Trading pullback, 6 techniques

Table of content

⚡️ Is it profitable to trade crypto?

Trading cryptocurrencies is particularly successful because cryptocurrencies are subject to wild price fluctuations. It's unusual for conventional equities or commodities to experience a ten percent increase in value in a single day. Such bounces happen fairly frequently in the cryptocurrency market.

⚡️ Is scalping better than day trading?

The more you trade and the narrower your profits are, the higher your potential for loss. Day trading – fewer trades, bigger profits, higher risks.

⚡️ How long do pullbacks last?

The second conclusion is that most pullbacks greater than 20% have been linked to recessions (there have been 12 since 1946). Second, for long-term investors, this indicates that even relatively uncommon but severe drawdowns of 20-40% do not last very long – only 14 months.

⚡️ Are pullbacks profitable?

The technique of trading on pullbacks has shown to be effective time and time again. The key to its high success rate is that we trade in the direction of the current trend. It's a simple method to profit from trading pullbacks by buying weakness in an uptrend and selling strength in a downtrend.

⚡️ What is a complex pullback?

The Canadian market experienced a complex pullback, which is essentially a two-way pullback with an entire ABCD structure. When you come across a chart exhibiting simple and complex pullback stock trading system, it's crucial to know the difference. In a trending market, pullbacks are generally either simple or complicated.

A pullback is a brief pause or decline in a stock's price from recent peaks. Although sometimes mistakenly used interchangeably, “pullback” and “consolidation” describe two distinct concepts. A “pullback” is typically associated with temporary price drops on time frames like hourly. At the same time, a “consolidation” will more often refer to price stagnation within the scope of daily or weekly charts.

What is a pullback in the stock market?

As you can see from the chart above,SPDR S&P 500 ETF (SPY) has had four pullbacks during its long uptrend. Usually, these included a move to where the 50-day moving average provided technical support before it went up again. To make sure they're not mistaken, traders should employ several different technical indicators when they are looking at palliatives.

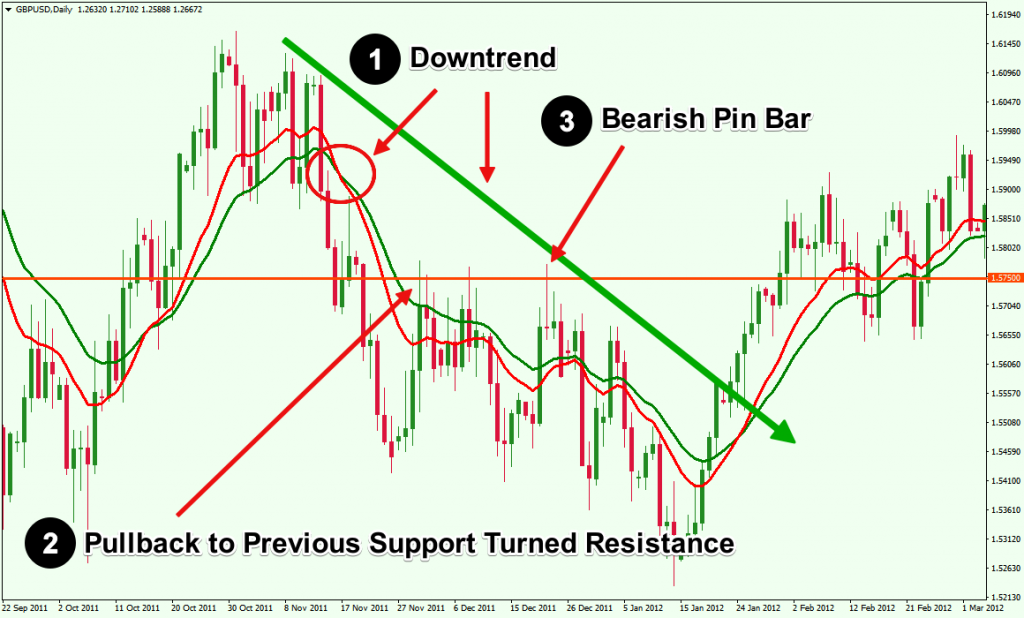

The distinction between a pullback and a reversal

A pullback, as the name implies, is a security's price sliding back down from its highs. Reversals are long-term. So, how can traders tell the difference between a trading and a reverse? Most reversals are caused by an alteration in a security's fundamentals that causes the market to overvalue it.

