trading Crypto

- Tactics for swing trading

- Trading Strategies for Swing Traders

- The cost of the loan, including interest and fees.

- A final word on Swing Trading Cryptocurrency

⚡️ What is the best coin for swing trading?

The most valuable cryptocurrencies are typically selected in swing trading crypto. Cryptocurrency exchanges and trading floors are bustling with the most coveted digital assets, like Bitcoin (BTC), Ethereum (ETH), and Tether (USDT).

⚡️ Why does cryptocurrency swing traders so much?

The cost of bitcoin is subject to ever-shifting fluctuations, influenced by such factors as an investor and consumer sentiment, media coverage, supply & demand dynamics, and even government regulations. These factors collaborate to produce price volatility.

⚡️ What is bitcoin swing trading?

Swing trading with cryptocurrencies is a combination of both. Swing traders invest for the long term. Nevertheless, they are perpetually vigilant for new investment opportunities. Daily even if they do not make transactions every day, they are usually aware of cryptocurrency market movements.

⚡️ Which coin will explode in 2025?

From 2022 to 2025, Avalanche will almost certainly be one of the most explosive cryptocurrencies.

What is swing trading cryptocurrency, and how does it work?

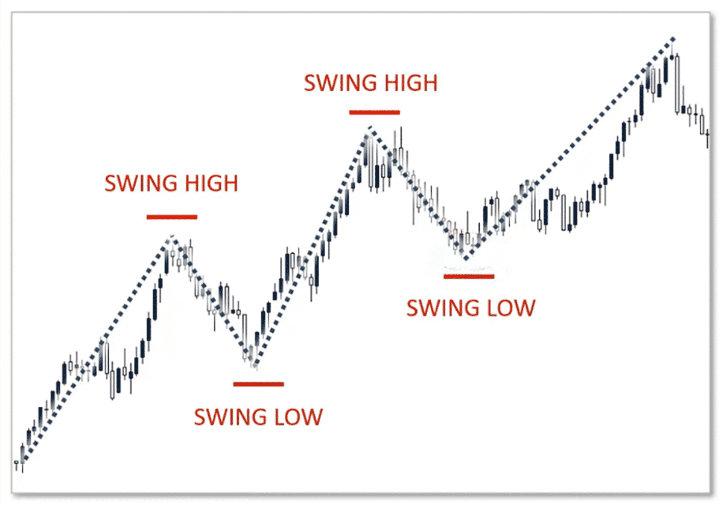

If you want to invest in the short to medium-term, swing trading crypto might be proper. This approach involves buying and selling futures contracts to capitalize on price changes. This strategy aims to spot any “swings” in the market over days, weeks, or months.

There are two values that traders focus on when watching a stock or commodity: the opening and closing prices. These prices can be predicted, with some leeway for adjustments during market downtimes.

- The best time to enter a new position is when the market is in a bull trend. When the market reaches a high, then it will begin to fall, providing an opportunity for a short trade.

- The maximum allowable volatility is near the current price, and no swing minima exist When the market falls and rebounds, this offers a chance for a long trade.

Swing trading techniques work well in trending markets, such as the forex market, stock market, and cryptocurrencies. If you're a beginner, Bitcoin, Ethereum, and Tether are some of the greatest cryptocurrencies for swing trading crypto. Because of their immense market capitalization and voluminous trading activity, these securities are some of the most liquid and actively traded assets.

Technical analysis is the most common tool successful crypto swing traders use to detect daily and weekly trends. Fundamental analysis is also essential since economic events might occur over several days or weeks.

Day-trade and swing-trade cryptocurrency.

Day traders aim to capitalize on short-term price rises during the day, while swing traders seek to benefit from longer-term price movements. Day traders actively monitor their positions and rarely leave their bets open for longer than one day, whereas swing traders may leave their positions open for several days or weeks.

