Pros and Cons of Using Crypto Cards

Crypto cards offer users a mix of benefits and challenges, depending on their financial goals and needs. This article explores the pros and cons of using crypto cards, providing a detailed overview to help you make an informed decision.

Table of content

Crypto Cards Pros and Cons

Crypto cards connect digital currencies to everyday spending, allowing users to use their cryptocurrency for regular purchases. While they come with benefits, there are also important drawbacks to consider. Here’s a straightforward look at the pros and cons of using crypto cards.

| Pros | Cons |

| Spend cryptocurrency directly without converting it. | Cryptocurrency prices can fluctuate, affecting spending power. |

| Accepted worldwide, making international transactions easier. | Various fees may apply, including transaction and conversion fees. |

| Some cards offer rewards and cashback in cryptocurrency. | Not all merchants accept crypto cards, with usage restrictions in some areas. |

| Offers more privacy compared to traditional banking. | Cryptocurrency regulations may impact usage and legality. |

| Easily manage funds with digital wallets. | Risk of hacking and theft despite generally secure transactions. |

| Cryptocurrency is converted to fiat currency at the point of sale. | Crypto purchases can create complex tax situations. |

| Many cards support various cryptocurrencies. | |

| Avoid high foreign exchange fees when spending abroad. |

Examples of Crypto Cards

Some examples of crypto credit and debit cards include:

Bybit Card

Bybit's Mastercard debit card allows you to spend your crypto holdings easily, directly accessing funds in your Bybit Funding Account for everyday purchases with virtual and physical card options. You can top up your account with crypto or fiat and earn up to 10% cashback on purchases, along with other benefits like subscription discounts.

Crypto.com Visa Card

Provides the opportunity to gain cryptocurrency rewards when making purchases and use a credit line for spending digital currencies. It also offers benefits like cashback or even entrance into airport lounges.

Nexo Card

The Nexo Card is a crypto-backed credit card that uses your crypto holdings as collateral instead of a traditional credit check. It allows you to switch between spending crypto directly from your Nexo account and using a credit line, and it works worldwide via the Mastercard network. It's a way to use your crypto for everyday purchases without selling it, though fees and interest apply.

Coinbase Card

You can use this tool to spend the cryptocurrency you have in your Coinbase account on purchases and ATM withdrawals, just like with any Visa card.

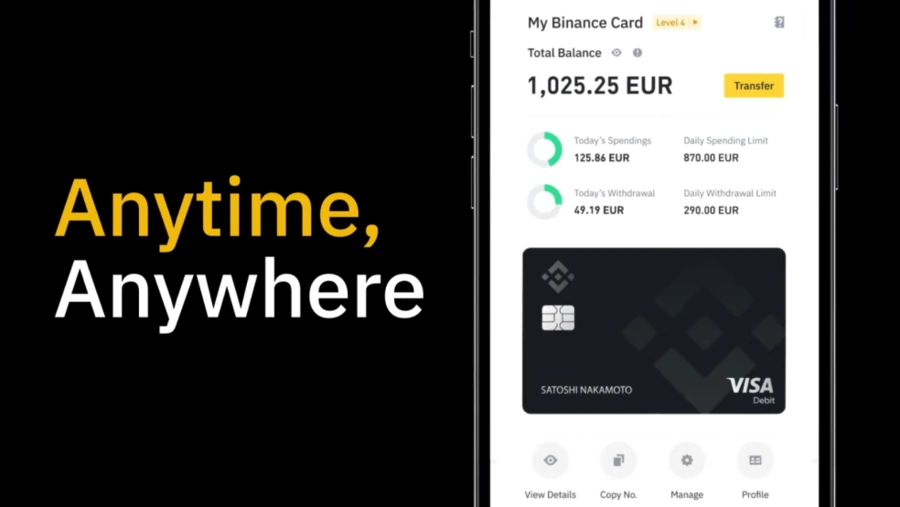

Binance Card

Provides users with the option to use their cryptocurrency balance for spending and getting cash on a worldwide scale, as it is accepted wherever Visa cards can be used.

BlockFi Rewards Visa® Signature Credit Card

This card lets you earn cryptocurrency rewards on your purchases and spend cryptocurrency through a credit line. It comes with benefits like a signup bonus and rewards for every purchase made.

For a more detailed comparison of these and other top options, check out our guide to the best crypto credit and debit cards.

What are Crypto Cards?

Crypto cards are payment cards that allow users to spend their cryptocurrency just like traditional debit or credit cards. They connect digital currencies with the regular financial system, making it easy to use digital assets for everyday transactions.

These cards convert cryptocurrency into fiat currency at the point of sale, simplifying the purchasing process. They usually integrate with cryptocurrency wallets, allowing users to manage their funds easily. Many crypto cards also feature security measures like two-factor authentication and fraud monitoring.

Overall, crypto cards provide a convenient way for cryptocurrency holders to make purchases while considering any associated fees and regulatory aspects.

Types of Crypto Cards

Physical Cards: These resemble normal debit or credit cards and are made of plastic, given by card providers. Physical crypto cards can be used at point-of-sale (POS) devices in physical shops and ATMs to take out cash.

Virtual Cards: In this case, crypto cards are only found as digital entities that people mostly use for online transactions. Users can get card details like card number, expiry date and CVV to type in when purchasing online.

Both types can function as either debit or credit cards, depending on whether they are directly linked to a cryptocurrency wallet or offer credit services.

