What are automated market makers?

Table of content

- Are you curious about what separates a market maker from an order taker? Let's explore the key differences between these two investment roles.

- What does it mean to be a market maker?

- How do automated market makers (AMMs) work?

- The Importance of Liquidity Providers in AMM

- AMM has several harvesting possibilities.

- What does the irreversible loss of liquid pool mean?

- AMM Security Issues

⚡️ Is Robinhood a Market Maker?

When you trade stocks, ETFs, and options on Robinhood, our orders are immediately sent to market makers who generally offer lower prices than public exchanges. To compete with the exchanges, we work with market makers who provide discounts to brokerage firms like ours.

⚡️ What is DeFi in the crypto world?

The term “Decentralized Financial” (or just DEFi) refers to a group of technologies that aim to create a new Internet financial system, replacing existing intermediaries and trust mechanisms, using blockchains.

⚡️ What is AMM and DEX?

An automated market maker (AMM) is a rudimentary protocol that enables decentralized exchange (DEX) functionality by allowing assets to be traded using cryptocurrency pools as counterparties rather than a typical buyers and sellers market.

⚡️ Why isn't Bitcoin DeFi?

Bitcoin – is a virtual form of currency based on its blockchain and operates in much the same way as paper money. But unlike banks, DeFi provides an outstanding opportunity to borrow, lend, and swap cryptocurrencies such as Bitcoin with unprecedented speed and reliability.

When Uniswap launched in 2018, it became the first decentralized network to effectively utilize an automated market maker (AMM) technology.

Automated Market Maker (AMM) is the basis of all decentralized exchanges (DEX), granting users a direct, intermediary-free way to trade cryptocurrencies. In contrast to traditional market maker plans, AMMs offer an automated and utterly decentralized trading experience – and this article will explain that revolutionary system in more detail.

The key to a well-functioning market is the presence of savvy Market Makers. Let us dive into who they are and how they drive orderly markets.

Are you curious about what separates a market maker from an order taker? Let's explore the key differences between these two investment roles.

A market maker creates liquidity for trading pairs on centralized exchanges- in other words, making it easier for traders to buy or sell. A central discussion does this by organizing and keeping track of transactions and offering an automated system that matches buys with sells. So, for example, if trader A wants to acquire 1 BTC at $34,000, the exchange guarantees that trader B will be ready and willing to sell 1 BTC at that price.

So, what if the exchange cannot immediately discover appropriate matches for buy and sell orders?

In such a case, we define the assets' liquidity as limited.

Liquidity is an apt description of the convenience of transacting assets. High liquidity implies the market is active, with many buyers and sellers of a specific purchase. Low liquidity indicates less activity and makes acquiring and selling an asset more difficult.

Slippage directly results from a lack of liquidity, causing a price mismatch at the end of a trade. This effect often occurs when dealing with highly energetic markets like cryptocurrencies, so exchanges need to expedite transactions to minimize slippage as much as possible.

On the other hand, centralized exchanges necessitate experienced traders or financial organizations to proffer liquidity for trading pairs to generate a dexterous trading system. These financial institutions establish many buys and sell orders to match retail traders' orders. It allows the exchange to guarantee that counterparties are always available for all transactions. In this system, liquidity providers take on the role of market makers. In other words, market makers aid in the processes required to provide liquidity to trading pairs.

What does it mean to be a market maker?

DEXs are decentralized exchanges that aim to minimize all intermediaries in cryptocurrency trading. They do not support order-matching technologies or custodial infrastructure (where the business keeps all private wallet keys). As a result, DEX encourages autonomy so that users may engage in trades directly from non-custodial wallets (wallets where

DEX is also replacing standard order-based systems with newer, more advanced protocols called AMMs. These technologies use intelligent contracts – self-executing computer programs – to price digital assets and provide liquidity by trapping them in the arrangements. Users are not technically trading against other parties; they are tradeoffs between the available liquidity within the smart contracts.

How do automated market makers (AMMs) work?

