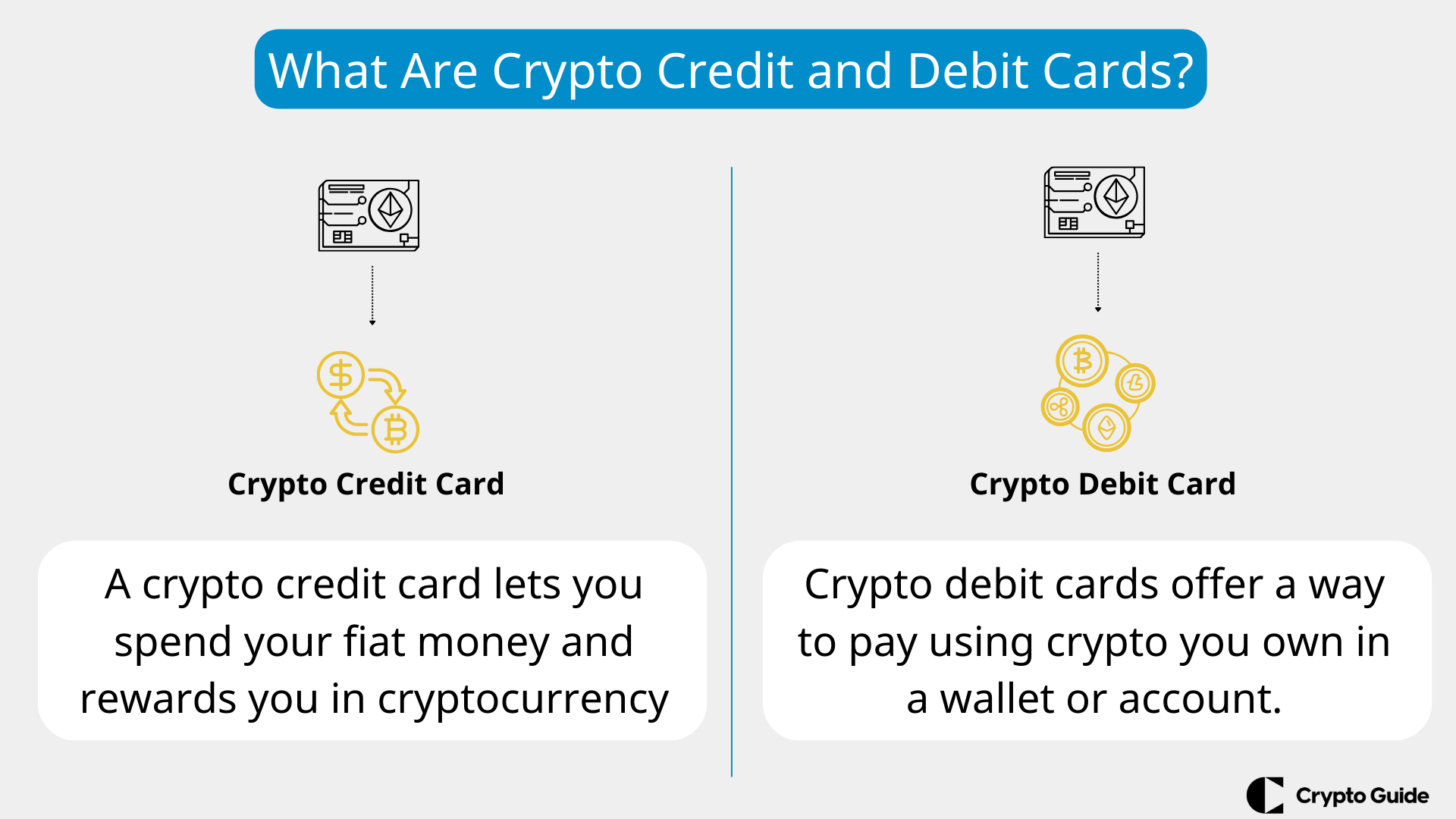

What Are Crypto Credit and Debit Cards?

Crypto credit and debit cards enable users to use their cryptocurrency for everyday spending. This article will explore how these cards function and their advantages, risks, regulations, and market trends.

Table of content

Key Highlights

- Crypto credit cards work like regular ones but use cryptocurrency.

- These cards are accepted everywhere, offer rewards, and are good for those without banks.

- Gemini and the Nexo are good examples of crypto credit cards.

- Crypto debit cards use crypto directly, turning cryptocurrency into cash.

- They offer quick access to funds, wide acceptance, privacy, and lower fees.

