Trump’s WLFI Triples Ethereum Holdings Amid Market Volatility

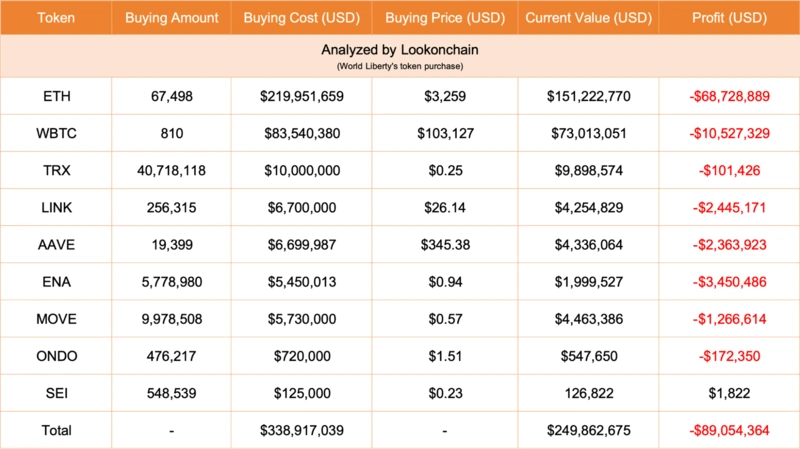

The decentralized finance (DeFi) platform associated with Donald Trump, World Liberty Financial (WLFI), has significantly increased its Ethereum (ETH) holdings over the past week, despite market uncertainty. WLFI’s total unrealized losses have now surpassed $89 million across its investments.

Major Increase in Ethereum Holdings

As Ethereum briefly dropped below $2,000, WLFI tripled its ETH holdings, taking advantage of the price dip. ETH fell to $1,991 on March 4 before recovering. Information from Arkham Intelligence shows that WLFI now holds $10 million more in Ethereum than it did a week ago.

Alongside Ethereum, WLFI also acquired $10 million in Wrapped Bitcoin (WBTC) and $1.5 million in Movement Network (MOVE) tokens. Despite these purchases, Lookonchain data reveals that the platform’s overall investments remain at a significant loss.

This wave of buying took place during a period of high volatility, influenced by economic concerns and crypto-related events, such as the $1.4 billion Bybit hack on February 21—one of the largest security breaches in crypto history.

A report from Binance Research indicated that, due to uncertainty in the market, investors shifted toward safer assets with predictable returns, particularly tokenized real-world assets (RWA).

WLFI’s Macro Strategy Fund and Future Plans

WLFI’s recent crypto investments followed the launch of its “Macro Strategy” fund, introduced nearly a month earlier. This fund focuses on Bitcoin, Ethereum, and other leading digital assets, aiming to enhance financial stability and resilience through diversified investments.

According to a statement from February 11, the fund is designed to support emerging opportunities in DeFi and reinforce a diverse portfolio of tokenized assets. This announcement came amid speculation about the Trump family’s potential business ventures on Ethereum.

Joseph Lubin, co-founder of Ethereum and founder of Consensys, previously suggested that Trump’s administration might integrate Ethereum technology into government operations, similar to how internet protocols are currently used.

WLFI’s largest holding remains Ethereum, followed by $14.9 million in Wrapped Bitcoin (WBTC) and $13.2 million in USDT stablecoins. Despite ongoing market challenges, the platform’s recent moves highlight a long-term commitment to digital asset investments.

Blockchain Expert