How do Crypto Cards Differ from Traditional Bank Cards?

Unlike traditional bank cards linked to centralized banking systems, crypto cards work on decentralized networks, giving users more control and privacy.

However, the government is tightening regulations and seeking to tax cryptocurrency trading, which is resulting in reduced privacy on some centralized exchanges.

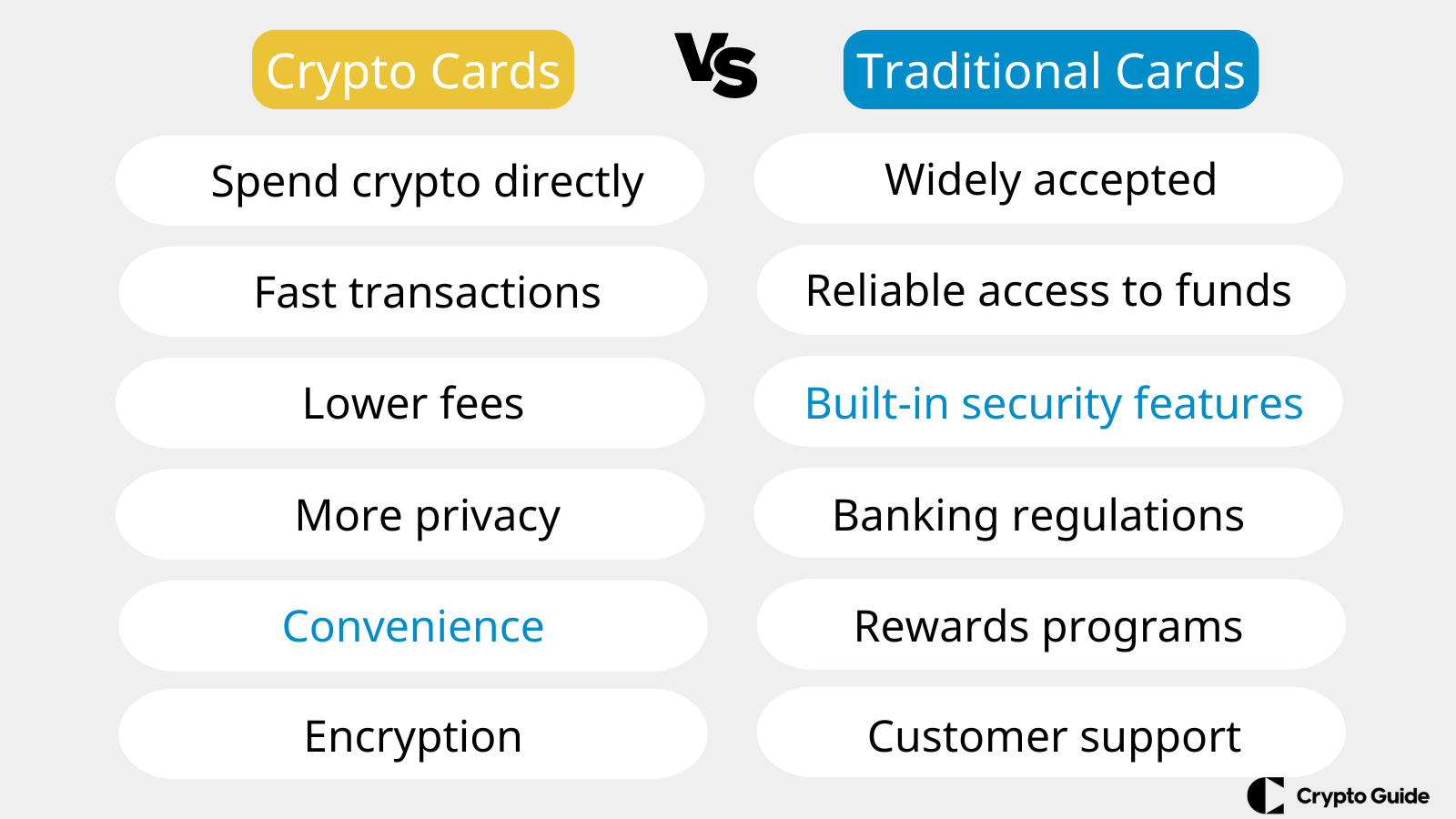

This article offers a comprehensive comparison of crypto cards and traditional cards, highlighting their differences and advantages.