- Examples of crypto debit cards are the Coinbase Card and the Crypto.com Visa.

- Risks of using both types of cards are unstable crypto value, security issues, and changing rules.

Crypto Credit Cards

Crypto credit cards function similarly to traditional ones but with a cryptocurrency twist – users deposit their crypto into an account linked to the card.

When making a purchase, the card issuer converts the crypto into fiat currency, allowing the transaction to occur. Users then repay the borrowed amount, typically with interest, according to the terms set by the card issuer.

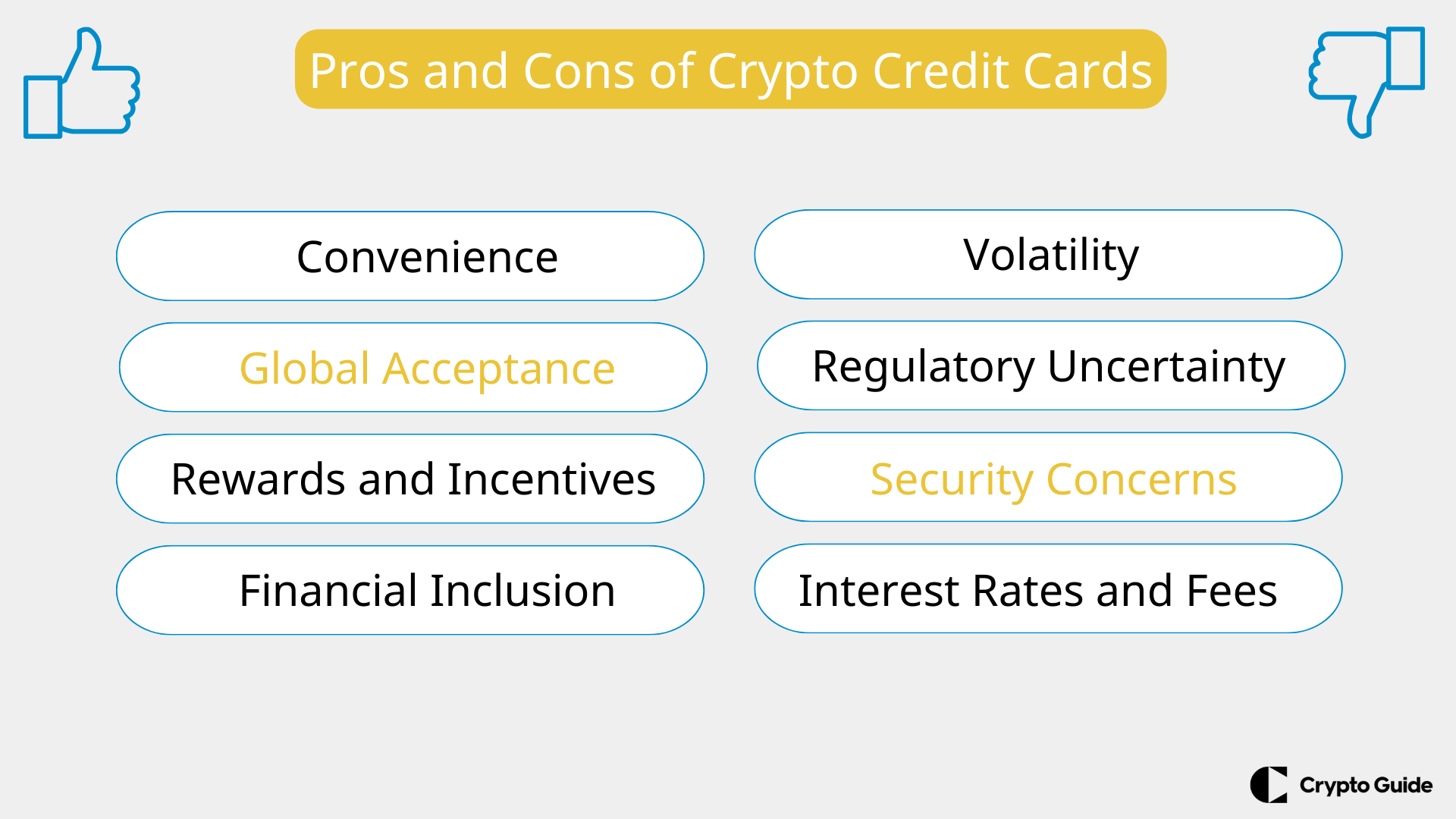

Benefits of Crypto Credit Cards

Convenience

People can use crypto credit cards to spend their cryptocurrency in regular transactions. This way it connects crypto with traditional financial systems.