Integration with Cryptocurrency Wallets

People connect their crypto cards to crypto wallets, which are either hardware or software ones, or accounts in an exchange for cryptocurrency.

The wallet that is connected stores the user's cryptocurrency funds. This can be various types of cryptocurrencies, including well-known ones like Bitcoin, Ethereum, Litecoin and more.

Conversion to Fiat Currency

If a user uses the crypto card for buying, the provider of this card changes the cryptocurrency in the user's wallet to an equivalent amount of fiat currency like USD, EUR or GBP as per current exchange rates.

This changeover occurs in an instant, making sure that the traders get paid in their desired fiat money.

Transaction Process

When a user swipes, taps or inserts their crypto card in a POS terminal, or they enter card details for online transactions. It is the job of the card provider to process this transaction.

The cryptocurrency is quickly changed into fiat currency, and the trader gets paid in their selected form of fiat money.

Global Acceptance

Most crypto cards bear the logos of well-known card networks like Visa or Mastercard, which makes them usable at an extensive range of merchants worldwide.

Users can employ crypto cards to make purchases, withdrawals from ATMs or do online dealings on any location that accepts these card networks.

Security Features

Crypto card providers incorporate strong security features to protect users' funds and personal information.

These aspects could include two-factor verification, encoding, live fraud observation, and the power to halt or shut down the card if it's misplaced or taken away.

Fees and Costs

People who use prepaid cards should know that there could be extra charges connected to it. These can consist of initial issuance fees for getting the card, transaction fees when making a purchase or withdrawing money, and costs for converting currency if you use the card in another country's currency. Fee structures vary among different card providers.

Regulatory Considerations

Regulatory frameworks governing crypto cards vary by jurisdiction. Users should ensure compliance with relevant laws and regulations when using crypto cards.

The rules around crypto cards can differ a lot depending on where you are. Users should make sure they follow the relevant laws in their area, including those about licensing, preventing money laundering, and protecting consumers.

It's important to check if the provider follows these rules, as this affects how safe and reliable your transactions are. Staying updated on any changes in the laws is also key since these rules can change. Knowing these considerations helps protect users and supports wider acceptance of cryptocurrencies in regular financial systems.

Comparison between Crypto Credit and Debit Cards

Functionality

Credit and debit cards connected to crypto allow users to use their stored digital currency for buying things. Debit card use means you spend money straight from the balance in your cryptocurrency wallet, and this is where funds for transactions come from too – they are not taken out of any other source.

Risk and Cost Considerations

As users employ their own cryptocurrency assets, there is no threat of accumulating debt using crypto debit cards. Generally, less fees come with crypto debit cards.

Borrowing Structure and Interest

Alternatively, crypto credit cards give users a line of credit. So, money for purchases comes from the card provider and functions like regular credit cards. If someone doesn't pay back what they borrowed within the set period, this can cause debt accumulation.

Credit and Approval Process

Interest is another charge that users might face on unpaid balances with credit cards. Crypto credit cards differ from debit cards because they essentially involve borrowing money from the entity that provided the card.

Debit cards do not involve checking credit or credit history. Credit cards might need a process of checking and approving, which relies on how much the user's credit is worth.

Decision Making

Debit cards give you an easier method to use your cryptocurrency for spending. In contrast, credit cards offer a borrowing limit that needs paying back later on and usually with interest added. The choice between these two types of cards depends on your financial requirements and habits.

| Attribute | Crypto Debit Cards | Crypto Credit Cards |

| Funding Source | Directly from cryptocurrency wallet | Line of credit provided by the card issuer |

| Debt Risk | No risk of accumulating debt | Risk of debt accumulation if balance is not paid |

| Fees | Generally lower fees | May include various fees such as interest and late fees |

| Interest Charges | None | Applicable on unpaid balances |

| Credit Check Requirement | No credit check required | Credit check and approval process required |

| Spending Limit | Limited to the balance in the cryptocurrency wallet | Set borrowing limit defined by the card issuer |

| Payment Responsibility | Immediate payment from crypto balance | Payment due later, potentially with interest |

| Credit History Impact | No impact | Can impact credit history positively or negatively |

| Usage | Direct spending from crypto assets | Borrowing money to be paid back later |

| Financial Management | Easier to manage due to direct spending | Requires careful management to avoid debt and interest |

Final Words

Crypto cards let you spend cryptocurrency directly and are accepted worldwide through networks like Visa and Mastercard. They offer rewards, cashback, and security. You can also manage funds with digital wallets.

However, be aware of fluctuating cryptocurrency values, various fees, limited merchant acceptance, regulatory changes, and risks like hacking. Despite these issues, crypto cards help connect digital assets with traditional financial systems.

FAQ About Prost & Cons of Crypto Cards

What are the advantages of using crypto cards?

Crypto cards provide accessibility to spend cryptocurrency in everyday transactions, offering security features and global acceptance.

Are there any drawbacks to using crypto cards?

Yes, crypto cards come with risks such as the price volatility of cryptocurrencies and various fees associated with transactions.

How do crypto debit cards work compared to credit cards?

Debit cards spend directly from your cryptocurrency wallet, while credit cards offer a line of credit that must be repaid later, often with interest.

Can you give examples of crypto card providers?

Examples include Coinbase Card and BlockFi Rewards Visa® Signature Credit Card for debit and credit options, respectively.

Overall, are crypto cards worth considering?

Yes, they offer practicality but users should carefully assess fees, risks, and regulatory compliance when choosing a provider.