What Are Perpetual Futures Contracts?

Table of content

- Have you ever wondered how to harness the power of cryptocurrency derivatives?

- Are you curious about the ins and outs of futures contracts?

- Are you curious about cryptocurrency futures contracts and how they function? Discover the fundamentals of this lucrative form of trading.

- Are you curious about open-ended swaps and what they involve? If so, we'll explain exactly how these exchanges function.

- How do exchange rates work?

- How do open-ended swaps work?

- The initial margin is the amount of money required to open a position.

- What is liquidation?

⚡️ What are crypto ftx perpetual futures?

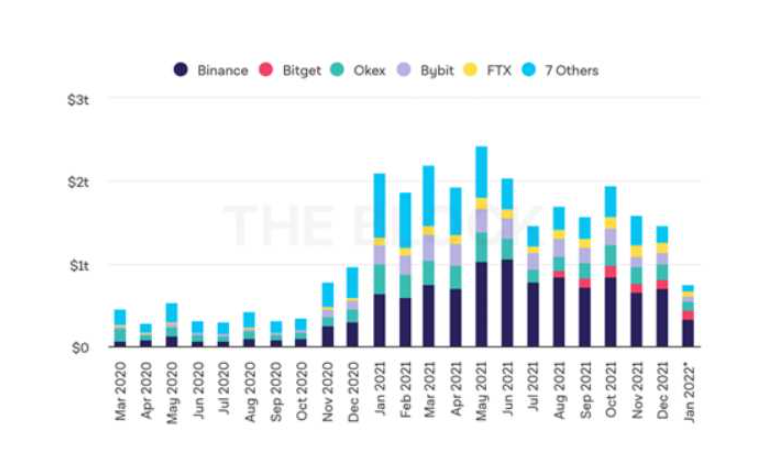

Perpetual contracts are often offered by crypto derivatives exchanges, and they function similarly to futures ❕agreements.

⚡️ How long can you hold Binance perpetual futures?

A flexible contract is a kind of futures contract that has no expiration date, unlike a traditional form of futures. Thus, you can securely keep your investments open for as long as desired.

⚡️ What happens when a futures contract expires?

When a futures contract comes to an end, the clearinghouse links the long holder with the short position owner. The underlying asset is transferred from the short position to the long one.

⚡️ Are futures profitable?

Futures are a valuable financial tool that enables investors to benefit from the predicted price movements of oil. Because they trade at ten times the risk of a typical stock, they may be acquired by any investor with minimal capital and rather volatile trading experience. In addition, futures prices tend to fluctuate more than cash or spot rates.