Global Acceptance

Crypto credit cards can be used to make purchases at any place that accepts regular credit cards, giving flexibility and ease of access.

Rewards and Incentives

Most issuers of crypto credit cards have programs that give rewards, cashback or other benefits to promote card use. This makes the offer even more appealing for users.

Financial Inclusion

Credit cards powered by crypto could offer financial services to people who cannot use regular banking systems.

Crypto Credit Cards Risks

Volatility

Due to their volatility, cryptocurrencies' unpredictable nature can bring risks for those who have the cards. Changes in the value of funds held in a card account may occur because cryptocurrency prices are not steady. Note, that understanding which cryptocurrencies are the most volatile can help you manage these risks better.

Regulatory Uncertainty

Regulations for cryptocurrencies in connection to financial services are still being developed. This creates a lack of clarity and probable difficulties related to compliance for those who issue crypto credit cards.

Security Concerns

Crypto credit card platforms can be vulnerable to hacking, fraud, and other security issues. This underscores the importance of having strong security measures in place to protect user funds. So, if you face problems such as hacking or loss, learning about crypto recovery can help to get your assets back.

Interest Rates and Fees

Although crypto credit cards have their benefits, we should still consider other costs. These are interest rates and fees associated with borrowing against our cryptocurrency. Not paying back borrowed amounts within the agreed time can lead to big interest charges and penalties in money matters.

Crypto Credit Cards Examples

Bybit Card

Bybit's Mastercard debit card allows you to spend your crypto holdings. You can access funds in your Bybit Funding Account for everyday purchases with both virtual and physical card options. You can top up your account with crypto or fiat. Bybit VIP users can enjoy cashback of up to 10%, receiving 50 points for every EUR/GBP spent

Nexo Card

The Nexo Card is a crypto-backed credit card that uses your crypto holdings as collateral instead of a traditional credit check. It allows you to switch between spending crypto from your Nexo account and using a credit line.

Also, it works worldwide via the Mastercard network. It's a way to use your crypto for everyday purchases without selling it, though fees and interest apply.

Gemini Credit Card

The Gemini Credit Card is a new offering from the Gemini cryptocurrency exchange. It offers earn up to 3% crypto back on dining, 2% crypto back on groceries, and 1% crypto back on all other purchases. There is no annual fee for this card.

Venmo Credit Card

The Venmo Credit Card is a cash-back rewards card that allows you to redeem your rewards in crypto. You can choose to redeem your rewards in Bitcoin, Ethereum, Litecoin, or Bitcoin Cash. There is no annual fee for this card, but there is a 1% fee for converting your rewards to cryptocurrency.

Crypto Debit Cards

Debit cards for crypto are like regular debit cards, but they let you use your cryptocurrency holdings instead of first converting them. These types of cards usually have a connection with a cryptocurrency wallet.

When the user makes a payment, it deducts funds from their linked wallet at that time and converts it into regular money to complete the transaction process. So when someone buys something using this card, an equal amount of digital currency gets removed from their wallet balance according to current exchange rates.

So, understanding how to manage and secure these cards begins with knowing what a crypto wallet is.