Before exploring how AMMs work, we must understand the concept of an order book. An order book is a digital ledger where all buy and sell orders for a specific asset organize by price level. So, when a market maker on centralized exchange places either type of order, they create an entry in the order book.

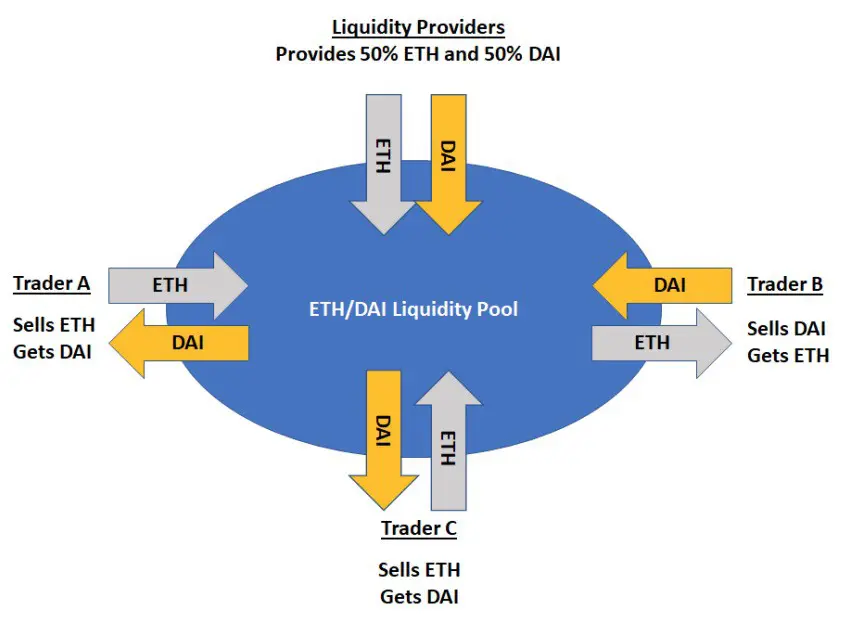

Anyone, not just market makers, can aid these pools by contributing assets from the collection. For example, if you want to offer liquidity to an ETH/USDT pool, you must supply a certain predetermined proportion of ETH to USDT.

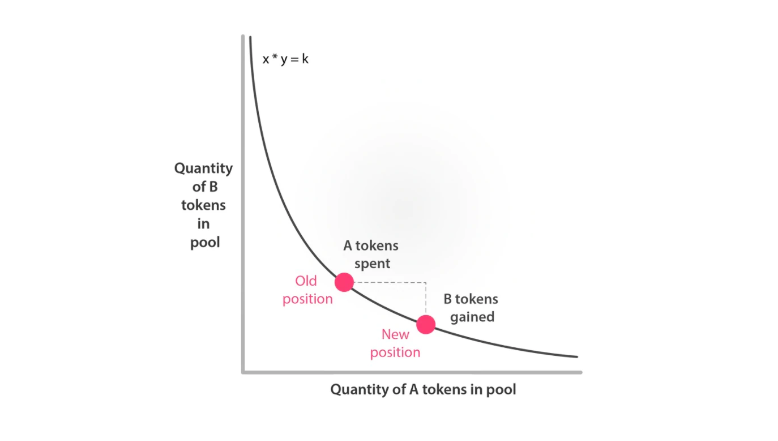

To maintain the balance of assets in the liquidity pools as consistently as possible and to eliminate pricing disparities between pooled investments, AMMs employ predetermined mathematical formulas. Uniswap, for example, uses the easy formula x*y=k to establish a mathematical relationship between specific assets stored in liquidity pools.

Formula: x/(y+k)=a 100. This method is used when you want to compare two known proportions. For instance, the stock market uses this equation to display how the value of one asset shifts in comparison to another's. In our example, x represents the worth of asset A while y equals the value of asset B; k is a constant, While a displays both assets' new proportion after the investment.

Essentially, Uniswap liquidity pools keep a condition where the product of A's and B's prices always equals the same number.