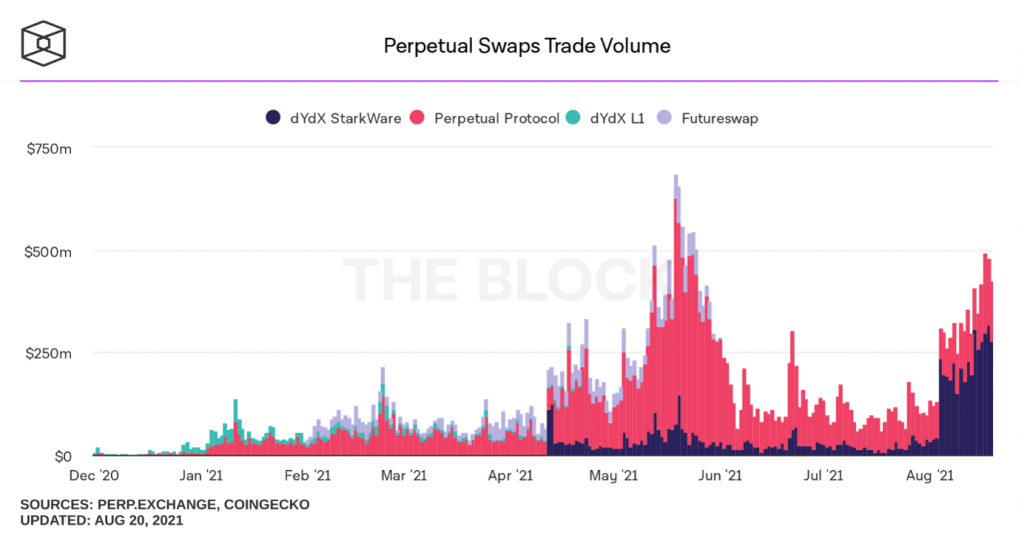

Perpetual swaptions are a type of derivative that has become more popular among cryptocurrency traders in the last few years.

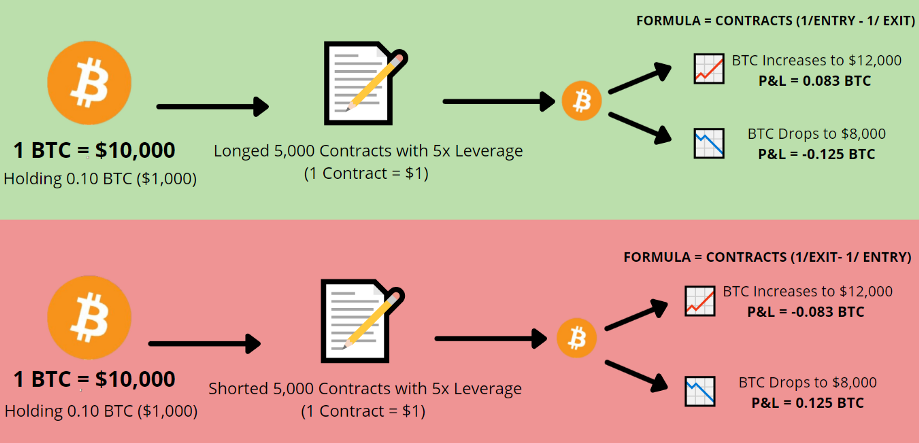

Perpetual swaps were introduced in May 2016, and they allow traders to open very large positions with only a small deposit. This scheme is highly enticing to many as it offers a possibility of great returns on slight fluctuations; however, tremendous risks are also involved.

Have you ever wondered how to harness the power of cryptocurrency derivatives?

Derivatives are financial instruments that reflect the worth of an asset at its core.

Open-ended swaps are a form of derivative contract that enables you to make wagers on the worth of a commodity while it is still in effect.

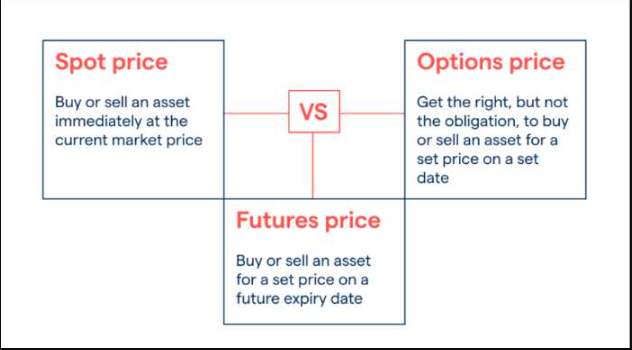

With a forward contract, investors can speculate on the future value of cryptocurrencies by committing to buy or sell them at an agreed upon date and price. Options give their buyers the ability to take advantage of market movements without any obligation; they can purchase or sell assets for a predetermined cost at any pre-determined point in time.

By using crypto derivatives, traders can make a profit off of price changes in digital assets without having to worry about the security threats or complexities that come with cryptocurrencies.

If you are looking to expand your portfolio with cryptocurrency, buying an asset is one way to do it, while trading a derivative product can be another route you may consider. Buying assets is the method used in the first scenario.

When you purchase a digital asset from an exchange, the quantity of that asset needs to be immediately delivered and remain in your possession until it is sold for either a profit or loss. This is also referred to as spot trading.