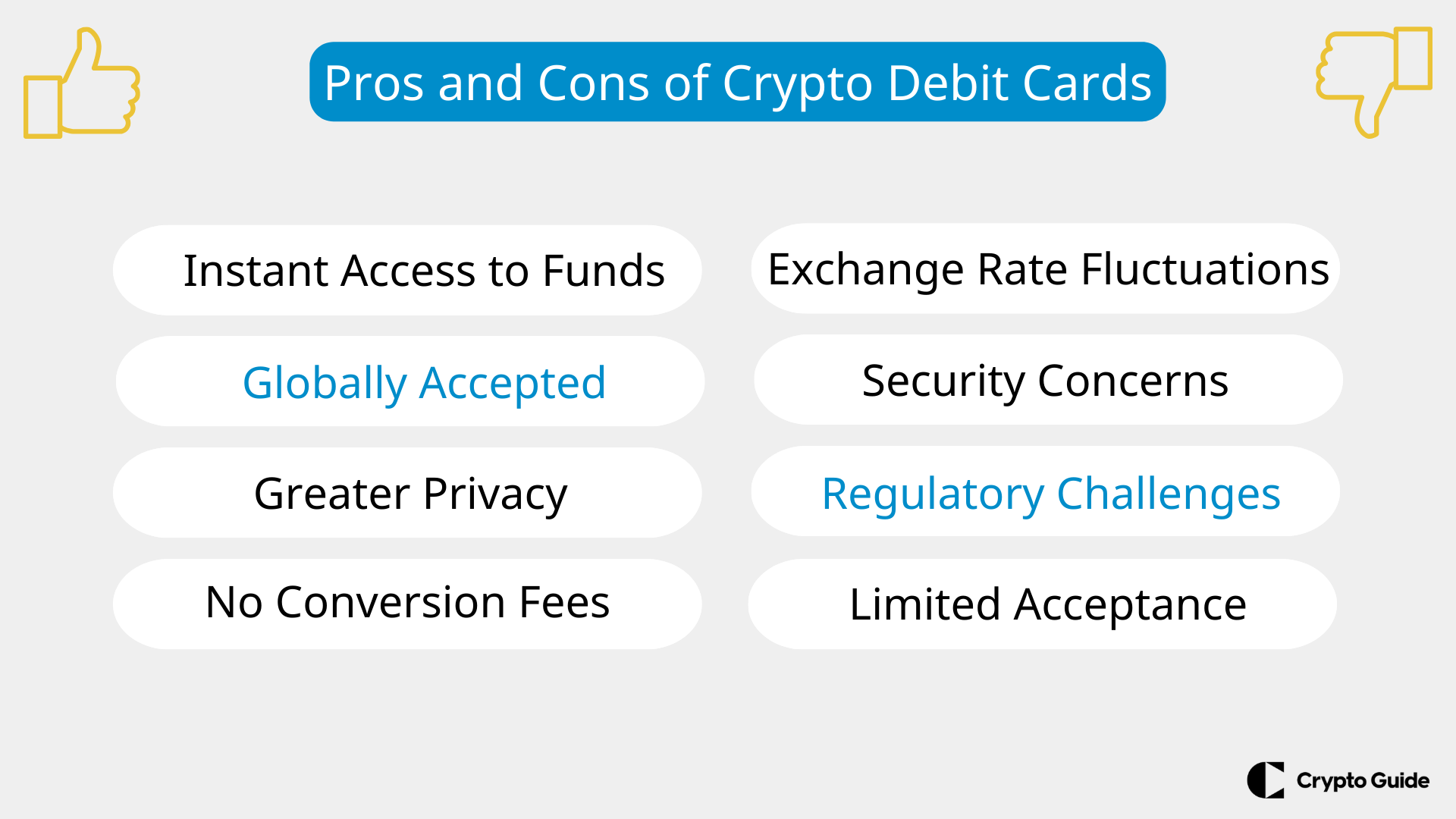

Advantages of Using Crypto Debit Cards

Crypto debit cards provide instant access to funds, allowing users to spend their digital assets like regular fiat money. Merchants globally accept them, facilitating smooth transactions across countries.

Transactions with crypto debit cards offer greater privacy than traditional banking systems. Additionally, these cards help users avoid currency conversion fees typically associated with international transactions, saving money on cross-border purchases.

Risks of Crypto Debit Cards

Exchange Rate Fluctuations

The rate of cryptocurrencies can change quickly. If the value of cryptocurrency goes down, users could spend more than initially expected.

Security Concerns

Crypto debit cards, like any other type of card, can fall victim to security threats such as being hacked or used for fraud. Users need to keep their wallet login details very secure and ensure they have measures in place to prevent unauthorized entry.

Regulatory Challenges

The rise in regulatory attention towards cryptocurrencies could affect the availability and working of crypto debit cards in some areas. Following compliance requirements might be difficult for both card issuers and users.

Limited Merchant Acceptance

Not all merchants accept crypto debit cards, which can limit where users can spend their cryptocurrency holdings. This acceptance issue can reduce the overall utility of the card for everyday transactions.

Crypto Debit Card Examples

Coinbase Visa Card

This Visa debit card allows you to spend various cryptocurrencies held on your Coinbase account. You can earn up to 4% back in crypto rewards on your purchases.

Crypto.com Visa Card

Crypto.com card is one of the most popular crypto debit cards on the market. It offers a variety of rewards tiers, depending on how much Crypto.com Coin (CRO) you stake. The top tier can earn up to 8% back on your purchases in crypto.

Wirex Visa Card

Wirex Visa card for cryptocurrency supports various coins for account funding and spending. It boasts up to 8% cashback in crypto rewards, but it's important to note the cashback is available in Wirex's native token, X-Points, which can be converted to other cryptocurrencies at conversion fees.

Comparison Between Crypto Credit and Debit Cards

Borrowing and Spending

The key distinction between crypto credit and debit cards is how you access funds. In a crypto credit card, users borrow money against their cryptocurrency assets; however, in a crypto debit card, they spend money directly from their cryptocurrency wallet.