Table of content

Key Highlights

- Crypto cards allow you to spend cryptocurrency directly, converting it to fiat currency at the time of purchase.

- Traditional bank cards are linked to fiat currency, issued by banks, and widely accepted with familiar security features.

- Crypto cards offer faster transactions and potentially lower fees but come with cryptocurrency volatility and less regulation.

- Crypto cards use blockchain technology, while traditional cards rely on PIN codes and fraud monitoring.

- Traditional cards are best for stability and acceptance; crypto cards are ideal for those wanting to use digital currencies.

Comparison Chart

| Feature | Traditional Bank Cards | Crypto Cards |

| Currency Type | Fiat currency (e.g., USD, EUR) | Cryptocurrency (e.g., Bitcoin, Ethereum) |

| Issuing Institutions | Banks | Cryptocurrency exchanges, fintech companies |

| Transaction Conversion | Fiat currency | Cryptocurrency to fiat currency |

| Transaction Speed | May take some time | Almost instant |

| Security | PIN codes, fraud monitoring | Encryption, multi-factor authentication |

| Usage and Acceptance | Widely accepted | Widely accepted |

| Fees | Annual fees, overdraft fees, etc. | Issuance fees, conversion fees, etc. |

| Cross-Border Transactions | Fees for currency conversion, international transactions | Lower fees, faster transactions |

| Volatility | Stable | Cryptocurrency value fluctuations |

Crypto Cards

There are two main types of crypto cards:

Crypto Debit Cards

Debit cards work like regular debit cards but use your cryptocurrency instead of traditional currency. They instantly convert your crypto into regular money when you make a purchase.

You can use them for shopping, paying bills, or getting cash from ATMs. You can reload them with more cryptocurrency when needed.

Crypto Credit Cards

Prepaid cards are like gift cards. You load them with a set amount of cryptocurrency and spend it until it's used up. They're handy for online shopping, bill payments, and ATM withdrawals.

Once you've spent all the money on the card, you must reload it to keep using it. These cards offer more security since you can't spend more than what's loaded.

Both crypto cards make it easy to use your cryptocurrency for everyday transactions, but you should consider fees and security when choosing the right one.

Benefits of Crypto Cards

- You can use crypto cards to spend your cryptocurrency directly for everyday purchases.

- Transactions with crypto cards happen fast, making payments convenient.

- The best crypto cards often have lower fees, saving you money, especially for international purchases.

- Using crypto cards can offer more privacy since transactions don't always need personal information.

Traditional Bank Cards

Traditional bank cards, like debit or credit cards, come from banks and let you buy things without cash. They're linked to your bank account or a loan, and you can use them to shop, pay bills, or get cash easily.

Debit Cards

Debit cards are directly linked to the cardholder's bank account. When a transaction is made using a debit card, the purchase amount is immediately deducted from the available balance in the linked account.

Debit cards can be used at ATMs for cash withdrawals and point-of-sale purchase terminals. Examples of debit cards include Visa Debit, Mastercard Debit, and Maestro.

Credit Cards

Credit cards allow cardholders to borrow funds up to a certain credit limit from the issuing bank. When a purchase is made using a credit card, the cardholder takes a short-term loan from the bank.

To avoid interest fees, the cardholder must repay the borrowed amount along with any applicable interest charges by the due date. Credit cards offer benefits such as rewards points, cashback, and travel perks.

Examples of credit cards include Visa, Mastercard, American Express, and Discover.

Prepaid Cards

Prepaid cards are similar to debit cards but are not linked to a bank account. Instead, users load funds onto the card in advance, and the card can be used until the prepaid balance is depleted.

Prepaid cards are often used as alternatives to traditional bank accounts by individuals who may not have access to banking services or for budgeting purposes.

Prepaid cards are Visa Prepaid, Mastercard Prepaid, and prepaid gift cards.

Charge Cards

Charge cards are similar to credit cards but typically require the cardholder to pay the balance in full each month. Charge cards, like American Express Charge Cards, are different from credit cards.

With credit cards, you can pay off your balance over time, but you'll pay interest. Charge cards don't have a set spending limit, but you have to pay the full amount you spend every month.

So, traditional bank cards, including debit and credit cards, are handy for buying things and are accepted everywhere. They make it easy to shop and keep your money safe.