Day traders often employ technical analysis to spot short-term trends and leverage them for maximum profits. They may also use indicators such as moving averages, support and resistance levels, and other chart patterns to determine when to enter and exit trades. Swing traders, on the other hand, focus more on fundamental analysis. They look at news events, economic reports, company announcements, and other information sources to identify market trends. These traders are likelier to hold positions for extended periods to maximize profits.

The investor's investing preferences and objectives ultimately determine the decision between day trading and swing trading crypto. Some traders like to make daily transactions, while others hesitate to keep positions overnight. Furthermore, some traders may benefit from a fast-paced setting, while others want a more laid-back style.

Trading cryptocurrencies can be overwhelming with the vast variety of options available to fit your specific wants and needs.

Strategies for swing trading cryptocurrencies

Trading cryptocurrency on the swing is a little more complicated than trading fiat currency because swings incorporate different order types, spreads, and stop-loss orders. Trading cryptocurrencies can be complex, with many options to suit your needs. You must take the time to determine which method is best for you and your trading goals. We've provided two common examples below.

“Unable to Escape.”

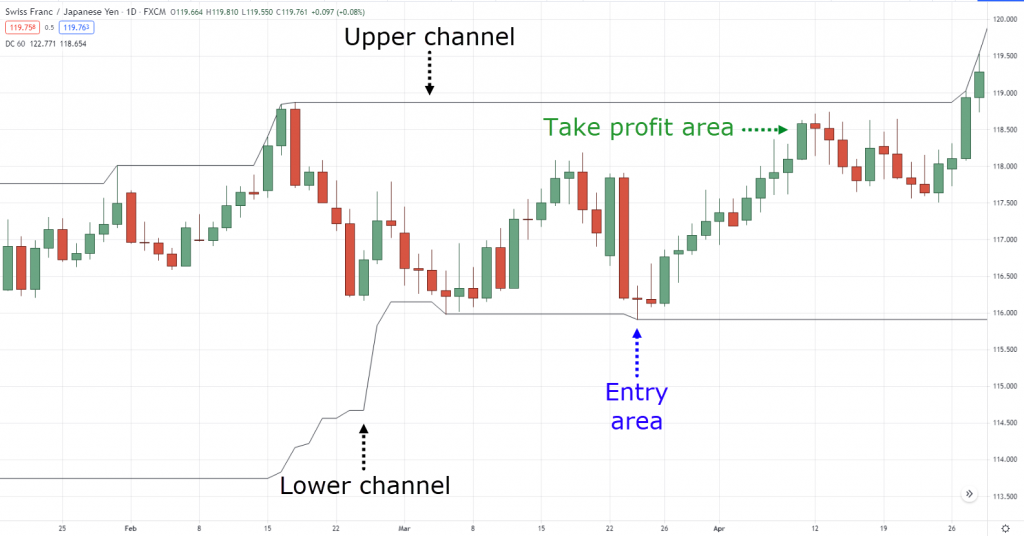

This method is built on finding points where the market reverses, stalls, or bounces. Because of this relation to level support and resistance lines, traders often consider it “trapped” between an upper and lower boundary. If the price does break below support, the trader waits for a significant price movement (the candle closes above support) before opening an extended position. The objective is to get out of the trade before buyer pressure reaches the resistance level.

The target is to use a third-term candlestick chart to identify and capitalize on potential buying opportunities. To guarantee the success of this plan, you must first be familiar with the everyday candlestick chart as well as support and resistance levels. Stop loss and taking profit will also be important since they will ensure you do not get overleveraged.

“Trend Following.”

As the name implies, this approach is about following the existing market trend. During a market surge, an astute trader can purchase low and capitalize on the demand by selling high.

“Catch the Wave”.

As the name implies, the objective of this approach is to take a single move in a trending market after the pullback has ended.

This strategy is the perfect solution if you maximize potential profits from Bitcoin trading while limiting risk. Take advantage of short-term trends and secure your financial future! Following this strategy can maximize your profits and minimize your losses. So go ahead and give it a try!

