Bitcoin Faces Risk of Price Drop to $71K Due to US Trade Tariffs

Bitcoin (BTC) is currently experiencing “very high risk” conditions following the announcement of global trade tariffs by President Donald Trump, with concerns that the price could fall to $71,000.

Charles Edwards, founder of Capriole Investments, a quantitative Bitcoin and digital asset fund, warned that higher-than-expected US tariffs could negatively impact Bitcoin's value. On April 2, following the tariff announcement, Bitcoin dropped by as much as 8.5%, while US stocks, like the S&P 500, managed to close higher by 0.7%.

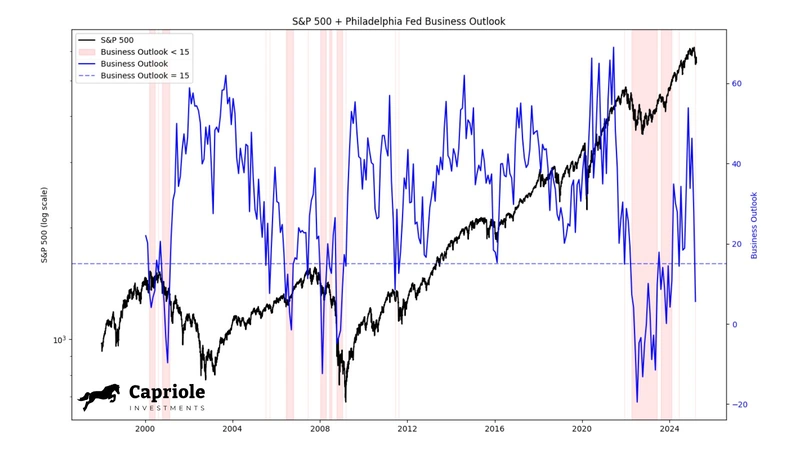

Edwards pointed out that the US business outlook is showing signs of uncertainty, similar to what was seen during previous major economic events, including the years 2000, 2008, and 2022. The Philadelphia Fed’s Business Outlook Survey (BOS) dropped below 15 for the first time in 2024, indicating a pessimistic outlook. This mirrors the conditions seen during the 2022 crypto bear market when Bitcoin reversed from $15,600.

In Capriole’s latest update on March 31, Edwards emphasized that although BOS data may give unreliable signals, it should not be dismissed. He noted that the tariff situation and US macroeconomic decisions will likely influence Bitcoin's price direction moving forward.

A key level to watch for Bitcoin after the tariff impact is $91,000, with Edwards suggesting that closing above this price would signal a potential bullish trend. Additionally, with the Federal Reserve loosening financial policy and expectations of quantitative easing (QE), there are predictions of a surge in the M2 money supply, which could lead to a significant increase in Bitcoin’s price.

In summary, Bitcoin’s price trajectory depends on the macroeconomic environment and how the US trade policies evolve. However, the anticipation of a potential M2 money influx raises hopes for Bitcoin’s price growth.

Blockchain Expert