Structure of Repayment

Crypto credit cards, like regular credit cards, require the return of borrowed amounts along with interest, as per agreed-upon terms. However, crypto debit cards do not include borrowing and do not generate interest.

Risk Exposure

Crypto credit cards are subject to interest charges, and users may face the risk of debt if they do not repay borrowed amounts within specified time frames. In contrast, crypto debit cards involve less financial risk as users expend their own cryptocurrency holdings.

Immediate Spending Needs

Crypto debit cards are perfect for users who want to use their cryptocurrency funds for everyday spending, without needing to borrow money against what they own.

Credit Flexibility

People who like the option of borrowing against their cryptocurrency assets might find that crypto credit cards suit them better, particularly when they need to make big purchases or are experiencing liquidity restrictions.

Establish Credit History

For users who want to establish their credit history, crypto credit cards provide chances for showing good borrowing habits.

Crypto Credit Cards and Crypto Debit Cards Comparison Chart

| Aspect | Crypto Credit Cards | Crypto Debit Cards |

| Functionality | Borrow against cryptocurrency holdings | Spend directly from cryptocurrency wallet |

| Repayment Structure | Repay borrowed amounts with interest | No borrowing involved; no interest accrued |

| Risk Exposure | Potential debt accumulation, interest charges | Lower financial risk; spend own cryptocurrency |

| Immediate Spending Needs | May require approval; borrowing limitations | Immediate access to cryptocurrency funds |

| Credit Flexibility | Flexible borrowing; potential credit history | No credit involved; no impact on credit score |

| Building Credit History | Opportunity to build or improve credit | No impact on credit history |

| Regulatory Considerations | Regulatory compliance may vary | Regulatory compliance may vary |

Security and Privacy

For crypto cards, security is essential. Many of them use multi-factor authentication and encryption to keep the account safe. Some providers store funds offline for extra security.

However, privacy might be an issue because transaction data can still be seen on the blockchain and there could exist third-party participation. Regulatory compliance may also affect user privacy.

For security and privacy, users must have strong passwords and secure wallets. It is important for card issuers to perform frequent security checks. Additionally, using privacy technologies to protect your identity, such as Tor or VPN services, and staying aware of risks can increase safety when using crypto cards. To ensure you select a reliable option, understanding how to choose a crypto wallet is very important.

What Factors Should You Consider When Choosing?

When looking for the best crypto credit and debit cards, users should consider their financial goals and risk tolerance. Those comfortable with borrowing and managing credit might prefer a crypto credit card, while others might favour the simplicity and lower risk of a crypto debit card.

If you often need quick access to extra funds, a crypto credit card may be more suitable, whereas a crypto debit card is better for those who prefer spending within their means. Additionally, users must consider the regulatory environment in their area, as local regulations on cryptocurrency and financial services can affect crypto credit cards and crypto debit cards functionality.

FAQ About Crypto Credit & Debit Cards

What are crypto credit cards and crypto debit cards?

Crypto credit and debit cards are financial instruments that allow users to spend their cryptocurrencies for everyday transactions, similar to traditional credit and debit cards.

How do crypto credit cards work?

Crypto credit cards enable users to borrow against their cryptocurrency holdings, allowing them to make purchases with borrowed funds that are repaid later with interest.

How do crypto debit cards work?

Crypto debit cards allow users to spend their cryptocurrency holdings directly, without the need for borrowing. Transactions are debited from the user's cryptocurrency wallet.

What are the benefits of using crypto credit cards?

Benefits include convenience, global acceptance, rewards programs, and the potential for financial inclusion by extending services to those without access to traditional banking.

What are the risks associated with crypto credit cards?

Risks include volatility in cryptocurrency prices, regulatory uncertainty, security concerns, and the potential accumulation of debt if borrowed amounts are not repaid on time.

What are the risks associated with crypto debit cards?

Risks include exchange rate fluctuations, security concerns, and regulatory challenges impacting availability and functionality.

How can I ensure the security of my crypto card?

Use secure wallet management practices, such as strong password. It's useful to know how to backup crypto wallet, too, and stay informed about the latest security threats.

Are there privacy concerns with crypto cards?

Yes, privacy concerns include visible transaction data on the blockchain, potential third-party involvement, and regulatory compliance requirements impacting user privacy.

How do I choose between a crypto credit and debit card?

Consider your financial goals, risk tolerance, and usage patterns. Choose a crypto credit card for borrowing flexibility or a crypto debit card for simplicity and lower risk.