Let's take the ETH/USDT liquidity pool as an example. When traders buy ETH, they contribute USDT to the pool and take ETH away. It causes the quantity of Ethereum in the pool to decrease, which results in a price increase to do the balancing work x*y=k. On the contrary, when more USDT enters the pool, the price of ETH will go down because there is more ETH in the liquidity pool.

Large exchanges of assets out of or into the liquidity pool can cause dramatic shifts in market and trade prices. For example, if Ethereum quotes at $3,000, but when exchanged for another currency from a similar pool receives more ETH, its value can drop by as much as $150!

To cash in on arbitrage opportunities, crypto exchanges must have adequate liquidity. This means enough market orders will be ready and waiting for large trading volumes. If constructing a pool on an exchange platform is something you've been considering, take comfort in knowing that ample room exists to trade sizeable amounts of Ether easily!

Arbitrage traders are eager for assets that trade at a discount in liquidity pools, and they buy them until the asset's price is back in line with its market value.

For example, suppose the price of ETH in the liquidity pool decreases compared to its exchange rate on other exchanges. In that case, arbitrage traders can profit by purchasing ETH in the collection at a lower price and selling it for a higher amount on external sales. The cost of pooled ETH will gradually recover until it matches the average market rate with each trade.

To conclude, it's worth noting that x*y=k from Uniswap is just one of the mathematical formulas AMM uses today. For example, Balancer employs a far more complex mathematical connection to allow users to combine up to 8 digital assets into a single liquidity pool. On the other hand, Curve utilizes a curve to stabilize the price of its synthetic assets.

But don't put all your eggs in one basket! It is vital to remember this as each automated market maker has its own set of regulations that must be understood before investing.

The Importance of Liquidity Providers in AMM

AMM, like other automated trading systems, requires liquidity to function. Pool underfunding is susceptible to slippage. Users are encouraged to deposit digital assets into liquidity pools so that others may trade them to minimize slippage.

The objective of the pool is to provide security for traders short on funds. To encourage liquidity providers (LPs) to maintain the collection, they will get a piece of the fees paid on transactions processed. Put another way, if your deposit represents 1% of the liquidity trapped in the pool, you'll earn approximately 0.25% of the transaction fees.

AMMs, on the other hand, give management tokens to LPs and traders. The management token allows the owner a voice in AMM protocol administration and development.

AMM has several harvesting possibilities.

In addition to the incentives outlined above, LPs can benefit from yield-growth opportunities promising to increase their earnings. To take advantage of this benefit, you must deposit the appropriate ratio of digital assets into the AMM protocol liquidity pool. Once your deposit is confirmed, the AMM protocol will send you LP tokens. In some cases, you can then deposit – or “invest” – that token into a separate lending protocol and earn additional interest.

Reap the maximum rewards of decentralized funding (DeFi) protocols and make substantial gains with liquidator tokens. You'll gain access to all capital stored in the original liquidity pool by exchanging these for cash. When used appropriately, liquidator tokens can guarantee investors huge yet dependable returns!

What does the irreversible loss of liquid pool mean?

When the price ratio of a combined asset pool within a liquidity pool alters, it can create insurmountable losses for investors. This is because when the pooled assets drift away from their initial investment value, Liquidity Pool (LP) automatically suffers capital loss. Moreover, extreme fluctuations in prices cause even more money to be lost. Low liquidity pools are particularly vulnerable to this kind of volatility.

However, this loss is only temporary since the price ratio will likely return to its previous level. If an LP doesn't wait for the price ratio to return to its original state and decides to cash out early, it will suffer a permanent loss. Transaction costs or LP token placement fees could nullify such losses.

AMM Security Issues

Though AMMs are more likely to be hacked, centralized exchanges are unsafe. In 2016, a staggering four billion dollars in Bitcoin was stolen from the cryptocurrency exchange Bitfinex. The United States Justice Department recovered some of the money in February 2022.

However, Defi protocols like Uniswap have been hacked when liquidity deposits for certain pools were stolen. Even though some security procedures are being implemented to help deter future hacks, only some Defi protocols have these safety measures set up. Also, depending on who wrote the contract initially, intelligent contracts can be hacked as well.