Trading strategies using cryptocurrency for swing traders

Whether you're trading bitcoins or other alternative currencies, there are several tools available to assist you in growing your swing trading approach and provide confidence when things go wrong.

You can use a copy trader if you trade cryptocurrency and want to know how the market changes prices. With this tool, people can follow your trading proposals and successful trades from others. So, it's perfect for those still experimenting in the field.

With their copy trading feature, you can copy the trades of more experienced traders and learn from them as you go. Their platform also offers various educational materials to help you build your skills. If you want to hone your swing trading skills, eToro is a perfect place to start.

Automation and Signals

Automated technologies such as crypto bots and signals can help you make more trades more quickly. Trading robots will scan the market and purchase and sell assets when certain conditions are fulfilled.

Many different types of robots are available to fit various swing trading methods. You may also create bots that operate according to your specifications, such as by volume, transactions, time, and price.

Some platforms collect signals from various sources that can be automated or manual. Since they're operational 24/7, swing trading techniques may use with them.

Technical Analysis

Support and resistance levels, relative strength index (RSI), Bollinger bands, Fibonacci recovery, volume, stochastic oscillator, and moving averages are common tools cryptocurrency swing traders use.

Technical tools assist traders in locating bullish and bearish areas on the chart where they may buy and sell. As a result, traders will seek to identify two sorts of possibilities: trends and breakouts. Long-term market movements are defined by short-term fluctuations known as trends. Breakouts remember the start of a new direction.

Moving averages are one of the most popular swing trading indicators. They compute the mean value of a crypto-assets price movement over a specified period. If any crossover is discovered, it might indicate strong or weak momentum. Moving averages may also be used as support and resistance levels.

Risk Management Tools

The golden rule of any swing trading technique is to never put more money into the market than you are willing to lose. Establishing stop-loss levels is the most effective approach to reducing risk while remaining in trade.

Should place a stop loss to protect your funds while not sitting at your computer. Stop trading frequently requires holding positions overnight, so a stop loss is necessary to safeguard your money.

The process is straightforward: First, place your wager. If you win the bet, your profit minus the wagered amount will be credited to your account. If it loses, you can then withdraw your winnings. The advantage of overbetting an exotic option frequently is that no matter how bad things go for the stock market, you're still getting paid.

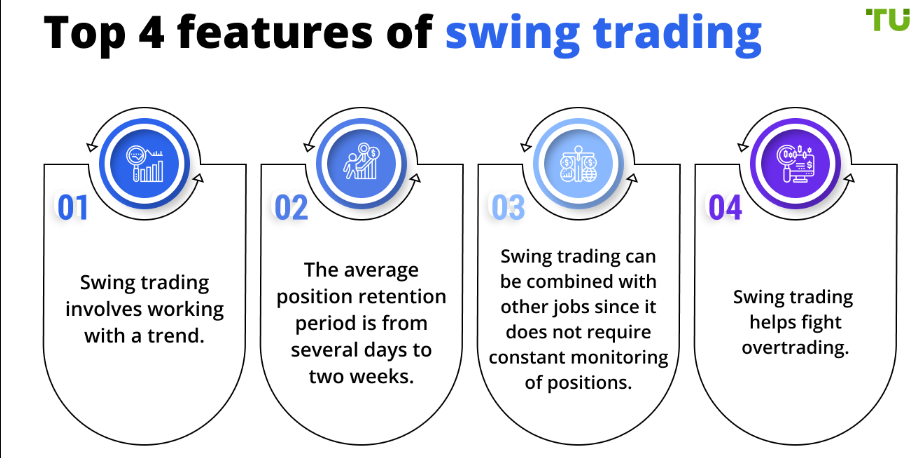

Pros of Trading in Crypto Using Swing Techniques

Although swing trading might seem simple, it is not as hard as other crypto trading techniques. Furthermore, you may get various advantages with this strategy:

- Long-term strategy. Compared to other forms of trading, swing trading does not require long hours of monitoring because transactions can last for days or weeks.