Trading crypto derivatives, on the other hand, does not need an investor to have any assets. Instead of holding the real thing, derivatives traders simply purchase and sell digital contracts.

Are you curious about the ins and outs of futures contracts?

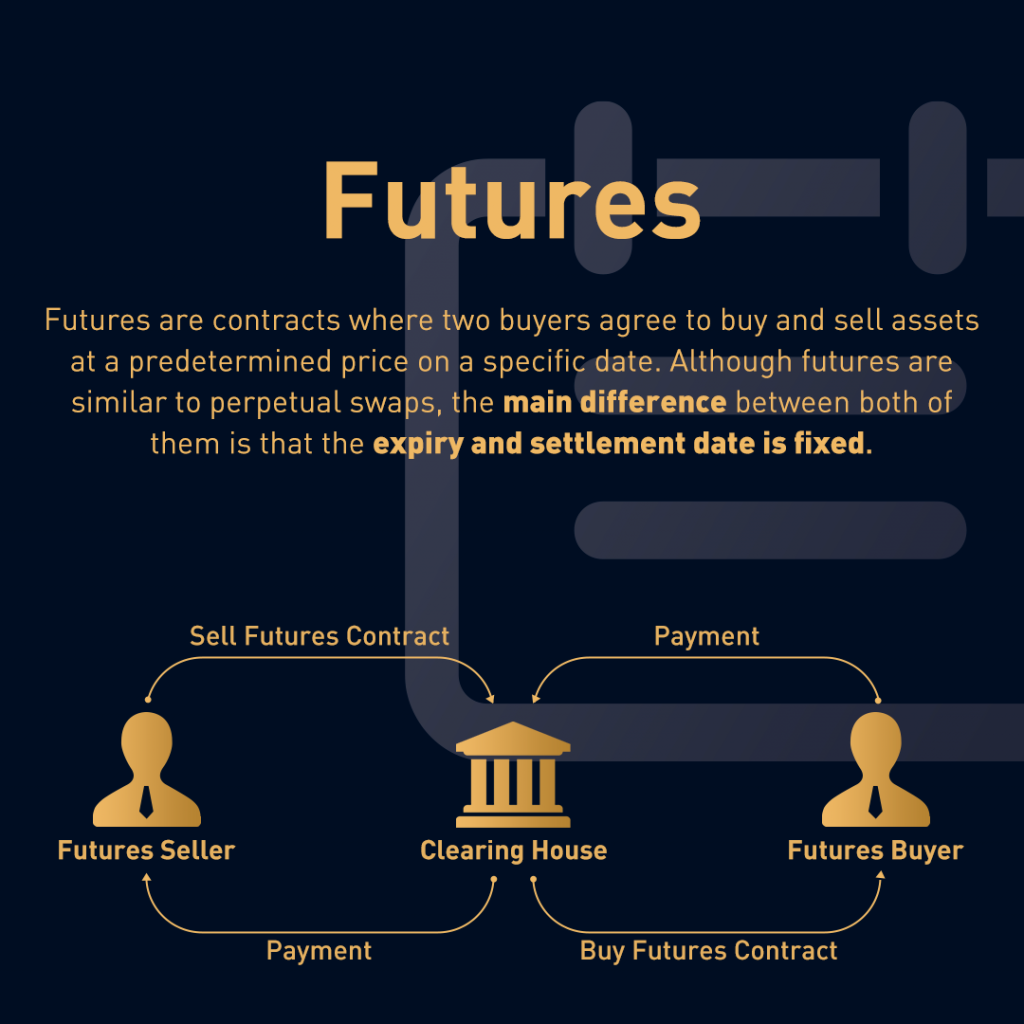

Futures contracts are financial agreements between two people to trade an asset at a specified price in the future. Futures contracts are an invaluable tool that empower two parties to negotiate and settle on a pre-determined price for any given asset.