Benefits of Traditional Cards

- Traditional bank cards are widely accepted by merchants worldwide, both online and at physical stores. This makes them convenient for everyday transactions.

- They operate within well-established banking systems, providing reliable access to funds and a familiar payment experience.

- Bank cards have built-in security features like PIN codes, EMV (Europay, Mastercard, and Visa) chips, and fraud monitoring to protect against unauthorized transactions and fraud.

- Consumer banking regulations often protect traditional bank card users against unauthorized transactions and fraudulent activities.

- Many traditional bank cards offer rewards programs, cashback incentives, and other perks such as travel insurance or purchase protection.

- Traditional banks provide customer support and assistance in case of lost or stolen cards.

Traditional Bank Cards vs Crypto Cards

Here's a detailed comparison of traditional bank cards and crypto cards:

Type of Currency

Traditional: Linked to fiat currency (e.g., US dollars, euros, etc.) and operate within the conventional banking system.

Crypto: Linked to cryptocurrency (e.g., Bitcoin, Ethereum, etc.) and operates within the decentralized blockchain network.

Issuing Institutions

Traditional: Issued by banks or financial institutions regulated by government authorities.

Crypto: Generally issued by cryptocurrency exchanges or fintech companies, often operating in a less regulated environment than traditional banks.

Currency Conversion

Traditional: Transactions are conducted in fiat currency. When making international purchases, currency conversion fees may apply.

Crypto: Transactions start in cryptocurrency and are automatically converted to regular money when you make a purchase. Some crypto cards offer good exchange rates for international purchases.

Transaction Speed

Traditional: Transactions may take a few days to clear, especially for international or large purchases.

Crypto: Transactions are typically processed almost instantly.

Security

Traditional: Protected by various security measures such as PIN codes, EMV chips, and fraud monitoring systems. Users can dispute unauthorized transactions and protected by consumer banking regulations.

Crypto: This newer technology uses encryption, multi-factor authentication, and blockchain security. Transactions can't be reversed, and funds may be lost if a crypto card is compromised.

Regulation and Compliance

Traditional: Subject to strict regulatory oversight, compliance requirements, and consumer protection laws.

Crypto: They operate in a less regulated environment, with different levels of oversight depending on the location. Compliance with anti-money laundering (AML) and know-your-customer (KYC) rules can vary.

Fees

Traditional: You might have to pay fees like yearly charges, extra fees for overdrafts (spending more money than you have), fees for using your card in another country, or fees for taking out cash from an ATM.

Crypto: There can be fees for getting the card, changing cryptocurrency into regular money, making transactions, or taking money from ATMs. These fees can vary a lot between different crypto card companies.

Volatility

Traditional: Regular money stays about the same in value, but cryptocurrencies can change significantly.

Crypto: Cryptocurrency prices can go up and down, affecting how much you can buy with it. Some cards may change your cryptocurrency into regular money when you purchase.

Final Thoughts on Which Card to Choose: Crypto or Traditional?

If you prefer something widely accepted and familiar, go for a traditional bank card. They're accepted everywhere, easy to use, and have familiar security features like PIN codes and fraud protection.

But if you're curious about new technology and want to try something different, consider a crypto card. These cards let you spend cryptocurrency directly, offering fast transactions and potentially lower fees.

In general, crypto enthusiasts should evaluate the pros and cons of crypto cards as they would traditional payment methods.

FAQ About Crypto & Traditional Cards

What are crypto cards?

Crypto cards are payment cards that allow you to spend cryptocurrency like regular money, converting it instantly at the time of purchase.

How do crypto cards differ from traditional bank cards?

Unlike traditional bank cards linked to fiat currency, crypto cards use cryptocurrencies and offer faster transactions with potentially lower fees.

Can I use crypto cards like regular debit or credit cards?

Yes, crypto cards can be used for everyday purchases, online shopping, and ATM withdrawals, just like regular debit or credit cards.

Are crypto cards safe to use?

Crypto cards rely on advanced encryption and blockchain security, but users should be aware that transactions are irreversible and may lack the consumer protections of traditional cards.

Which card should I choose: crypto or traditional?

Choose a traditional card for stability and widespread acceptance, or a crypto card if you want to use cryptocurrency directly with the potential for lower fees and faster transactions.