Scenarios like these abound. For example, a firm may report catastrophic earnings that prompt investors to re-value the stock's net present value. It might also be a lousy settlement, a new competitor's product launch, or any other development that has a long-term impact on the company.

These events, while not immediately apparent on the chart, will show over several sessions and may look like a pullback at first. As a result, traders use moving averages, trend lines

Pullbacks in trading are often limited

The most significant disadvantage of trading on pullbacks is that a pullback might be the start of a real reversal. Because both trading and reversals occur on different timeframes, including intraday, if you want to get more detailed, a multi-session pullback by one trader is a reversal for a day trader looking at the same chart. As a result, day traders need to be very careful when trading pullbacks, particularly on lower timeframes like the five-minute chart.

If unfavorable, there are more opportune moments to invest bullishly. Of course, incorporating additional technical indicators and looking at fundamental data will increase a trader's confidence in identifying pullback trading from genuine reversals.

Pullback trading strategies

The momentum indicators help determine when a stock might be ready to reverse. Here are 6 tactics for trading on pullback trading:

trend lines

The trend's direction can be told by observing the pattern of highs and lows in swings.

An uptrend is defined as a sequence of higher highs followed by a series of higher lows. Conversely, a downtrend is represented by a sequence of lower lows and lower highs.

The disadvantage is that trend lines demand more time to examine. To assess a trendline, you'll need 3 points of contact. You may always connect two random dots, but only after obtaining a third do you truly look at the curve.

As a result, you may only trade on a trendline retreat at the third, fourth, or fifth point of touch.

When combined with other pullback techniques, trend lines can be extremely valuable. But, if traders opt to follow only one of these strategies, they may miss out on several lucrative trading opportunities if it takes too long for them to analyze the trend line.

Moving Average (MA)

Utilizing moving averages is a widely used technique among traders and can be done so in numerous ways. For example, many use them to trade during a pullback.A 20-, 50- or even 100-period moving average may be used. It is unimportant, and it all depends on whether you are a short-term or long-term trader.

Traders who want answers more quickly use shorter moving averages. It's important to keep in mind that shorter moving averages are more vulnerable than longer ones when it comes to noise and bogus signals

.Larger-term moving averages move more slowly, and are less influenced by noise, but may overlook short-term trading opportunities. You must balance the benefits and drawbacks of your trading.

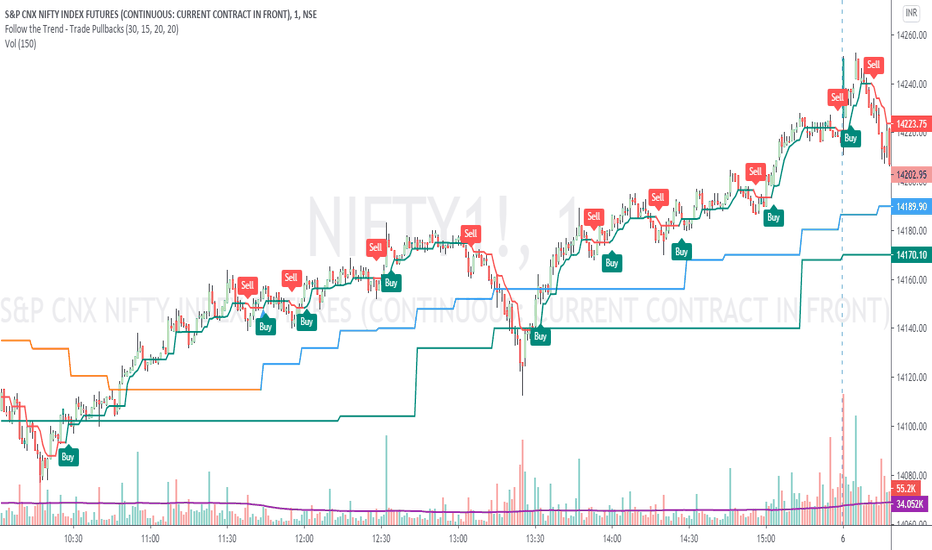

The 50-day moving average has been a key support for investors entering the stock during pullbacks. In the Suzlon Energy Ltd chart above, we see how the 50 EMA serves as a barrier, and when traders miss an opportunity to buy on a decline, they can use it.