Although the length of future contracts varies, each contract has a pre-determined settlement date. Before two parties can form a cryptocurrency futures settlement, they must agree on when the agreement will terminate.

Let us consider a futures contract for Bitcoin; this agreement is valid and effective for three months from the day of issuance.

Are you curious about cryptocurrency futures contracts and how they function? Discover the fundamentals of this lucrative form of trading.

If bitcoin equals $40,000 and Alice is a crypto derivatives trader who believes the value will increase by April, then…

She can bet on this opportunity by entering into an agreement with the understanding that she will be able to obtain $1 BTC for $40,000 per month. All she has to do now is open bitcoin futures contracts that cumulatively show her intention to pay $40,000 for 1 BTC next month, regardless of how high or low the spot market price

On the other side of this bargain, Bob considers that bitcoin's price will drop below $40,000 on the settlement date. He'll sell Alice $40,000 worth of contracts next month. To put it another way, while Alice is “pining” for bitcoins, Bob is “shorting” them.

Should the bitcoin price climb to $45,000 by the time of contract expiration, Alice will profit due to acquiring BTC from Bob at a discount. If, however, the price falls below $40,000 on settlement day as opposed to rising , Alice would be buying bitcoin from Bob at a higher rate than current market prices–resulting in substantial loss.

perpetual swaps are cash-settled, meaning Alice and Bob don't need to own bitcoins. All they have to do is open a position and wait for the price movement.

Are you curious about open-ended swaps and what they involve? If so, we'll explain exactly how these exchanges function.

An open-ended swap is similar to a futures contract in that it allows investors to bet on future cryptocurrency price rises. The main distinction is that, unlike a normal futures contract, open-ended swaps have no end date.

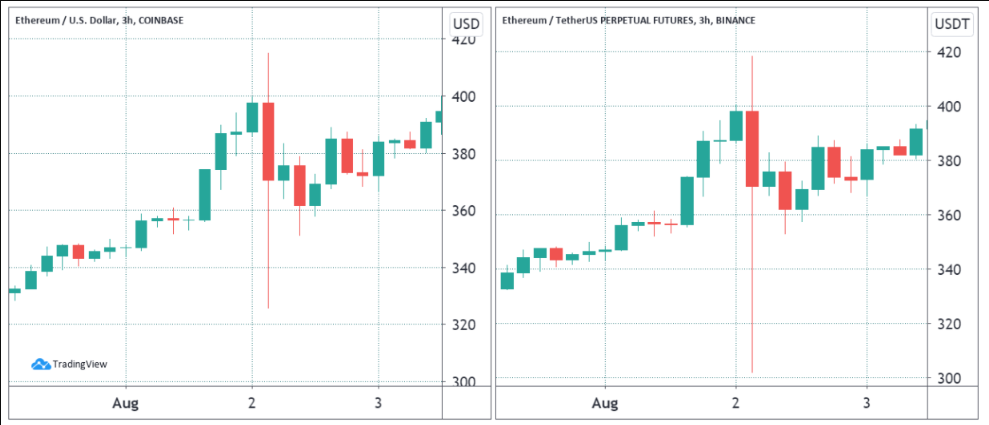

Previously, traders had to close and re-open a long or short position regularly to maintain the same exposure. In other words, this eliminates the need to keep repeating a long or short trade. As a result, perpetual contracts must be priced relative to the spot prices of their underlying assets. Because futures prices converge toward each other as the settlement date approaches, open-ended swaps are said to have an “inverse relationship” with spot prices.

The funding rate mechanism, which is used by exchanges to link the price of perpetual swaps, is one example. This system balances the short and long positions of perpetual swaps by incentivizing or prohibiting them. Consider it a discount or charge that helps to balance an overall interest in open-ended contracts' short and long sides.

How do exchange rates work?