- Less intensity. Swing trading cryptocurrencies may be less stressful than day trading since they entail a longer time frame and fewer trades.

- Trade part-time. Therefore, working a full-time job while actively trading is possible.

- Volatility. Because trading cryptocurrencies on a moving market like Bitcoin entails a lot of volatility, it's important to understand. The cryptocurrency market is extremely volatile, which may appeal to seasoned swing traders.

Cons of Swing Trading Crypto

Swing trading cryptocurrencies can be difficult for both beginners and experts.

- Overnight Risk. Swing trading might result in significant losses because you keep positions open longer than day traders. Also, consider any overnight swap expenses.

- Price gaps. Price gaps can occur when traders keep positions open overnight or over the weekend. This might happen when news and analyses take place during trading hours.

- Market timing. Even for seasoned cryptocurrency traders, market fluctuations can be difficult to predict.

Tactics for swing trading

If you're a swing trader, you spend most of your time looking at multi-day chart patterns. Common ones to look for include moving average crossovers, cup-and-handle patterns, head and shoulders patterns, flags, and triangles. In addition to these indicators, key reversal candlesticks can give you a solid idea of when to enter or exit a trade.

Ultimately, every swing trader creates a plan and strategy that gives them an advantage over most trades. This involves finding trade setups that usually result in foreseeable movements in the asset's price. However, this is not easy, and no strategy or setup always works. With a favourable risk/reward, winning every time is unnecessary. The more positive the risk/reward of a trading strategy, the fewer times it needs to win to generate an overall profit after multiple trades.

Trading Strategies for Swing Traders

A demo account is a perfect way to test cryptocurrency swing trading without risk. You'll be able to experience the markets in real time and get a feel for what it's like before committing any money. When you're ready to test your swing trading approach, most brokers provide a free demo account with simulated money. You will never risk your own money when testing your swing trading technique.

Keep an eye on Bitcoin.

In the cryptocurrency market, most altcoins are positively or negatively linked to bitcoin movements, which causes cryptocurrencies' prices to fall when BTC rises. This is due to people withdrawing from the altcoin sector and investing in bitcoin.

Should the worth of Bitcoin plummet dramatically, it is anticipated that other cryptocurrencies will also suffer similarly. As a result, trading altcoins is often the best opportunity when Bitcoin gradually increases over time.

The cost of the loan, including interest and fees.

When executing swing trades in cryptocurrencies, spreads are paid less frequently and have a smaller size. On the other hand, swing traders are charged a swap cost, an interest rate levied on overnight positions.

Some firms may charge high commissions or other expenses when you open an account, so double-check them first. Depending on your regulatory framework, you might be charged taxes on cryptocurrency trading in your nation.

Education

Cryptocurrency fluctuations may draw novices interested in learning medium- and long-term trading. However, you'll need access to excellent instructional materials and additional tools to expand your understanding.

A content course could be anything from a crypto training program to a discussion board to an online book on swing trading. When picking a crypto broker, think about this.

Analysis

In addition to fundamental study, technical methods are used in developing effective swing trading strategies.

You're off to a great start if you have a firm understanding of daily candlestick charts and indicators. However, being aware of crucial events and financial reports that can affect the market is imperative.

Regarding cryptocurrencies, reputable sources such as Binance, Coin Metrics, CoinDesk, or Coin Telegraph are worth following.

A final word on Swing Trading Cryptocurrency

Many people are attracted to swing trading in the cryptocurrency market because it seems like an easier, less time-consuming method than other types of trading. But before making any trades, newbie investors should learn how to swing trade crypto assets and get comfortable with the process by practising on a demo account. After you understand the fundamentals, it's time to decide which cryptocurrencies are worth investing in for swing trading.