Fibonacci Techniques for Profitable Trading

Fibonacci levels are very useful in the financial markets, as well as for traders on pullbacks. This is accomplished by waiting for a new incipient trend to emerge and then running your Fibonacci AB tool from the beginning of the trend to its conclusion. You may then create pullbacks using the C point of the Fibonacci recovery.

The current trend, which began in mid-March with a minor decline, has returned exactly to the 50 percent Fibonacci retracement and is now resuming its upward climb.

Utilize Fibonacci retracements in combination with moving averages to take advantage of high-probability pullback regions.

Breakout Trader Definition

Price does not always move in a straight line, and financial market price fluctuations are frequently characterized by price waves. Furthermore, markets go through bullish and bearish trend wave cycles.

As the chart below shows, wave heights increased during the upswing. Retracement phases are reversals of current trends that occur during pullbacks, which is when traders make transactions.

It's suggested that you hang back and anticipate a downturn to acquire the most favorable entry cost. If you expect the market will keep on growing, then it is critical to access trade at its most economical price when it rises.

The breakout pullback trading strategy is a powerful and common price action pattern that many traders rely upon.

Whenever a consolidation pattern is broken and the market undergoes a reversal, we can expect to see breakout pullbacks as well. Popular patterns that indicate such reversals are wedges, triangles and rectangles.

What are horizontal strategies?

During several trend phases, all financial markets may be observed displaying pitch behavior. It's a natural rhythm of the price that reveals the ebbs and flows of market activity.

Stocking up on technical analysis jargon is a bit intimidating at first. But by learning the basics of technical analysis, you'll be well prepared to master intermediate and advanced phases and even use backtesting as needed! Some traders are aware of this terminology and may or may not utilize it in real-time trading.

However, if a trader misses an early chance to join the trade, horizontal steps may help him or she find alternative entry possibilities as the market develops.

The trader may also use the step pattern to place their stop loss outside of a trend in a safer way. In this case, instead of immediately moving the stop loss after the price makes a move, as was done before, the trader waits for the price to make another move before removing it from danger.

Apply Fibonacci Trend Lines

We employ both trendlines and Fibonacci levels in this strategy to trade on pullbacks. The following are the stages:

- The first step is to identify a bullish trend by searching for a succession of higher highs and higher lows.

- We can now focus on the period of our choosing, and whether it was successful in detecting a pattern. It may be any time frame that is more convenient for you. However, we will utilize a time frame of 1 hour for this sort of trading on pulls backs.

- From the most recent swing, determine the minimum and maximum. Between the two swings, place a Fibonacci retracement indicator.

If the chart indicates a trade within the Fibonacci rebound region (ranging from 50% to 61.8%), then it is wise to act fast. You have the choice of buying at 50%, or you can wait until 61.8% has been achieved if desired. One strategic way to use this strategy is by taking advantage of low swing points when creating retracement levels, as they are ideal for placing protective stop losses and profit exits in order to reap maximum rewards with minimal risk!

Webinars on Pullback Trading Strategies

Interesting Ways to Use ADX and RSI in Your Trading Strategy by Amit Seth

Pullbacks can be a very touchy subject when trading. Not all Pullbacks work– that's for sure. To have greater success with them, we will use Price Action in combination with ADX and RSI as outlined in this rule-based strategy. This method is not timeframe specific and can be used if you're looking to hold a position for a while or make trades within the day.

A concise, rule-based strategy will be discussed to outline entries and exits. The focus will be on Risk Management and providing opportunities with low risk but high reward.

Price action and Pullback Trading by Stock Trader

A key element to a successful pullback trading system is a market confirmation before entering or taking the first trade. By doing this, you will be able to avoid entering the market with an inaccurate signal. Pullback trading is a great way for new traders to start. Trend-following strategies like pullback trading are basic concepts that every trader should know. There are numerous ways you can profit from trading pullbacks in trends–which this webinar will cover in-depth along with providing a complete price action and Pullback Trading system.

In conclusion, we`d want to add that we let you decide what's best for your situation.

Trading on pullbacks can be one of the most lucrative trading methods accessible. The technique of trading on a pullback trading strategy has been demonstrated to be effective time and again. Its high rate of success is because we trade in the direction of the current trend.

By taking advantage of pullbacks and buying low in an uptrend or selling high in a downtrend, you can earn a profit. We hope that you found our blog to be insightful and have already begun putting some of the strategies into practice. Your support goes a long way in helping us reach our goals, so consider spreading this article to your loved ones!