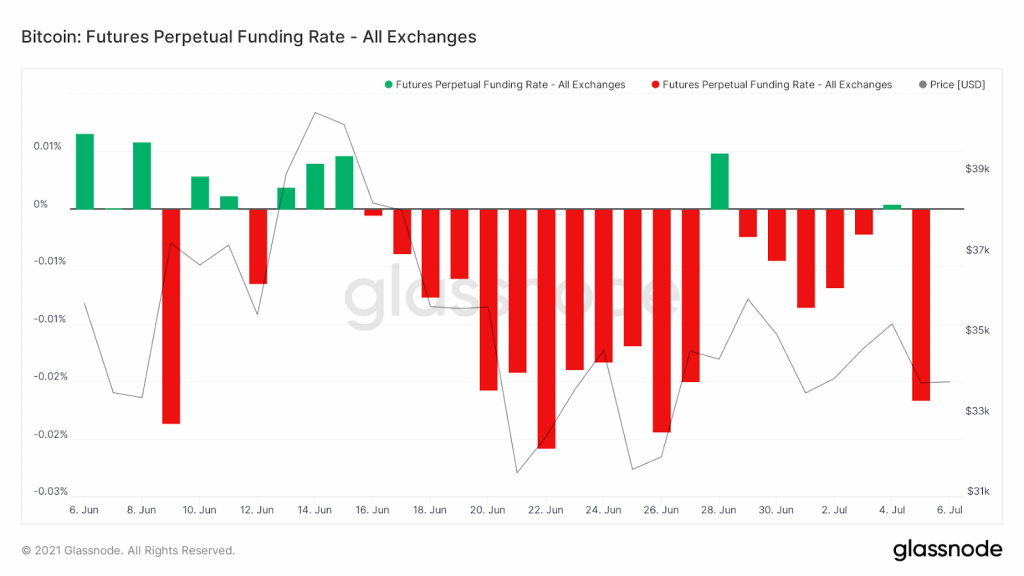

The funding rate mechanism maintains the pricing of perpetual futures contracts in line with the market values of the underlying assets they track by ensuring that the value of a perpetual swap contract is equal to or less than that of bitcoin daily.

The funding rate is the difference between the interest rates of the long and short positions. If there are more shorts than longs, the funding rate will be positive, meaning that longs will have to pay a fee to shorts.

Exchanges use a fluctuating price indicator to decide whether long or short traders should pay fees or get discounts. We refer to the funding rate as positive when the perpetual swap's explainable price is greater than the spot price of digital assets.

Long traders will be charged a little fee by those who sell the contract to them. The fee is used to pay for the interest that the trader owes on their short position. If the funding rate is negative, then it will be the shorts who have to pay a fee to the longs.

A negative funding rate is associated with an open-ended swap that trades below the spot price of the underlying asset. Those who short open-ended swaps will have to pay those who hold long positions, as in the example above.

It all depends on each trader's position size. For example, if the BTC/USD perpetual swap funding rate is +0.010%, a trader wishing to receive this particular $40,000 perpetual swap would have to pay a commission of $4 = ($40,000) x 0.010%. The funding commission is paid out at specified intervals. On certain exchanges, the funding cycle is enforced every eight hours.

How do open-ended swaps work?

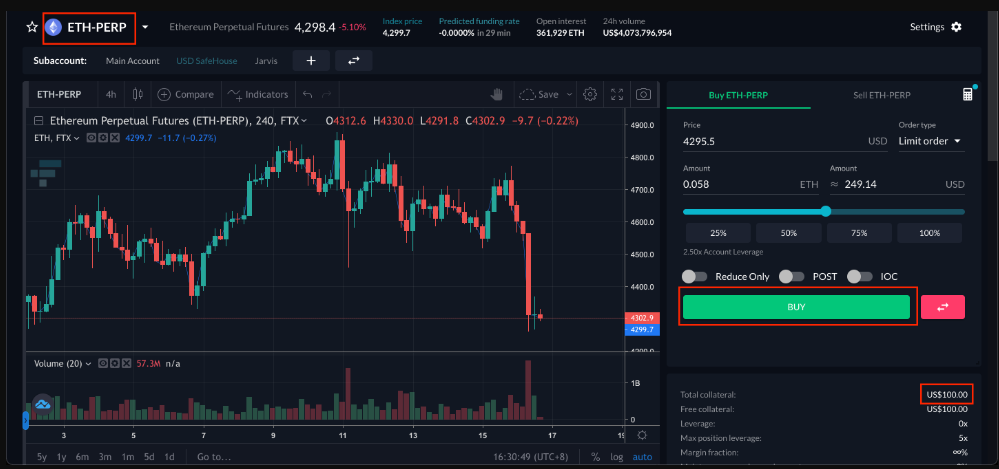

Traders may acquire bitcoin by selling open-ended swaps to themselves in the future for a profit. Alice, for example, purchases two BTC/USD perpetual swaps with $80,000 of collateral. As a result, each BTC/USD perpetual swap is worth $40,000.

Alice spends $100,000 on a few perpetual swaps. At the end of the month, when Bitcoin prices have risen to a steady $50,000, Alice closes her position. On each perpetual swap she purchased, she would make a profit of $10,000. Her total profits would be around $20,000.

profit = number of perpetual swaps * (current price – entry price)

profit = 2 * ($50,000 – $40,000)

profit = 20 000 USD

This calculation does not consider Alice's returns, which are primarily determined by funding rates. The fees paid and the discount Alice received as part of the exchange's attempt to peg the perpetual swap to the spot price of bitcoin will determine Alice's income.

The flexible options available to traders with open-ended swaps allow Alice to increase revenue. For example, she may purchase perpetual contracts for twice the amount she initially committed to do so.

The initial margin is the amount of money required to open a position.

The initial margin is the minimum value necessary to open a leveraged position. For instance, if you want to acquire 1,000 BNB with an initial margin of 100 BNB (at 10x leverage), then the first deposit would be equal to 10% of the total order value. This collateralizes your leveraged position.

What is liquidation?

If the value of what you are using as collateral falls below the maintenance margin, the exchange may require that your account be liquidated. The way this happens differs depending on which exchange you use. In general, however, the price at which liquidation occurs changes according to how risky and leveraged each user is (which is based on their collateral and net exposure). The more substantial your investments, the greater cushion you'll require to absorb any losses.

To avoid any unwanted losses, you can either close your positions prior to the price decreasing from the stock exchange's minimum value or add extra funds into your account. This amplifies the margin and thus reduces the probability of a position being forced closed.

Her cash collateral today is $160,000 (or 4 BTC/USD perpetual swaps), whereas her position size would be $160,000 (or 4 BTC/USD perpetual swaps) if she used a firm as collateral. Alice took advantage of double leverage in this case.

Assume the closing price of each BTC/USD perpetual swap is $50,000, and she sells when it does. Her profit would be about $40,000 if she closes her position when each BTC/USD perpetual swap sells for $50,000.

profit = 4 * ($50,000 – $40,000)

profit = $40,000

Surprisingly, some exchanges provide traders with up to 125x leverage to boost earnings. However, as leverage rises profits, it also increases losses. If the price of perpetual swaps falls 50% from the starting price at which Alice acquired them using 2x leverage, she would be exposed to liquidation risk.

profit = 4 * ($20,000-40,000)

loss = $80,000

When a trader's unrealized loss equals his or her deposited margin, the exchange will automatically close the position. As a result, the entire deposit will be lost. Margin and leveraged trading have significant risks that should not be undertaken by novices.

Although open-ended swap contracts are risky, they're appealing to traders because you can place bets on either short-term or long-term digital asset price changes without time limits. Another perk of open-ended swaps compared to regular SwapAgreements is that you can make money even when cryptocurrency values go down.

Nonetheless, traders are advised to exercise caution and obtain professional guidance before investing in cryptocurrency. When trading with open-ended swap contracts, a trader may lose all of the money invested if leverage is utilized.